Business owners selling through traditional brokers face steep fees, limited buyer pools, and months of delays. The average business broker charges 10-12% commission plus additional costs that can reach $50,000 or more.

Digital platforms flip this outdated model completely. We at Unbroker have seen sellers save 80% on fees while reaching 10x more qualified buyers through advanced matching technology.

The platform benefits extend far beyond cost savings – sellers close deals 40% faster with full transparency throughout the process.

What Makes Traditional Business Sales So Expensive

Traditional business brokers drain seller profits through excessive fees that most business owners never anticipate. The standard commission structure typically involves 2.5-3% commissions to both the seller’s and buyer’s agents. Marketing fees add another $3,000-$8,000, administrative costs pile on $2,000-$5,000 more, and legal documentation fees can reach $15,000. A Pepperdine Private Capital Markets study found that total transaction costs for traditional broker sales average 15-18% of the final sale price. For a $500,000 business, sellers lose $75,000-$90,000 in fees alone.

Geographic Boundaries Limit Buyer Competition

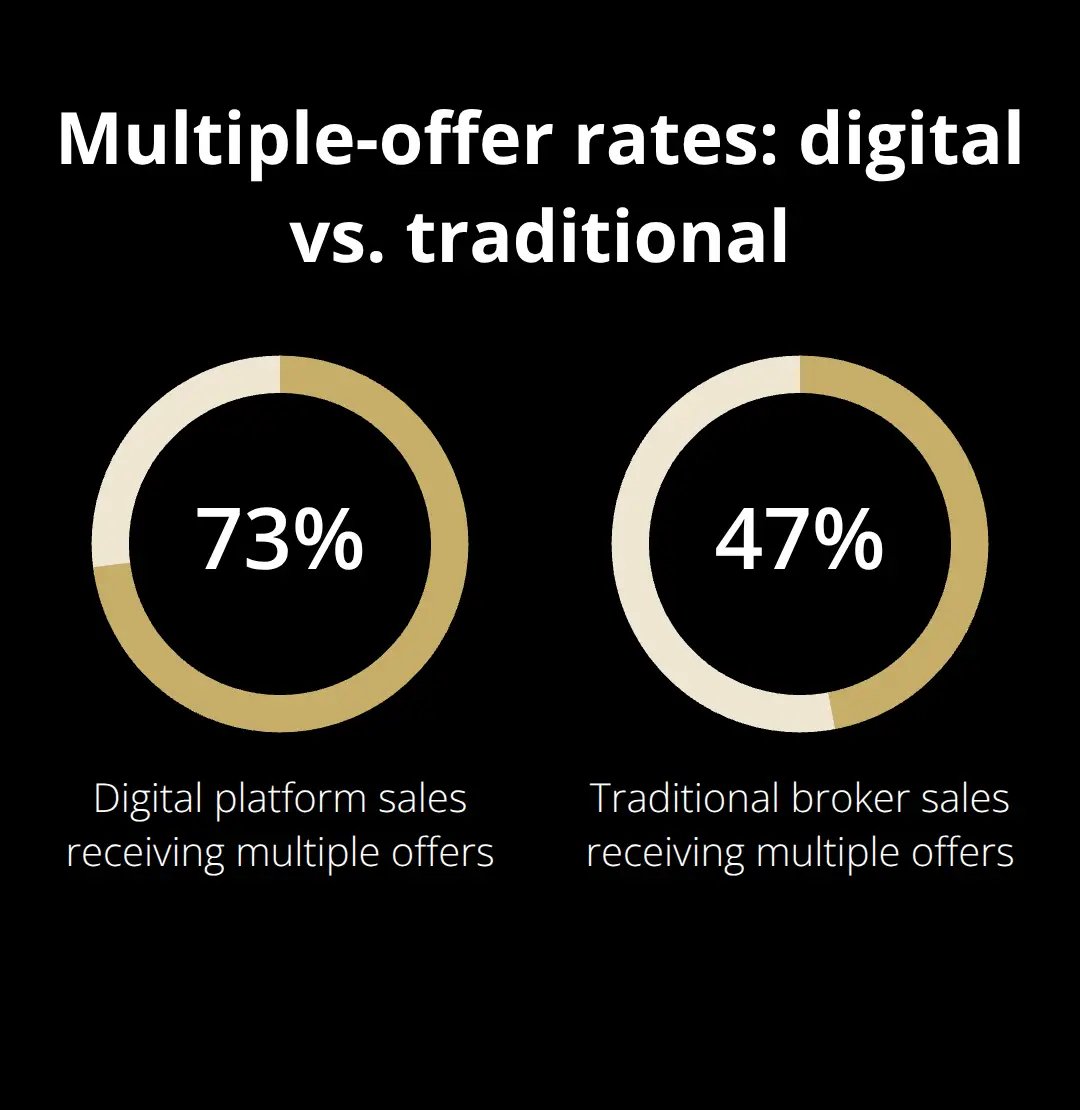

Traditional brokers operate within narrow geographic boundaries, typically serving only local or regional markets. This geographic restriction severely limits the pool of potential buyers, often resulting in 20-50 qualified prospects versus the thousands available through digital platforms. Market data reveals that 47% of successful deals had at least one competing offer, with 40% receiving multiple offers. Fewer buyers means weaker positions for sellers and lower final sale prices.

Outdated Communication Methods Kill Deal Momentum

Traditional sales processes rely on phone calls, fax machines, and in-person meetings that create dangerous delays. The average traditional business sale takes 8-12 months from listing to closing, with communication gaps causing 40% of deals to fall through (according to BizBuySell data). Buyers lose interest when responses take days instead of hours. Document sharing through email attachments and physical meetings slows due diligence to a crawl.

Modern buyers expect instant access to information and real-time updates that traditional methods simply cannot provide. Digital platforms address these fundamental flaws with technology-driven solutions that transform the entire sales experience.

How Digital Platforms Transform Business Sales

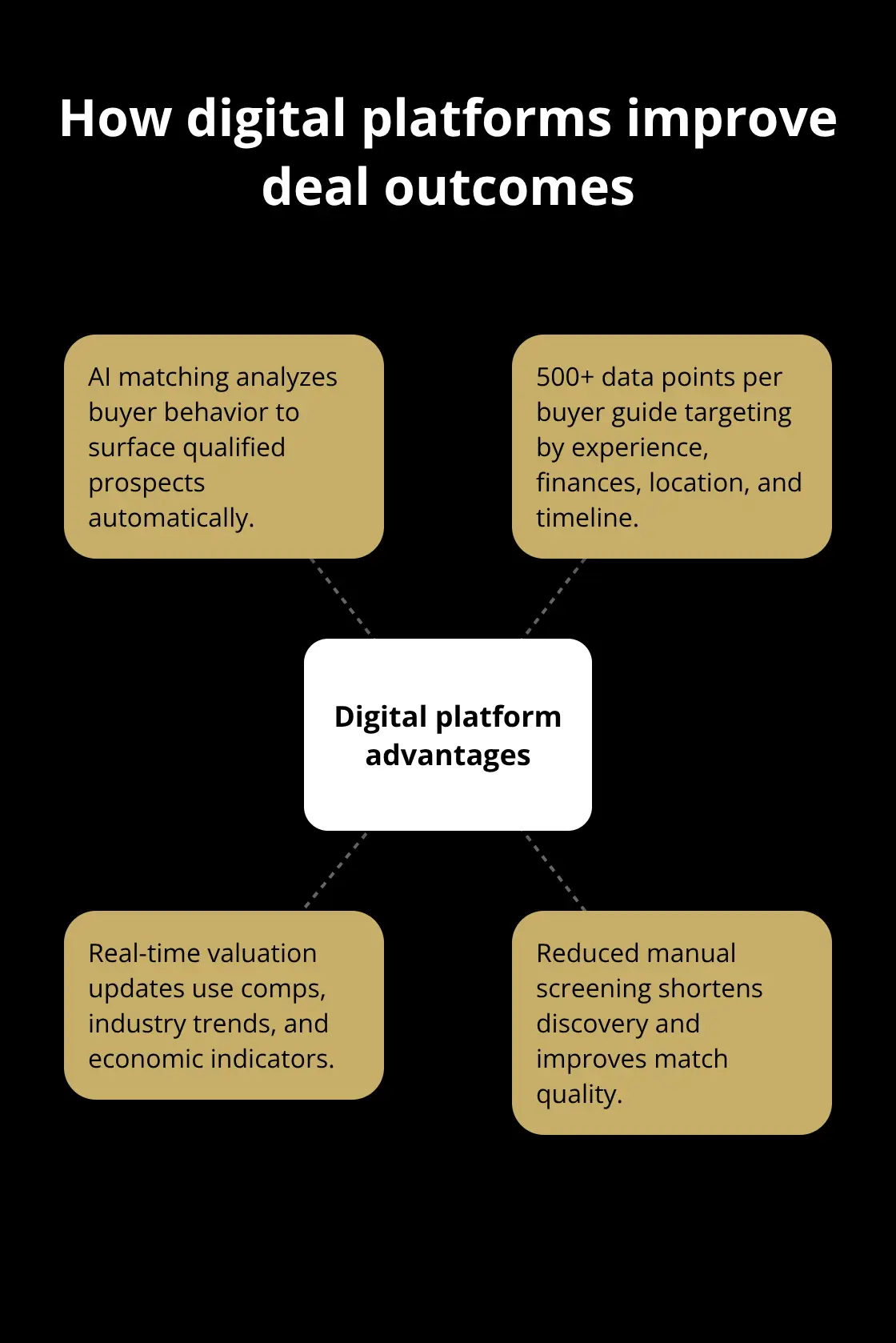

Digital platforms revolutionize business sales through sophisticated AI algorithms that analyze buyer behavior patterns and match sellers with qualified prospects automatically. These systems process over 500 data points per buyer including industry experience, financial capacity, geographic preferences, and acquisition timeline to create highly targeted matches.

Salesforce research shows that 91% of small and medium businesses with AI say it boosts their revenue compared to traditional broker screening methods. Advanced market analysis tools provide real-time valuation updates based on comparable sales data, industry trends, and economic indicators that traditional brokers simply cannot access or process manually.

Transparent Pricing Eliminates Fee Surprises

Digital platforms operate on transparent, fixed-fee structures that eliminate the commission-based pricing model that drains seller profits. Traditional brokers charge percentage-based fees that scale with sale price, creating misaligned incentives where brokers benefit from longer sales cycles. Most brokers charge between 8% and 12% of the final sale price, which means a $1 million business sale costs the seller $80,000 to $120,000 in fees. Hidden costs disappear entirely as platforms include marketing, legal templates, and buyer communication tools in their base pricing.

Streamlined Technology Accelerates Deal Completion

Digital sales platforms compress transaction timelines from 8-12 months to 4-6 months through automated document management, instant buyer communication, and real-time deal tracking. Virtual data rooms allow buyers immediate access to due diligence materials, eliminating the weeks of delays caused by physical document sharing. Automated workflow systems send alerts for missing documents, upcoming deadlines, and required signatures that keep deals moving forward. Digital platforms provide streamlined communication tools and automated processes that significantly reduce delays and accelerate closing times compared to traditional broker-managed transactions.

Enhanced Buyer Reach Through Digital Networks

Digital platforms connect sellers with thousands of qualified buyers across multiple geographic markets rather than the limited local pools that traditional brokers access. These platforms maintain active databases of pre-qualified buyers who have completed financial verification and demonstrated serious acquisition intent. The expanded reach creates competitive bidding environments that drive higher sale prices (with 73% of digital platform sales receiving multiple offers compared to 47% through traditional brokers).

This dramatic difference in buyer competition translates directly into better outcomes for sellers who want maximum value for their businesses.

How Much Money Do You Actually Save

Traditional business sales devastate seller profits through a maze of fees that most owners never see coming. A standard broker charges 8-12% commission on the final sale price, which means a $1 million business costs the seller $80,000-$120,000 in fees alone. Marketing expenses add $5,000-$10,000, legal documentation fees reach $15,000, administrative costs pile on another $5,000, and due diligence management can cost $8,000 more. The International Business Brokers Association reports that total transaction costs average 15-18% of the sale price (a $500,000 business through traditional channels costs $75,000-$90,000 in combined fees).

Digital Platforms Slash Costs by 80%

Digital platforms operate on fixed-fee structures that eliminate percentage-based commissions entirely. These platforms charge flat rates regardless of business value, which creates massive savings compared to traditional brokers. A $1 million business sale through traditional brokers costs $150,000 in total fees, while digital platforms charge under $5,000 – this represents savings of $145,000 or 97%. Even smaller businesses benefit dramatically, with a $300,000 sale that saves $40,000 compared to traditional broker fees.

ROI Analysis Proves Digital Superiority

The return on investment for digital platform sales consistently outperforms traditional methods across all business valuations. Traditional business brokers charge commissions ranging from 8% to 12% for businesses under $1 million, while digital platforms typically cost less than 1% of the final sale price. A McKinsey study found that businesses that use digital sales platforms achieve 23% higher net proceeds after all costs compared to traditional broker sales.

Speed Advantage Amplifies Savings

Digital platforms close deals 40% faster than traditional methods, which reduces carrying costs, lost revenue from delayed transitions, and opportunity costs from extended sale periods. The accelerated timeline means sellers access their capital months earlier (allowing for reinvestment opportunities that traditional sales methods delay). These time savings compound the financial benefits beyond simple fee reductions.

Final Thoughts

The evidence overwhelmingly favors digital platforms over traditional business sales methods. Sellers save 80% on fees while they access 10x more qualified buyers through AI-driven technology. Platform benefits extend beyond cost savings as deals close 40% faster with complete transparency throughout the process.

Traditional brokers drain $75,000-$90,000 from a $500,000 business sale through excessive commissions and hidden fees. Digital platforms eliminate these profit-draining costs through fixed-fee structures that charge under 1% of the sale price (regardless of business value). The future of business sales belongs to technology-driven solutions that prioritize seller outcomes over broker profits.

Smart business owners recognize that modern digital platforms deliver superior results at a fraction of traditional costs. We at Unbroker have transformed business sales with transparent pricing, AI-enhanced buyer connections, and streamlined processes. The choice between outdated broker methods and efficient digital platforms becomes obvious when you examine the data.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)