Selling your business through an asset sale offers significant advantages over stock transactions, particularly for tax optimization and liability protection.

We at Unbroker see many business owners overlook the strategic benefits of structuring their exit as an asset purchase. This approach allows sellers to retain certain liabilities while transferring specific business components to buyers.

The right structure can save thousands in taxes and reduce post-sale risks substantially.

What Makes Asset Sales Different from Stock Sales

Asset sales and stock sales operate through fundamentally different mechanisms that create distinct outcomes for both parties. In an asset sale, buyers acquire specific business components like equipment, inventory, customer lists, and intellectual property while they leave unwanted liabilities with the seller. Stock sales transfer complete ownership of the entire entity, which includes all assets and liabilities, both known and unknown.

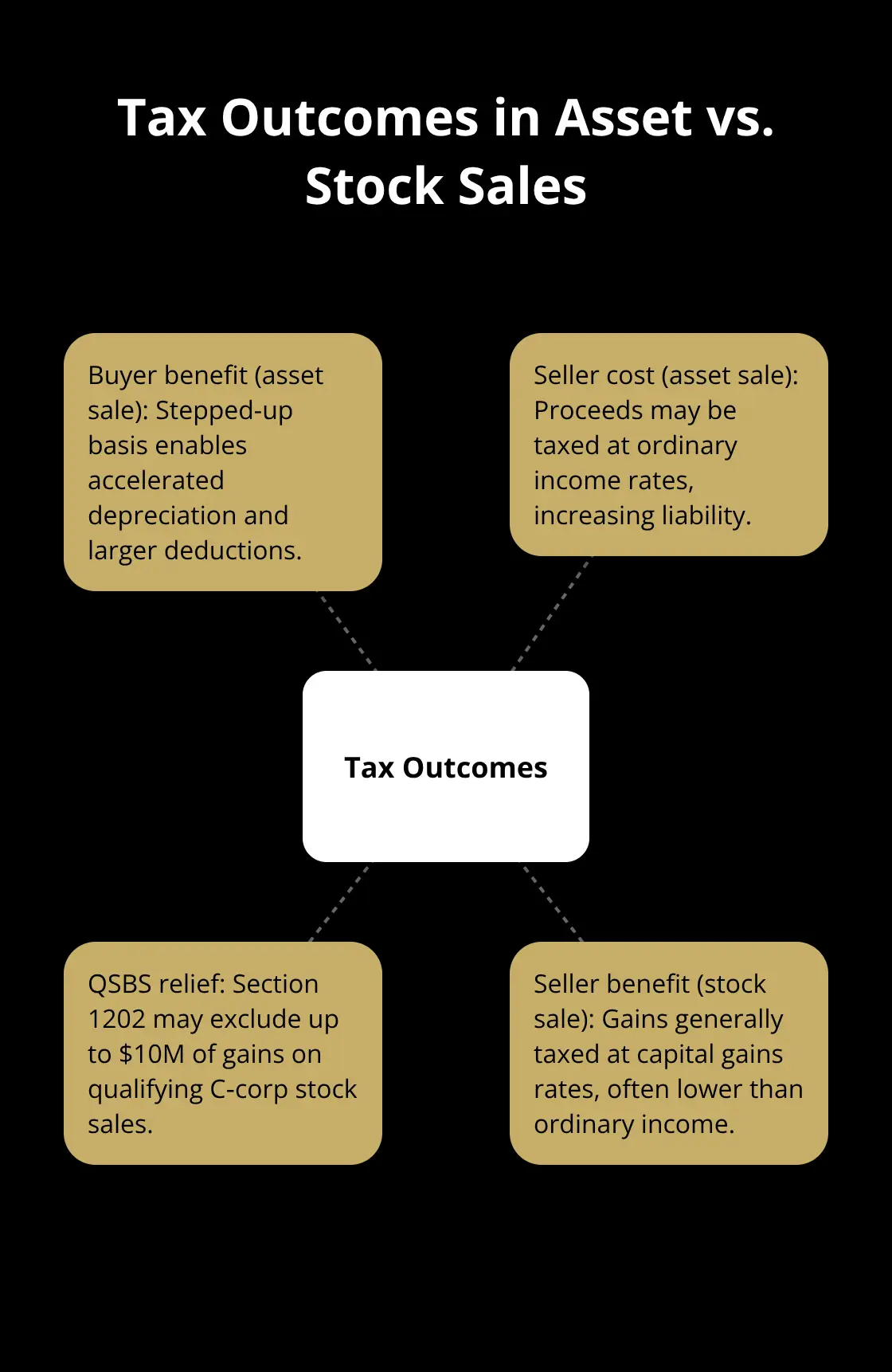

Tax Treatment Creates Major Financial Differences

Asset sales provide buyers with a stepped-up tax basis equal to the purchase price, which allows accelerated depreciation on acquired assets. This benefit often justifies premium prices compared to stock transactions. For sellers, asset sales typically trigger higher taxes since proceeds may face ordinary income rates rather than capital gains treatment. However, sellers who use C corporations may qualify for Section 1202 exclusions on up to $10 million in gains from qualified small business stock sales. Stock sales generally result in better tax treatment for sellers, with gains taxed at capital rates rather than ordinary income rates.

Liability Protection Shapes Transaction Structure

Asset purchases allow buyers to cherry-pick which liabilities to assume, which protects against environmental claims, product liability issues, or employment disputes that predate the sale. Sellers retain responsibility for excluded liabilities but maintain greater control over post-sale risks. Stock sales transfer all liabilities to buyers, which includes undisclosed obligations that surface later.

This liability assumption explains why stock buyers typically demand extensive representations, warranties, and indemnification provisions that can extend seller exposure for years after the transaction closes.

Asset Selection Flexibility Drives Strategic Value

The selective nature of asset purchases creates opportunities that stock sales cannot match. Buyers can exclude outdated equipment, problematic contracts, or underperforming divisions while they focus on profitable components. This flexibility often results in cleaner transactions with fewer complications during due diligence. Sellers benefit from this approach because they can retain valuable assets (like real estate or cash reserves) while they transfer operational components to new ownership.

These structural differences directly impact how you should approach the next phase: evaluating the specific benefits and drawbacks that each party faces in asset transactions.

Why Asset Sales Win for Both Buyers and Sellers

Sellers Gain Control and Tax Benefits

Asset sales give sellers unprecedented control over transaction structure while they potentially reduce long-term exposure. Sellers retain cash reserves, real estate holdings, and other valuable assets outside the sale scope, which preserves wealth beyond the transaction price. The ability to exclude specific liabilities means sellers avoid the transfer of environmental issues, pending litigation, or employment disputes that could create post-closing headaches.

The IRS allows sellers to time asset sales strategically to manage tax brackets across multiple years, which spreads ordinary income recognition when beneficial. Manufacturing businesses particularly benefit since they can retain expensive real estate while they sell operational assets, which creates ongoing rental income streams from buyers.

Buyers Secure Tax Advantages and Risk Protection

Asset purchases deliver immediate tax benefits that stock sales cannot match. The stepped-up basis allows buyers to depreciate assets at full purchase price rather than the seller’s historical cost, which creates substantial annual deductions. A buyer who purchases $2 million in equipment gets depreciation based on that full amount instead of the seller’s potentially much lower book value.

This tax treatment often justifies the payment of 10-15% premiums over stock sale prices. Buyers also eliminate unknown liability risks since they choose exactly which obligations to assume. Technology companies especially favor asset purchases because they can exclude outdated software licenses, problematic vendor contracts, or potential intellectual property disputes while they secure valuable customer databases and proprietary systems.

Risk Factors Require Careful Management

Asset sales create complexity that demands expert navigation. Third-party contract assignments often require individual consent from vendors, landlords, and key customers, which can delay closings or derail transactions entirely. The Hart-Scott-Rodino Act requires antitrust filings for transactions that exceed $119.5 million in 2024, which adds regulatory complexity and timing constraints.

Sellers face double taxation exposure since asset sale proceeds may trigger both corporate and individual tax obligations. Employee transitions become more complicated as workers technically terminate with the seller and start fresh with the buyer (which requires new I-9 forms and benefit enrollments). Due diligence processes are more complex in asset sales due to the need for detailed asset valuations, title searches, and individual contract reviews.

These complexities make proper preparation essential for success. Effective negotiation often leads to better deals for both buyers and sellers. The next phase focuses on the specific steps that transform these strategic advantages into a well-executed transaction.

How to Execute an Asset Sale Successfully

Asset sale execution requires precision in three critical phases that determine transaction success. Start with comprehensive asset identification and hire professional appraisers who understand your industry – manufacturing equipment needs different valuation approaches than software licenses or customer databases. Create detailed asset schedules that specify included items down to individual pieces of equipment, intellectual property registrations, and contract assignments. Exclude problematic assets early rather than address them during due diligence when time pressure mounts.

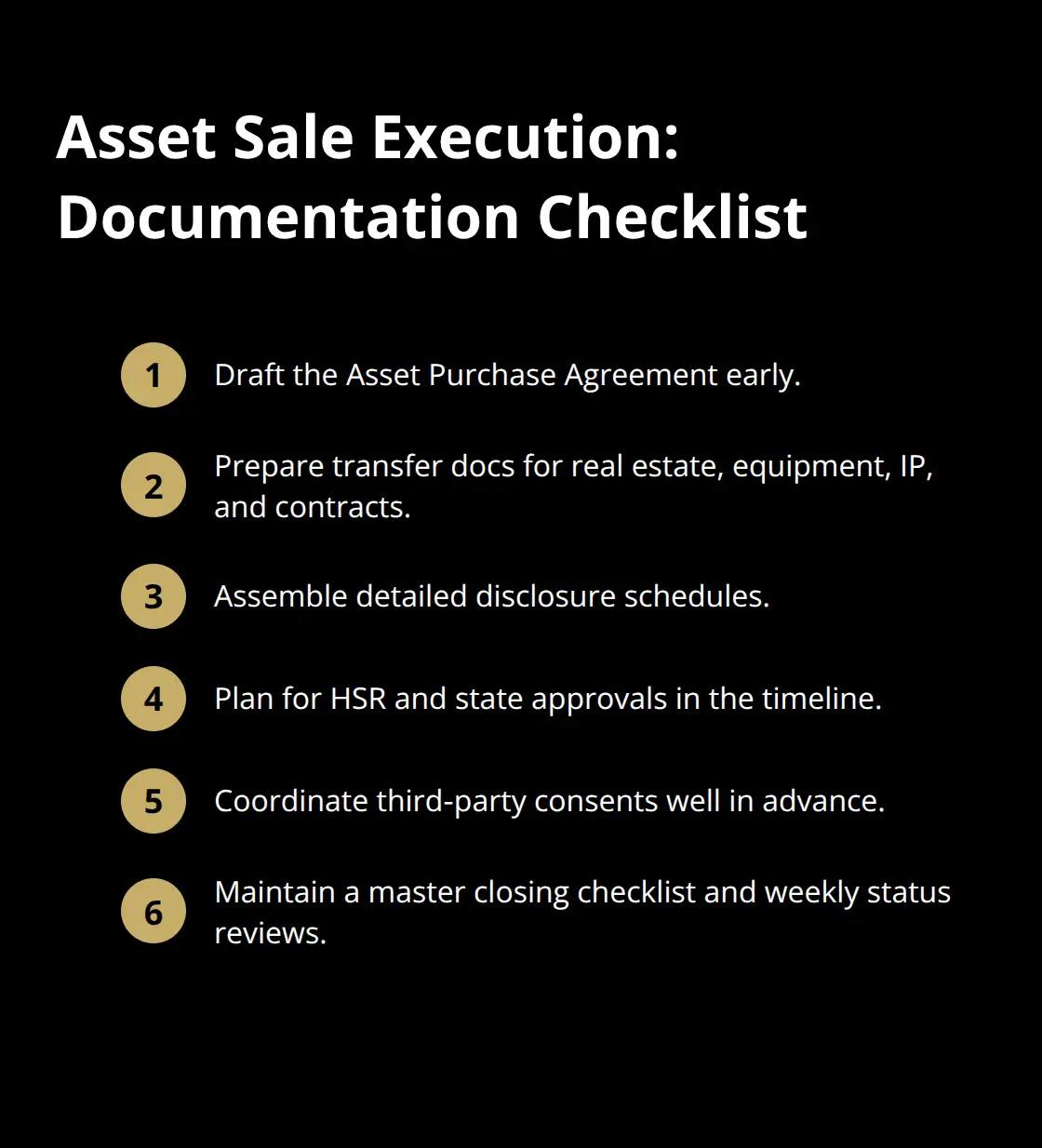

Documentation Requirements Shape Transaction Speed

Asset Purchase Agreements require extensive documentation that stock sales avoid. Prepare individual transfer documents for real estate, equipment titles, intellectual property assignments, and contract novations months before your target close date.

The Hart-Scott-Rodino process takes 30 days minimum for transactions that qualify, while state regulatory approvals can extend timelines by 60-90 days. Draft disclosure schedules that detail every representation and warranty to prevent buyer claims later – incomplete schedules create liability exposure that lasts years beyond the transaction close.

Legal Expertise Prevents Costly Mistakes

Work with M&A attorneys who specialize in asset transactions since general business lawyers often miss industry-specific transfer requirements. These specialists understand the nuances of contract assignments, third-party consents, and regulatory filings that can derail deals. They also structure indemnification provisions that protect both parties while they limit post-sale exposure appropriately.

Payment Structure Optimization

Structure payment terms that reflect asset transfer complexity – buyers should pay 70-80% at the transaction close with amounts held in escrow for 12-18 months to cover potential claims. Negotiate assumption of specific liabilities rather than blanket exclusions since strategic liability assumption can benefit deal structure. Address employee transition costs upfront and require buyers to honor benefit obligations for 90 days minimum (which protects your workforce while it reduces your post-sale exposure).

Timeline Management Prevents Deal Failure

Set firm deadlines for third-party consents since delayed approvals from landlords or major customers can derail transactions entirely. Plan for 90-120 days from signed letter of intent to close, with additional time for complex regulatory approvals. Monitor progress weekly and maintain backup options for critical contract assignments that face potential rejection.

Final Thoughts

Asset sales work best for businesses with valuable tangible assets, established customer relationships, or significant liability concerns that sellers want to exclude. Manufacturing companies, technology firms with proprietary systems, and service businesses with strong client databases see the greatest benefits from this structure. Success in an asset sale depends on early preparation and professional guidance.

Start asset valuation and legal documentation at least six months before your target sale date. Work with M&A attorneys who understand the complexity of contract assignments and regulatory requirements. Plan for extended timelines since third-party consents and regulatory approvals can add months to the process.

Business owners who plan an asset sale should focus on clean financial records, clear asset ownership documentation, and strategic liability management. The stepped-up tax basis benefits for buyers often justify premium prices, but sellers must account for potential double taxation and complex transfer requirements. We at Unbroker help business owners navigate these complexities through our transparent platform that provides expert support throughout the asset sale process.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)