Buying a business can be a game-changing move, but finding the right financing is crucial. At Unbroker, we know that navigating the world of business acquisition loans can be overwhelming.

This guide will walk you through the best loans to buy a business, helping you understand your options and make an informed decision. We’ll explore various loan types, key factors to consider, and steps to secure the most favorable terms for your business purchase.

What Are the Best Loans for Buying a Business?

When it comes to financing a business acquisition, several loan options stand out. Let’s explore the top choices for aspiring business owners.

SBA Loans: The Gold Standard

SBA loans often top the list for business acquisitions. The 7(a) loan program is SBA’s primary business loan program for providing financial assistance to small businesses. These loans can cover a significant portion of the purchase price, which makes them attractive for buyers with limited capital.

The CDC/504 program, another SBA option, works well for purchasing real estate or equipment. It provides fixed-rate financing for up to 40% of the project cost, with a bank covering 50% and the buyer contributing 10%.

Traditional Bank Loans: For Established Buyers

Traditional bank loans suit buyers with strong credit and substantial assets. These loans typically offer lower interest rates than alternative lenders but require a higher down payment – usually 20% to 25% of the purchase price.

Online Lenders: Speed and Flexibility

Online lenders have transformed business financing. They often provide faster approval times and more flexible terms than traditional banks. For example, OnDeck offers loans from $5,000 to $250,000 with potential same-day approval. However, interest rates tend to be higher, so careful review of the terms is essential.

Seller Financing: A Win-Win Solution

Seller financing can change the game in business acquisitions. This option can cover anywhere from 5% to 60% of the total asking price. It often comes with more flexible terms and can signal the seller’s confidence in the business’s future success.

Combination Financing: The Best of All Worlds

Many successful deals use a combination of these loan types. The key is to understand your financial situation, the business’s potential, and the terms each lender offers. The best loan isn’t just about the lowest interest rate – it’s about finding the right fit for your specific acquisition scenario.

Now that we’ve covered the main types of loans for buying a business, let’s move on to the factors you should consider when choosing the best option for your needs.

What Factors Matter Most in Business Acquisition Loans?

Interest Rates and Terms: The Long Game

Interest rates significantly impact your total cost over time. Average business loan interest rates range from 7 percent to 99 percent depending on the type of loan and the lender. SBA loans offer some of the most competitive rates.

Don’t focus solely on interest rates. Loan terms are equally important. A lower rate with a shorter term might mean higher monthly payments, which could strain your cash flow. A slightly higher rate with a longer term could provide more breathing room for your new business to grow.

Down Payments and Loan Amounts: Finding the Sweet Spot

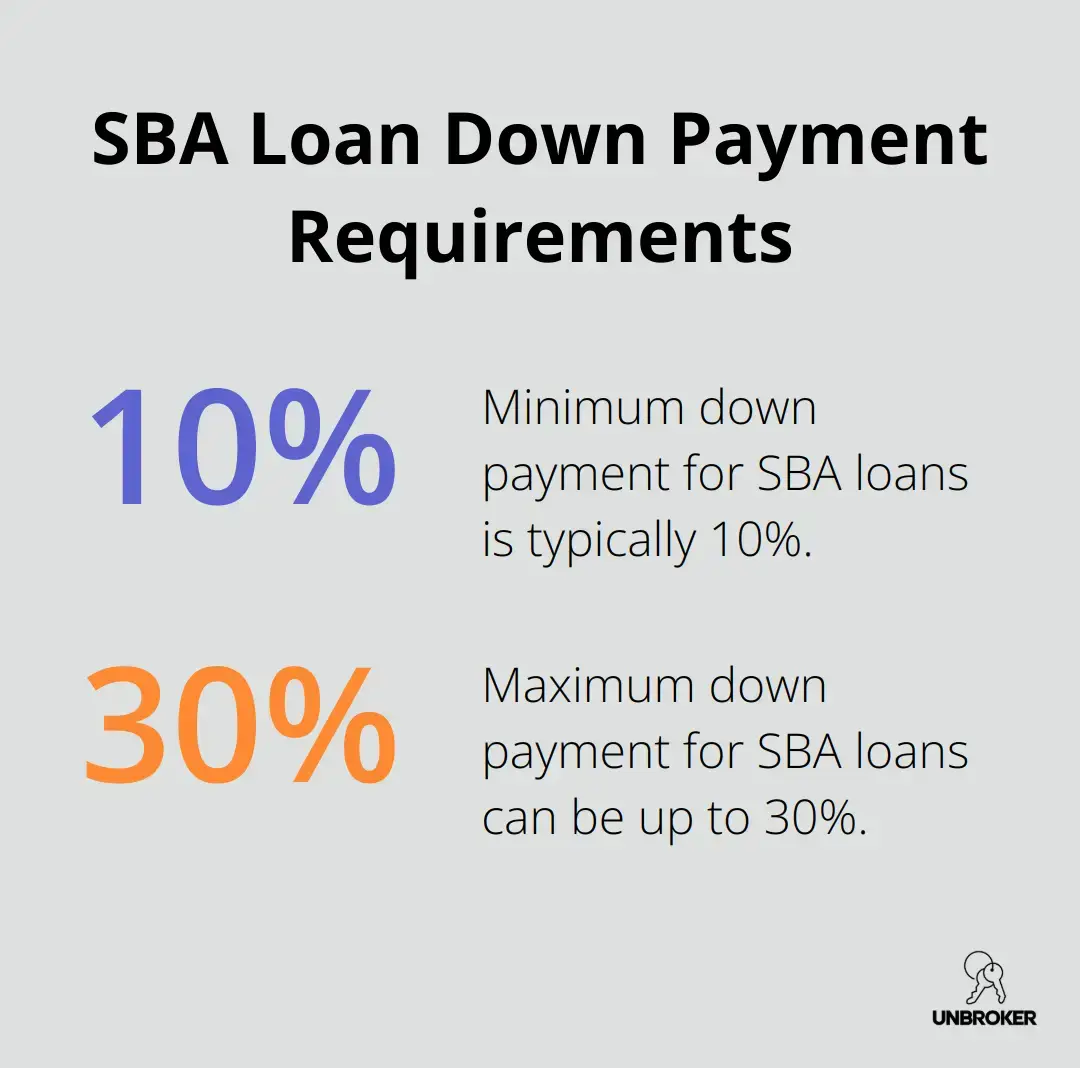

Most lenders require a down payment. Business owners should expect to pay a down payment of 10% to 30% for a SBA loan, but the actual amount can vary. Your down payment affects your loan amount and, consequently, your monthly payments.

A larger down payment can lead to better terms and lower interest rates. However, it’s vital to balance this with maintaining enough working capital for your newly acquired business. Try not to drain your reserves for a slightly better rate.

Collateral and Personal Guarantees: Skin in the Game

Lenders often require collateral to secure the loan. This could include business assets, real estate, or even personal assets. For SBA loans, collateral requirements vary depending on the loan amount. For loans $50,000 or less, the SBA does not require collateral, except for International Trade loans.

While offering collateral can improve your chances of approval (and potentially lower your interest rate), it also increases your personal risk. Consider carefully what you’re willing to put on the line and how it aligns with your risk tolerance.

Flexibility and Prepayment: Planning for Success

Business acquisition loans aren’t one-size-fits-all. Look for lenders offering flexibility in repayment schedules, especially if your business has seasonal fluctuations. Some loans allow interest-only payments for a set period, giving you time to stabilize cash flow.

Prepayment penalties can be a hidden cost. Some lenders charge fees if you pay off your loan early, which could limit your options if your business outperforms expectations. Always ask about prepayment terms and factor them into your decision.

The Right Balance: Tailoring Your Loan to Your Needs

Choosing the right business acquisition loan involves balancing these factors against your specific needs and circumstances. Take the time to thoroughly evaluate each option, and don’t hesitate to negotiate terms with potential lenders. The best loan isn’t just about the numbers-it’s about finding a financial partner who believes in your vision and supports your path to success.

Now that you understand the key factors in business acquisition loans, let’s explore the steps you can take to secure the best possible financing for your business purchase.

How to Secure the Best Business Acquisition Loan

Polish Your Financial Profile

Your personal and business financial health significantly influences loan approval and terms. Check your credit score – try to achieve at least 680 for optimal terms. If your score needs improvement, pay down existing debts and correct any errors on your credit report.

Assess your debt-to-income ratio. Lenders typically prefer a ratio below 43%. If yours exceeds this, increase your income or reduce your debt load before applying for a loan.

Create a Compelling Business Plan

A well-crafted business plan convinces lenders of your venture’s potential. Include detailed financial projections for the next 3-5 years, demonstrating how you’ll generate sufficient cash flow to repay the loan.

Emphasize your industry experience and management team’s expertise. A study found that 12% of owners struggle to find candidates with the right technical skills, while 11% struggle to find candidates with the right soft skills.

Prepare Your Documentation

Compile a comprehensive package of financial documents. This typically includes:

- Personal and business tax returns (last 3 years)

- Personal financial statement

- Business financial statements (if acquiring an existing business)

- Proof of assets for collateral

- Business licenses and registrations

Having these documents ready speeds up the application process and demonstrates your preparedness to lenders.

Compare Multiple Lenders

Don’t accept the first offer you receive. The Federal Reserve presents over-time trends on small business performance and financing metrics using Small Business Credit Survey data from 2016 through 2023.

Consider various lender types – traditional banks, online lenders, and SBA-approved lenders. Each has its strengths. For instance, online lenders can provide quick approvals, while SBA loans often offer the most favorable terms for qualified borrowers (though approval times may be longer).

Negotiate Effectively

Once you have offers, negotiate. Focus on more than just the interest rate. Consider factors like prepayment penalties, collateral requirements, and loan covenants.

If one lender offers a lower rate but stricter terms, use that as leverage with other lenders. Lenders want your business – you have more negotiating power than you might think.

Some clients have successfully negotiated by presenting competitive offers from multiple lenders.

Final Thoughts

The best loans to buy a business require careful consideration and thorough research. We explored various loan types, each with unique advantages, and the right choice depends on your specific circumstances and the business you’re acquiring. Interest rates, repayment terms, down payment requirements, and collateral are all important factors in selecting the ideal loan.

Due diligence plays a key role in the loan selection process. Take time to assess your financial situation, prepare a comprehensive business plan, and gather all necessary documentation before you approach lenders. Compare offers from multiple lenders, as each has different criteria and strengths (casting a wide net can lead to more favorable terms).

Unbroker specializes in helping entrepreneurs navigate the business buying process with transparent, low-cost options. Our platform offers valuable resources and support to ensure you make informed decisions about financing your business purchase. The right financing can set the foundation for your future success as a business owner.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)