Choosing the wrong business broker can cost you months of wasted time and thousands in unnecessary fees. A poor broker reputation often signals deeper problems that will hurt your sale.

We at Unbroker see sellers fall victim to unscrupulous brokers who make big promises but deliver poor results. The warning signs are clear once you know what to look for.

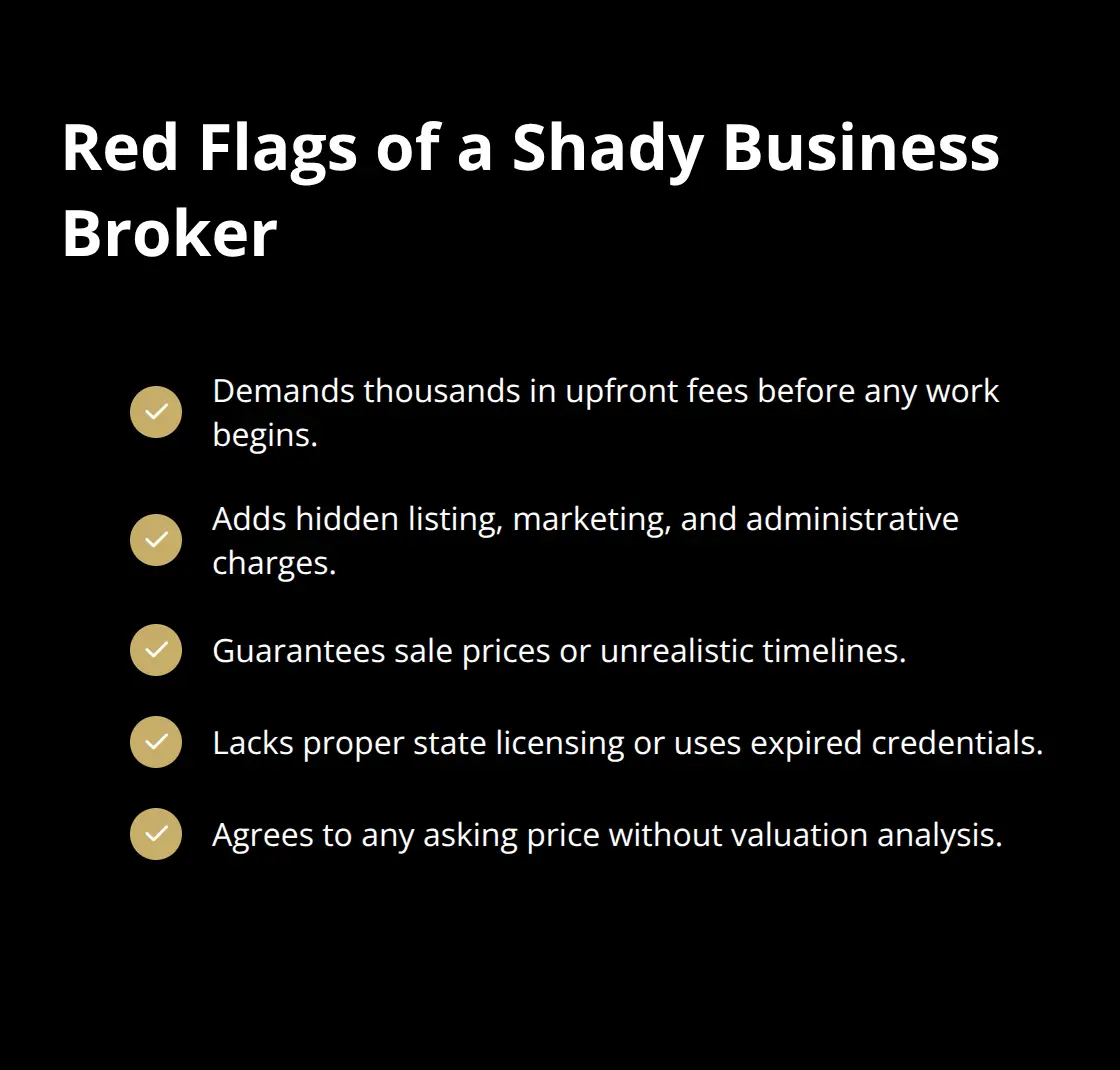

Red Flags That Indicate a Shady Business Broker

Excessive Upfront Fees and Hidden Costs

Legitimate brokers charge success fees after your business sells, typically 5-10% of the final sale price. Shady operators demand thousands upfront before they do any work. The International Business Brokers Association provides guidance to business brokers when conducting business brokerage services through uniform practices and procedures.

A broker who asks for $5,000 or more before marketing begins sends a clear warning signal. Hidden costs pile up fast with questionable brokers who add listing fees, marketing charges, and administrative costs that were never disclosed initially. These fees can reach $10,000-15,000 before you see a single qualified buyer.

Licensing Problems That Cost You Money

Most states require business brokers to hold proper licenses, yet enforcement remains weak. Many unqualified operators work without credentials or use expired real estate licenses inappropriately. Check your state’s database directly rather than trust broker claims.

Professional associations like IBBA maintain member directories with verified credentials. Unlicensed brokers cannot provide legal protections during transactions (leaving you vulnerable to costly mistakes and contract disputes). Some states have zero licensing requirements, which creates opportunities for inexperienced operators to enter the market.

Promises That Sound Too Good

Brokers who guarantee specific sale prices or promise to triple your revenue within months are lying. The average business sale involves over 300 hours of work from initial valuation through closing, yet shady operators claim they can close deals in weeks. No legitimate professional can predict exact buyer behavior or market conditions.

Real brokers discuss realistic timelines, market challenges, and potential obstacles honestly. They ask detailed questions about your business rather than make immediate promises about outcomes they cannot control. A broker who agrees to any asking price without analysis lacks valuation expertise.

Now that you recognize these red flags, you need to ask the right questions to separate legitimate professionals from questionable operators.

Questions to Ask Before Hiring a Business Broker

Smart sellers ask specific questions that expose broker weaknesses before they sign contracts. Start with track record verification by requesting the names and contact information of three recent clients who sold businesses similar to yours in size and industry. A legitimate broker provides references immediately, while questionable operators make excuses or offer vague testimonials.

Ask for their average time to sale and success rate for completed transactions versus total listings taken. Quality brokers maintain strong completion rates according to IBBA data, while poor performers struggle to reach 30%.

What Is Your Track Record and Success Rate

Request specific details about their recent transactions in your industry and business size range. Professional brokers share concrete examples of successful sales, including sale prices and timeframes (without violating confidentiality agreements). Ask how many businesses they currently have listed and how long those listings have been on the market.

Experienced brokers discuss market challenges honestly and explain why certain deals failed to close. They provide realistic timelines based on actual data rather than optimistic projections. Avoid brokers who cannot produce verifiable success metrics or refuse to discuss their track record openly.

How Do You Market My Business to Buyers

Demand detailed explanations of their buyer outreach methods beyond basic online listings. Professional brokers maintain databases of 500+ qualified buyers, actively network with acquisition-focused companies, and use targeted marketing campaigns. Ask how they plan to reach strategic buyers versus financial buyers, as strategic buyers continue to drive activity and pay premium valuations.

Request examples of their marketing materials and buyer presentation packages. Brokers who rely solely on generic listing websites lack the sophisticated approach needed for competitive sales. Question their confidentiality protocols to protect your business reputation during the business sale process.

What Are Your Total Fees and Commission Structure

Get complete fee breakdowns in writing before any commitment. Business broker commissions typically range from 8% to 12% of the sale price, varying by business size and complexity. Ask about additional costs for legal documents, marketing materials, or administrative services that should be included in standard commission rates.

Calculate total potential costs including all fees to compare different brokers accurately. Transparent professionals provide detailed fee schedules upfront, while shady operators reveal hidden charges throughout the process. These questions help you identify brokers worth your time, but traditional brokerage isn’t your only option for selling your business.

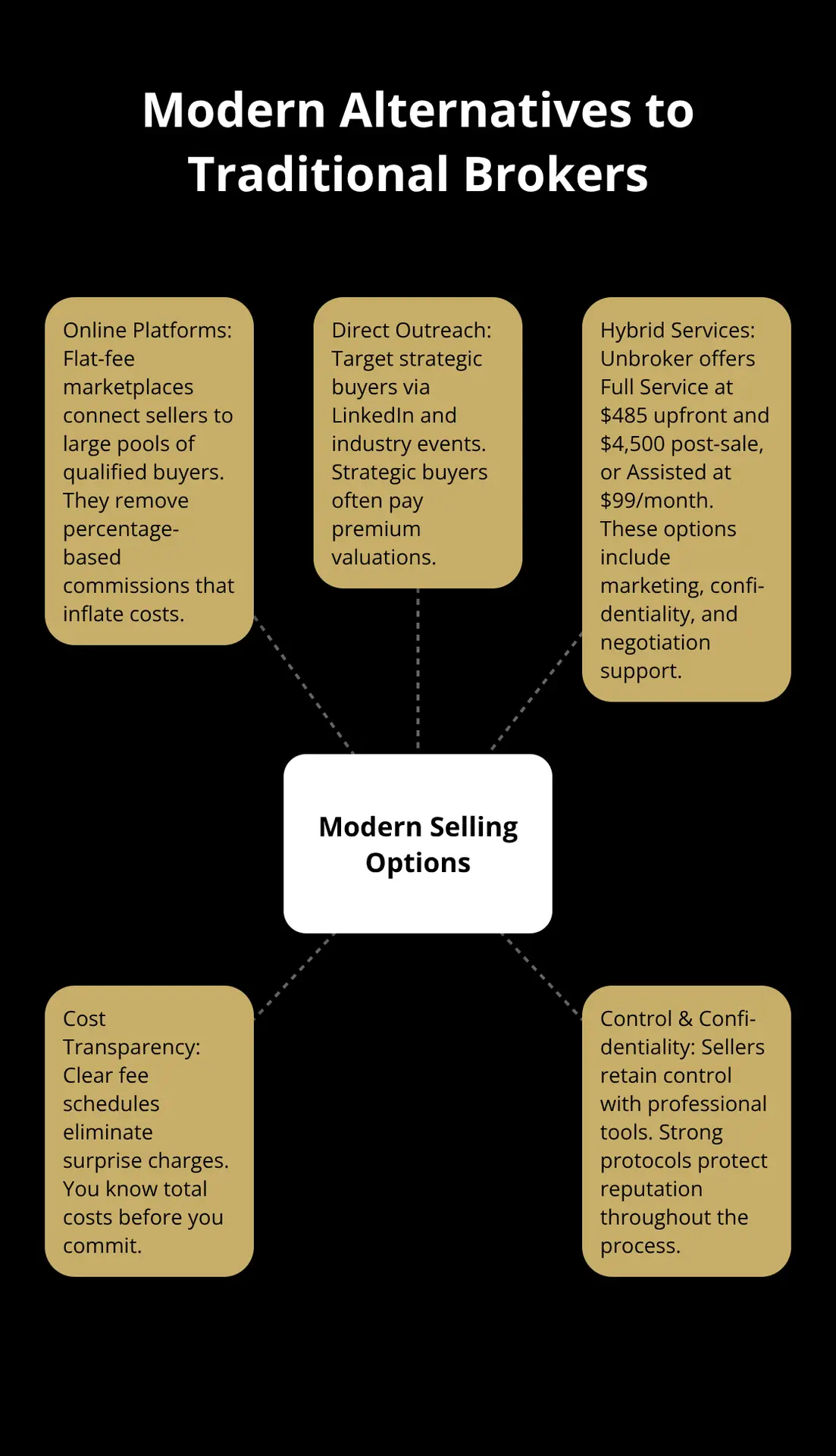

Alternative Options to Traditional Business Brokers

Traditional brokers charge 8-12% commissions plus hidden fees, but modern platforms offer superior alternatives at a fraction of the cost. Online business sale platforms like Flippa report over 300,000 active buyers, while BizBuySell processes thousands of transactions monthly with transparent fee structures. These platforms eliminate the middleman markup while they provide access to qualified buyer pools that often exceed individual broker networks.

Direct Buyer Outreach Delivers Better Results

Smart sellers bypass brokers entirely through targeted outreach to strategic buyers in their industry. LinkedIn Sales Navigator helps identify acquisition-focused companies, while industry conferences provide direct access to decision makers. Cold email campaigns to competitors and suppliers generate serious inquiries without commission fees.

Research shows strategic buyers pay higher premiums over financial buyers, which makes direct outreach financially superior to broker-mediated sales. Document everything in written form to maintain legal protection throughout negotiations.

Online Platforms Reduce Costs Dramatically

Modern online platforms connect sellers directly with qualified buyers at transparent prices. These platforms charge flat fees instead of percentage-based commissions, which saves sellers thousands on typical transactions. Many platforms offer professional marketing tools, buyer verification services, and transaction support without the overhead costs that traditional brokers pass to clients.

Sellers maintain complete control over their sale process while they access buyer databases that rival or exceed individual broker networks. The elimination of commission-based pricing removes conflicts of interest that plague traditional brokerage relationships.

Hybrid Models Combine Best Features

We at Unbroker offer a modern platform with transparent, low-cost options that eliminate high brokerage fees. The Full Service Business Sale costs $485 upfront and $4,500 post-sale for hands-off sellers, while the Assisted Business Sale charges $99 monthly for DIY sellers who want expert support.

Both services include confidentiality protection, premium marketing tools, legal document templates, and negotiation assistance without hidden fees. AI-driven processes enhance buyer matching while satisfaction guarantees protect seller interests throughout the transaction.

Final Thoughts

You can protect yourself from shady business brokers when you recognize excessive upfront fees, missing credentials, and unrealistic promises about sale prices or timelines. These warning signs reveal operators who prioritize their profits over your success. A damaged broker reputation often signals deeper problems that will plague your entire transaction.

Transparent alternatives eliminate the guesswork and hidden costs that plague traditional brokerage. Modern platforms provide direct access to qualified buyers without percentage-based commissions that can cost tens of thousands on typical sales. You maintain control while you access professional tools and support at predictable prices.

Your next step involves choosing between expensive traditional brokers or cost-effective modern solutions. Unbroker offers transparent pricing with Full Service Business Sale at $485 upfront and $4,500 post-sale, or Assisted Business Sale at $99 monthly (both options include confidentiality protection, premium marketing tools, legal templates, and negotiation assistance without hidden fees). The platform combines AI-driven buyer matching with satisfaction guarantees.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)