Selling a business takes longer than most owners expect. Recent market data shows the average sale timeline has shifted significantly in 2025.

We at Unbroker see business owners consistently underestimate the time needed for a successful exit. The process involves multiple complex stages that can stretch for months or even years.

How Long Will Your Sale Actually Take

The reality is stark: most businesses take 6 to 12 months to sell in 2025, with the average timeline now reaching nearly 10 months according to current market data. This timeline represents a significant increase from previous years, as buyers apply heightened scrutiny and conduct more complex due diligence processes. BizBuySell reports that only businesses with exceptional preparation and realistic price points achieve sales within the shorter 6-month window.

Market Conditions Drive Your Timeline

Current market dynamics heavily influence sale duration. Technology and healthcare companies consistently sell faster than traditional retail or manufacturing businesses, often completing transactions in 3 to 6 months due to higher buyer demand. The International Business Brokers Association conducts industry research to explain the current brokerage marketplace and explore forecasts, but these same businesses required extensive upfront preparation that lasted 12 to 36 months. Overpriced businesses remain the biggest timeline killer – companies priced above market value can sit on the market for over a year without serious buyer interest.

Industry Performance Shows Dramatic Variation

Manufacturing and distribution companies face longer sales cycles (typically 8 to 14 months) due to complex asset evaluations and regulatory requirements. Healthcare businesses in regulated sectors can extend beyond 12 months when license transfers are involved. Service-based businesses with strong recurring revenue streams move fastest, often closing within 4 to 8 months. Private equity firms continue to drive demand in 2025, particularly for businesses that show consistent annual growth above 15%, which can reduce sale timelines by 30% compared to stagnant companies.

Preparation Phase Determines Success Speed

The preparation phase dramatically impacts your final timeline. Businesses that maintain clean financial records and documented procedures attract buyers faster and achieve higher prices. Professional valuations become essential – business valuations cover key concepts and different purposes for valuation. This preparation work, while time-intensive upfront, pays dividends when you enter the active market phase and need to respond quickly to serious buyer inquiries.

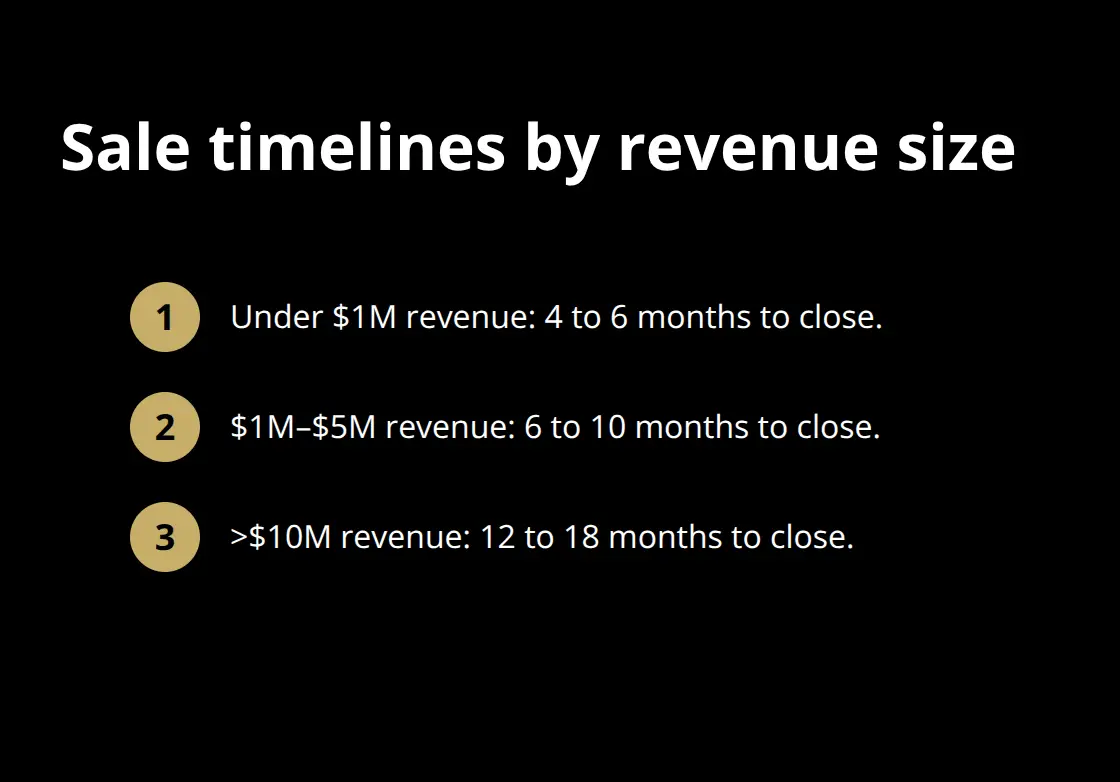

What Determines How Fast Your Business Sells

Your business size directly controls your sale complexity and timeline. Companies with revenue under $1 million typically close within 4 to 6 months because buyers can evaluate them quickly with minimal due diligence requirements. Businesses that generate $1 to $5 million face 6 to 10 month timelines as buyers conduct deeper financial analysis and operational reviews. Large companies that exceed $10 million revenue often require 12 to 18 months due to extensive legal documentation, regulatory approvals, and complex asset evaluations that involve multiple buyer meetings and board approvals.

Market Demand Controls Your Speed

Buyer demand varies dramatically across industries and directly impacts your timeline. The Exit Planning Institute reports that business owners are exploring exit readiness nationwide, which creates competition for quality buyers. Technology companies benefit from higher buyer interest compared to traditional retail businesses, and this leads to faster sales and premium prices. Healthcare and manufacturing sectors attract private equity attention, with firms that actively seek businesses show growth rates. Economic conditions in 2025 favor sellers in essential services and digital businesses, while discretionary sectors face longer market exposure times.

Documentation Quality Makes or Breaks Speed

Professional preparation separates fast sales from prolonged market exposure. Businesses with organized financial records, documented procedures, and clean legal structures benefit from streamlined sale processes compared to unprepared competitors. Accurate professional valuations prevent price mistakes that extend timelines – overpriced businesses sit on markets for extended periods. Complete tax returns, audited financials, and operational manuals signal serious sellers to buyers, while missing documentation triggers extended due diligence periods that can add months to your timeline.

Financial Performance Drives Buyer Interest

Strong financial metrics accelerate your sale process significantly. Businesses that demonstrate consistent revenue growth attract multiple offers within the first months of market exposure. Companies with diversified customer bases where customer concentration doesn’t negatively impact valuation close faster than those dependent on major accounts. Positive cash flow trends over consecutive years create competitive interest that can compress normal timelines, while declining margins or seasonal volatility extend buyer evaluation periods substantially.

The next phase focuses on specific strategies that can accelerate these natural timelines through strategic preparation and smart execution tactics.

How Can You Speed Up Your Business Sale

Prepare Professional Financial Documentation

Smart financial preparation cuts months off your sale timeline. Start with professional financial audits that reveal operational weaknesses before buyers find them – though only 25%-30% of businesses successfully sell to new ownership according to industry data. Organize three years of tax returns, profit and loss statements, and cash flow projections in digital format for instant buyer access. Professional valuations prevent price mistakes that kill deals – with 77% of buyers confident they can purchase at acceptable prices in today’s market.

Document all revenue streams, customer contracts, and operational procedures in detailed manuals that demonstrate business stability to serious buyers. Clean financial records signal professional management and reduce buyer concerns about hidden problems.

Target Qualified Buyers Through Strategic Marketing

Mass marketing wastes time and compromises confidentiality. Focus on prequalified buyers who match your business profile and have verified financial capabilities. Technology companies should target industry-specific private equity firms that understand software valuations, while service businesses benefit from strategic buyer networks within their sector.

Create compelling marketing materials that highlight your strongest financial metrics upfront – businesses that emphasize consistent growth rates and diverse customer bases generate buyer interest within the first month of exposure. Professional business brokers maintain buyer databases that can reduce your search time from months to weeks (though their fees typically range from 8% to 12% of sale price).

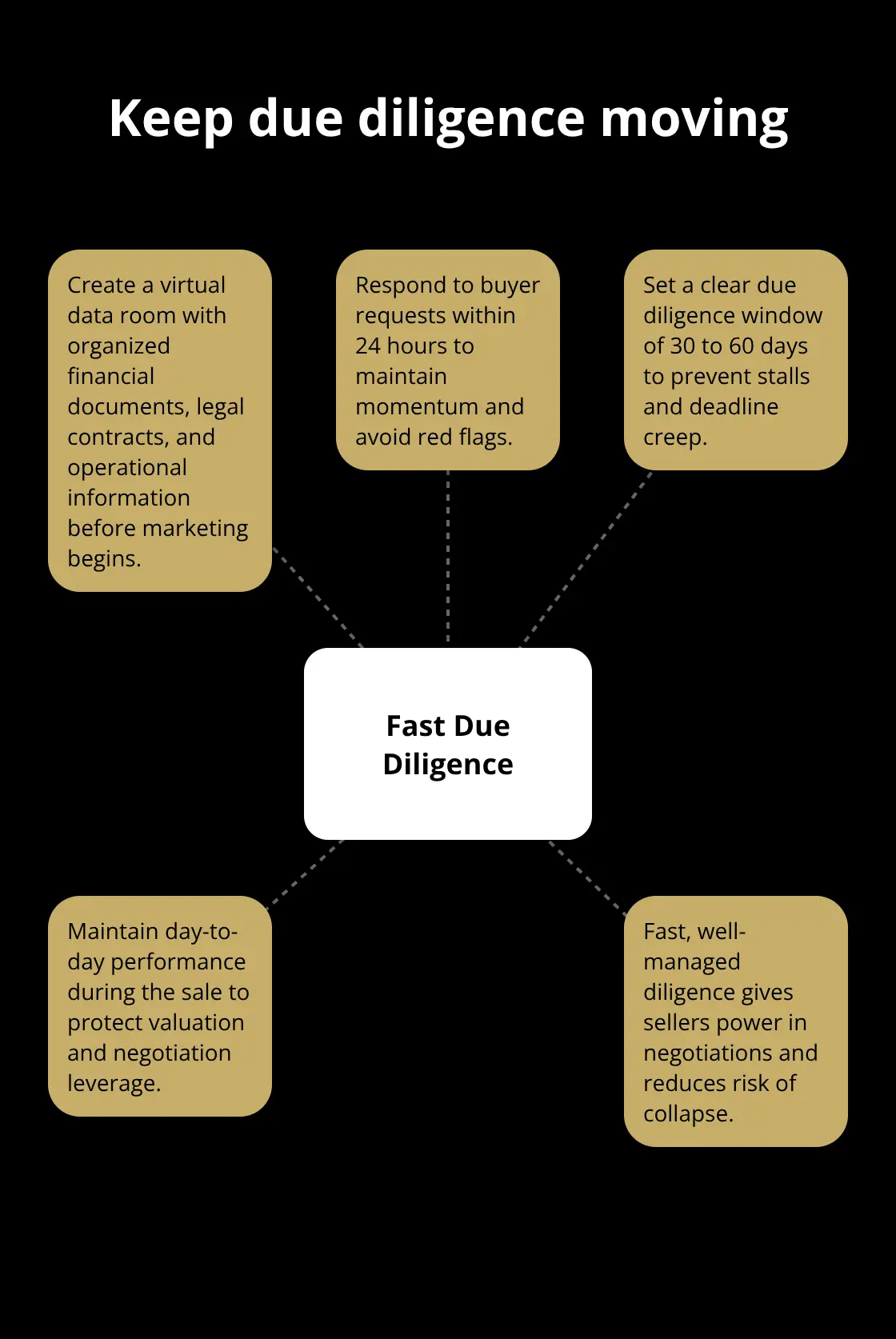

Manage Due Diligence Like a Professional Process

Due diligence preparation determines your negotiation strength. Create virtual data rooms with organized financial documents, legal contracts, and operational information before marketing begins. Respond to buyer requests within 24 hours to maintain deal momentum – delayed responses signal operational problems that concern buyers.

Set clear due diligence timelines of 30 to 60 days maximum to prevent deals from stalling indefinitely. Maintain business operations during the sale process because declining performance during due diligence destroys buyer confidence and forces price reductions. Fast due diligence processes give sellers power in negotiations and prevent deals from collapse.

Final Thoughts

Most businesses need 6 to 12 months to complete transactions in 2025, with technology companies that move faster and manufacturing businesses that take longer. Your preparation quality directly impacts this sale timeline – businesses with organized financials and professional valuations sell 30% faster than unprepared competitors. Start your preparation 12 to 36 months before you list to maximize speed and value.

Focus on clean financial documentation, professional valuations, and strategic buyer targeting rather than mass marketing approaches. Maintain operational performance during the sale process because declining metrics destroy buyer confidence and extend timelines significantly. Companies that demonstrate consistent performance throughout the sale process achieve better prices and faster closures.

Consider professional assistance when your business exceeds $1 million in revenue or operates in complex industries that require specialized buyer networks. Traditional brokers charge 8% to 12% of sale price, but modern platforms like Unbroker offer transparent alternatives that can accelerate your timeline while reducing costs substantially. Professional preparation, realistic pricing, and strategic execution minimize your sale timeline rather than hoping for quick solutions (which rarely work in complex business transactions).

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)