Business broker ethics shape every transaction in our industry. Poor ethical standards cost brokers their licenses and destroy client trust permanently.

We at Unbroker see firsthand how ethical violations damage both individual deals and the broader brokerage reputation. The stakes are too high to ignore these principles.

This guide covers the ethical foundations every business broker must follow to protect clients and build lasting success.

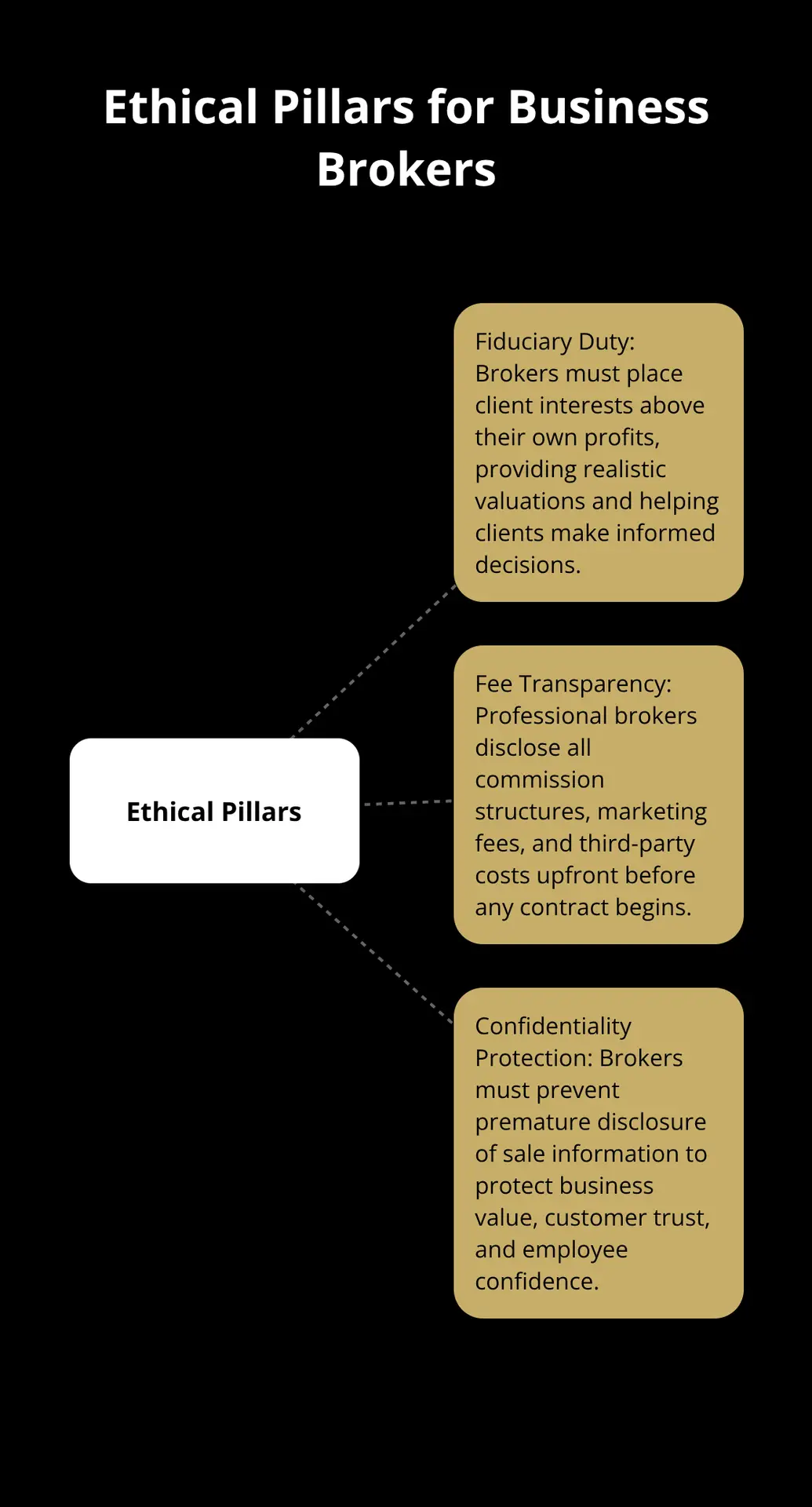

What Ethical Standards Must Every Business Broker Follow

Business brokers operate under three non-negotiable ethical pillars that determine transaction success and client protection. Fiduciary duty requires brokers to place client interests above their own profits, yet many brokers violate this standard when they inflate valuations to secure new business. The International Business Brokers Association has established authoritative principles and a code of professional ethics, which provides important professional accountability standards. Brokers must provide realistic business valuations that reflect both strengths and weaknesses, and they must help clients make informed decisions rather than chase quick commissions.

Complete Transparency in All Financial Matters

Fee transparency separates ethical brokers from predatory operators who hide costs until the deal closes. Professional brokers disclose all commission structures, marketing fees, and third-party costs upfront before any contract begins. The Securities Exchange Act regulates secondary market securities transactions, mandates disclosures, and establishes the SEC to enforce securities laws. Ethical brokers explain exactly how they earn compensation and identify any potential conflicts of interest that could influence their advice. This transparency builds trust and prevents the financial surprises that damage broker-client relationships permanently.

Absolute Confidentiality Protection Standards

Confidentiality breaches destroy business value faster than any other ethical violation. Premature disclosure that a business is for sale erodes customer trust, employee confidence, and vendor relationships immediately. Buyers must sign binding nondisclosure agreements before they receive any sensitive information about the business. Experienced brokers use controlled information release processes that balance buyer due diligence needs with seller protection requirements (without compromising either party’s interests).

Professional Competence and Expertise Requirements

Many real estate agents take business listings without proper training in valuation and marketing techniques. This practice leads to drastically over-priced listings and confidentiality breaches that harm sellers. FINRA Rule 2010 requires members to observe high standards of commercial honor and just and equitable principles of trade, which means brokers who take assignments outside their expertise violate their fiduciary duty. Ethical brokers engage experienced professionals when they handle real estate aspects of business sales (rather than attempt complex transactions beyond their qualifications). Successful business brokers must possess deep understanding of financial statements to interpret income statements and cash flow accurately.

These ethical foundations become even more important when brokers face common violations that can destroy their careers and harm clients financially.

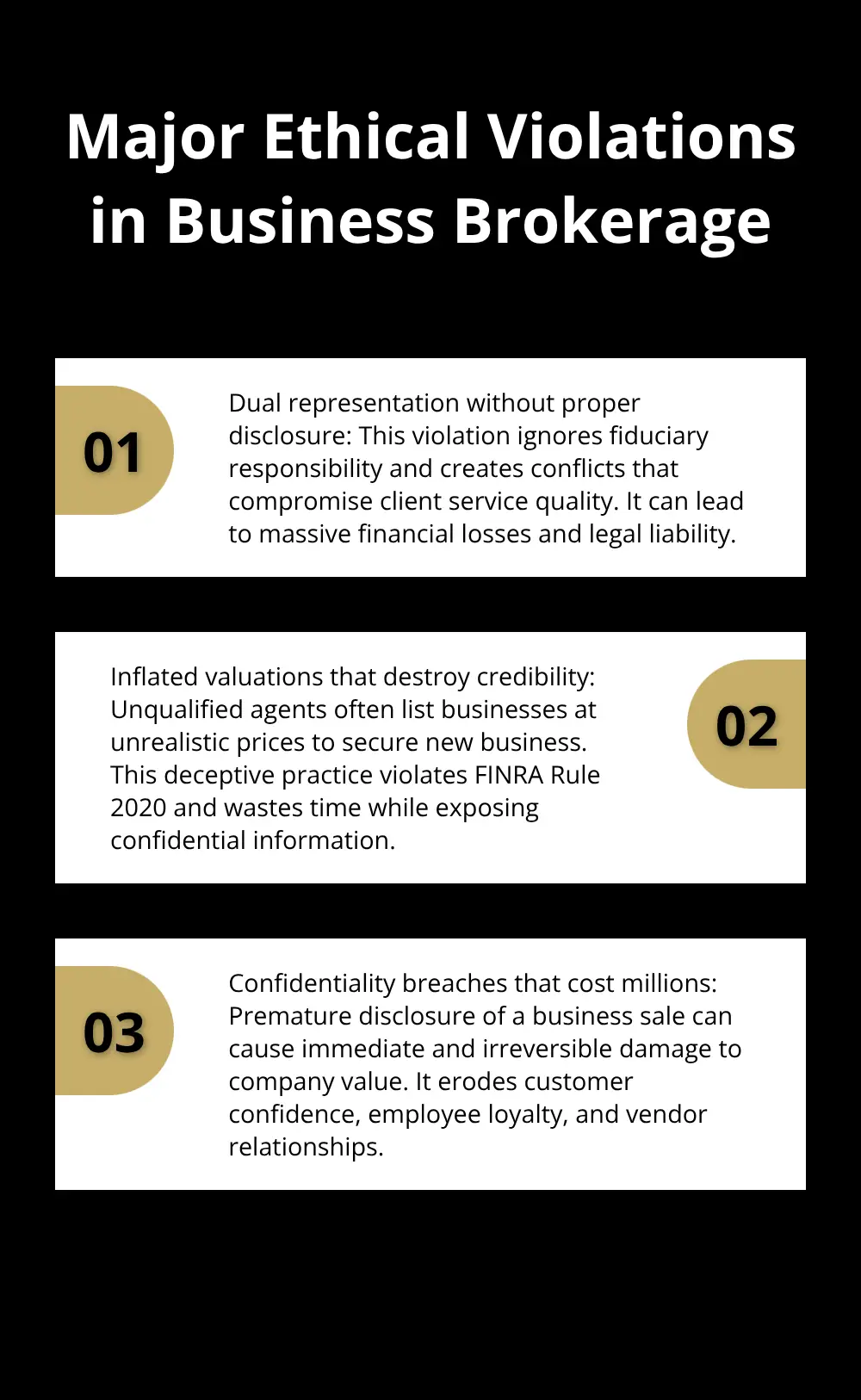

Which Ethical Violations Destroy Business Brokers

Dual representation without proper disclosure ranks as the most devastating violation in business brokerage. Commercial real estate brokers who represent tenants of properties they manage ignore their fiduciary responsibility and create conflicts that compromise client service quality. The SEC charged several individuals for a scheme that solicited over $528 million from more than 4,000 investors, which demonstrates how undisclosed conflicts lead to massive financial losses. Brokers must reveal all relationships and potential conflicts before any engagement begins, or they face legal liability and complete loss of client trust.

Inflated Valuations That Destroy Credibility

A significant number of businesses receive drastically inflated prices when unqualified agents list them to secure new business. This deceptive practice violates FINRA Rule 2020, which prohibits manipulative or deceptive practices in business conduct. Real estate agents without proper business valuation experience routinely price businesses at unrealistic multiples that waste months of time and expose confidential information to unqualified buyers. Professional brokers provide realistic assessments that reflect actual market conditions and comparable sales data from their specific industry sectors.

Confidentiality Breaches That Cost Millions

Premature disclosure that a business is for sale creates immediate and irreversible damage to company value. Customers lose confidence, employees seek new jobs, and vendors question payment terms when sale information leaks early. One documented case showed a seller who lost significant business value due to inadequate confidentiality protection during the sale process. Buyers who refuse to sign nondisclosure agreements pose serious risks to confidentiality, yet many brokers proceed without proper legal protection.

Fee Structure Deception and Hidden Costs

Many brokers hide commission structures and additional fees until deals near completion (which creates financial surprises that destroy client relationships). Unethical operators charge marketing fees, administrative costs, and third-party expenses without prior disclosure. These hidden costs can add thousands of dollars to transaction expenses and violate basic transparency requirements. Professional brokers disclose all fees upfront and explain exactly how they earn compensation from each transaction.

These violations demonstrate why proper ethical practices become essential for successful business transactions and long-term broker success.

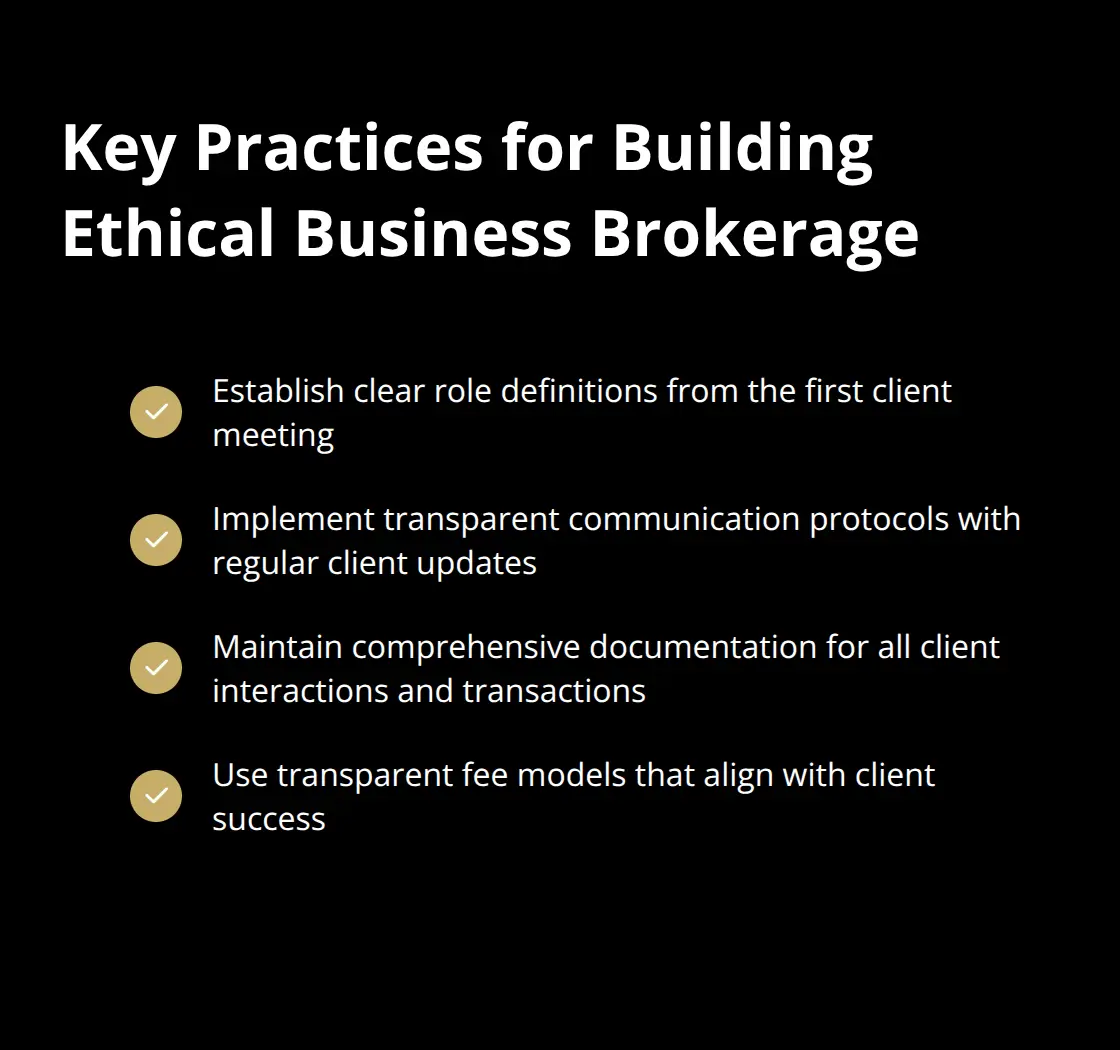

How to Build Ethical Business Brokerage Practices

Professional business brokers establish clear role definitions from the first client meeting to prevent misunderstandings that lead to ethical violations. Successful brokers explain their specific duties, limitations, and compensation structure before any contract occurs. They define whether they represent the buyer, seller, or both parties, and they document these relationships in written agreements with signatures. The National Association of Realtors code of ethics requires agents to identify themselves and their role immediately, which business brokers should adopt as standard practice.

Clear Communication Protocols

Professional brokers explain their complete process, timeline expectations, and communication methods upfront to avoid conflicts later in the transaction. They schedule regular check-ins with clients and provide status updates on buyer inquiries, market feedback, and next steps. Ethical brokers maintain consistent contact throughout the sale process and establish clear communication standards that set expectations for response times. They also clarify decision points where client approval is required (such as price negotiations or disclosure of additional information to qualified buyers).

Documentation Standards That Protect All Parties

Ethical brokers maintain comprehensive documentation for every client interaction, valuation method, and activity throughout the sale process. They provide written summaries after each meeting, document all buyer inquiries and responses, and keep detailed records of confidentiality agreement compliance. Professional brokers use standardized forms for nondisclosure agreements, purchase offers, and commission structures that clearly outline terms and conditions.

They require buyers to provide financial qualification documents before they share sensitive business information. These brokers maintain secure digital files that protect confidential data from unauthorized access (which creates legal protection for both brokers and clients while demonstrating professional competence to regulatory authorities).

Transparent Fee Models That Build Trust

Professional brokers disclose all fees upfront with written commission agreements that specify exact percentages, minimum fees, and any additional costs before engagement begins. They explain how their compensation aligns with client success rather than transaction volume, which prevents conflicts of interest that damage client relationships. Ethical brokers avoid upfront fees that create financial pressure to accept unsuitable buyers or unrealistic offers.

They provide detailed cost breakdowns that include expenses, legal document preparation, and third-party services so clients understand exactly what they pay for throughout the process. This transparency builds long-term client relationships and referral networks that sustain successful brokerage practices over time (without the hidden surprises that destroy professional reputations).

Final Thoughts

Business broker ethics directly impact the entire industry’s credibility and client trust. Ethical violations like dual representation without disclosure and inflated valuations have cost brokers millions in legal settlements and destroyed professional reputations permanently. Companies with strong ethics programs experience better long-term success and risk management, while unethical practices lead to regulatory sanctions and client lawsuits.

Professional brokers protect business owners from confidentiality breaches that can destroy company value overnight. These brokers provide realistic valuations, transparent fee structures, and proper documentation that safeguards client interests throughout complex transactions. Such practices build lasting relationships and referral networks that sustain successful businesses.

The future of business brokerage depends on transparent, client-focused service models that eliminate hidden fees and conflicts of interest. Unbroker represents this evolution with upfront pricing and comprehensive support without traditional brokerage markups. As regulatory oversight increases and clients demand greater transparency, ethical brokers who prioritize client success over commission volume will dominate the market (and set new industry standards for business broker ethics).

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)