Selling a business requires more than just finding the right buyer. The difference between a mediocre deal and an exceptional one often comes down to your negotiation tactics.

We at Unbroker have seen countless business owners leave money on the table simply because they weren’t prepared for the negotiation process. Smart preparation and strategic thinking can transform your sale outcome completely.

What Research Wins Business Sale Negotiations

Calculate Your Business Worth Down to the Dollar

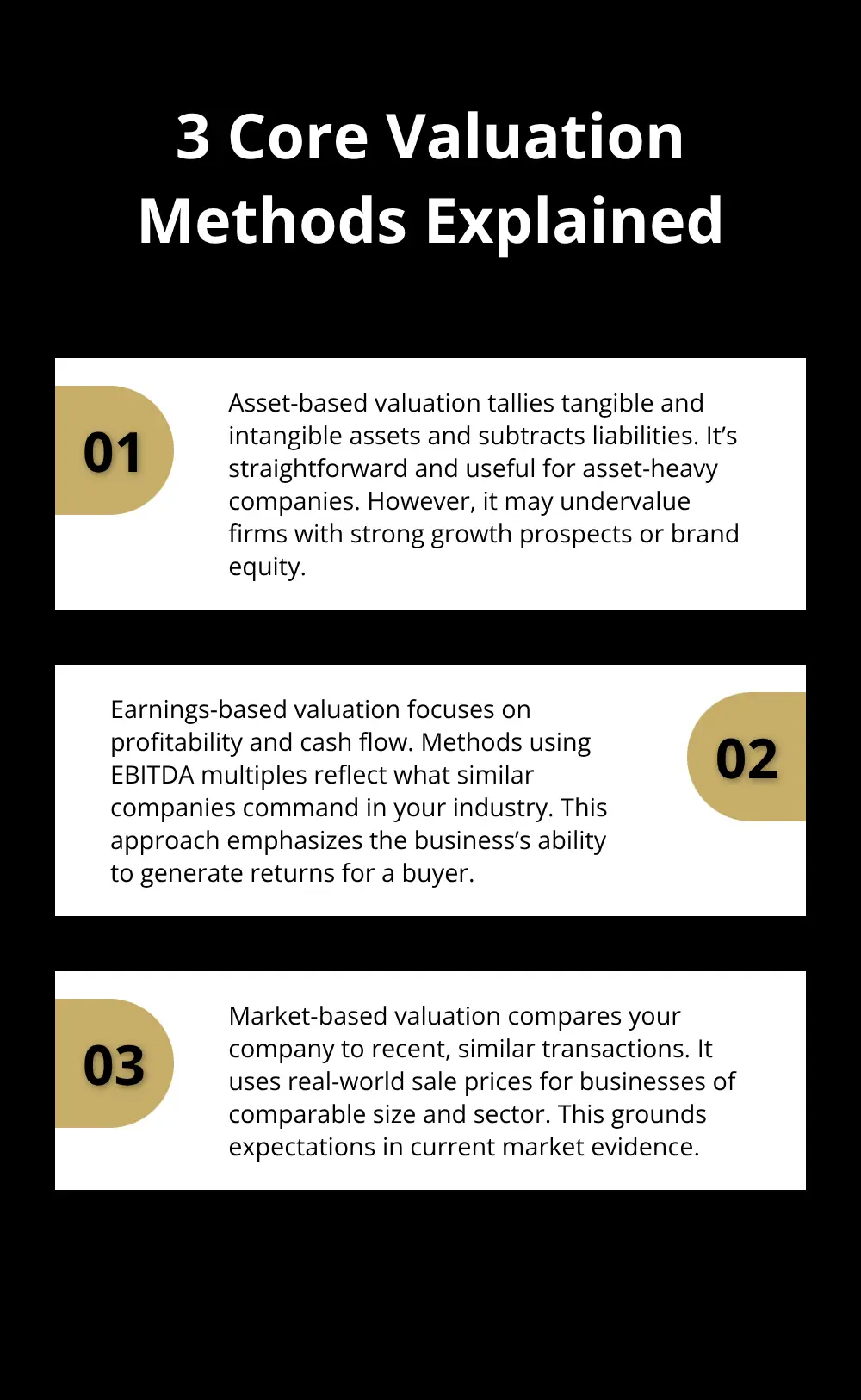

Most business owners guess their company’s value instead of calculating it precisely. This approach costs them thousands in negotiations. Start with three valuation methods: asset-based, earnings-based, and market-based approaches.

Asset-based valuation adds up tangible and intangible assets minus liabilities. Earnings-based methods like EBITDA multiples typically range from 2-6x depending on your industry. Market-based valuation compares your business to recent sales of similar companies in size and sector.

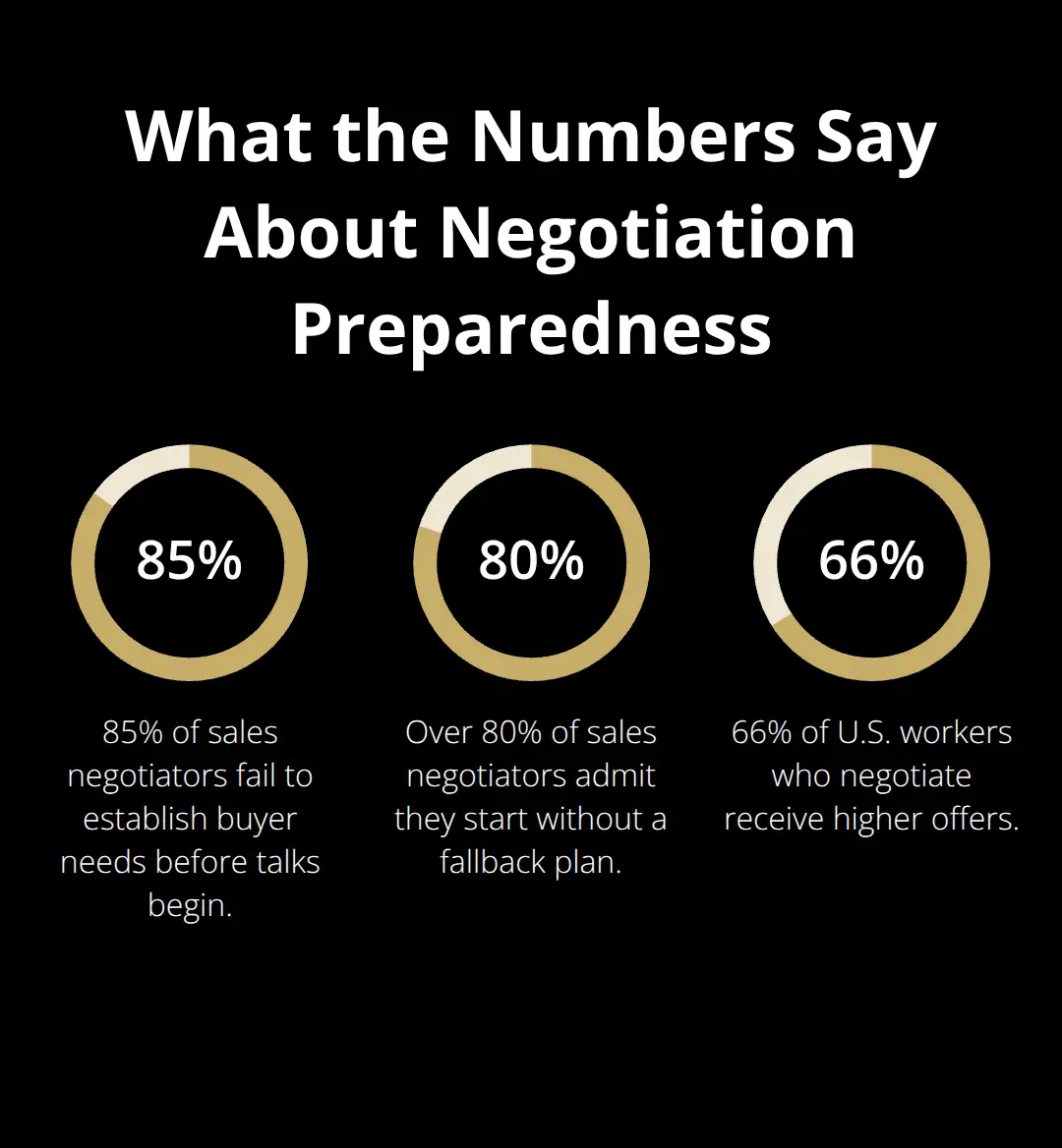

Research shows that 85% of sales negotiators fail to establish what buyers want before negotiations begin. This fundamental mistake weakens your position from the start. Dig into comparable sales data through industry reports, business broker databases, and public transaction records. Companies in the same industry, revenue range, and geographic area provide the most relevant benchmarks. Document these comparables with sale prices, financial metrics, and deal structures.

Decode Buyer Psychology and Financial Reality

Smart sellers investigate their buyers as thoroughly as buyers investigate them. Financial capacity determines negotiation limits more than stated interest levels. Request proof of funds early in discussions. Cash buyers drove one-third of home sales in the first half of 2025, which gives you leverage in timing negotiations. Private equity firms often pay higher multiples but demand more due diligence. Strategic buyers from your industry may offer premium prices for synergies but expect detailed integration plans.

Analyze Buyer Motivations Through Their Focus Areas

Buyer motivations reveal themselves through their questions and focus areas. Growth-focused buyers ask about expansion opportunities and customer acquisition costs. Cost-cutting buyers examine operational efficiencies and redundant expenses. Succession-focused buyers worry about key employee retention and knowledge transfer. Understanding these priorities helps you position your business strengths effectively and anticipate negotiation pressure points.

Your thorough preparation work sets the foundation for the actual negotiation techniques that will determine your final sale price and terms.

How Do You Control Business Sale Negotiations

Set Your Minimum Price Before Buyers Arrive

Establish your walk-away price before negotiations begin to prevent emotional decisions under pressure. Research shows that over 80% of sales negotiators admit they enter talks without a fallback plan. Calculate your absolute minimum with three factors: outstanding debts, personal financial needs, and opportunity costs of continued operations. Write this number down and share it only with your advisors, never with buyers. This psychological anchor keeps you grounded when buyers present attractive but insufficient offers.

Your walk-away price should account for tax implications and transaction costs. Capital gains taxes are taxed at different rates depending on overall taxable income, although some or all net capital gain may be taxed at 0%. Legal fees, due diligence costs, and broker commissions typically add another 8-12% to transaction expenses. Factor these costs into your minimum acceptable offer to avoid unpleasant surprises at closing.

Master Strategic Silence During Price Discussions

Silence creates psychological pressure that often leads buyers to improve their offers without additional concessions from you. The principle that whoever speaks first loses applies directly to business sale negotiations. When buyers present an initial offer, pause for at least 10 seconds before you respond. This technique works because humans naturally fill uncomfortable silence, often with better terms or higher prices.

Studies show that negotiators who operate from their home field can claim between 60% and 160% more value than others according to research by Markus Baer and Graham Brown. Schedule negotiations at your business location when possible. Use silence strategically after you present counteroffers, share financial data, or discuss deal structures. Buyers interpret silence as dissatisfaction with their current proposal, which motivates them to sweeten the deal.

Build Value Beyond Purchase Price Negotiations

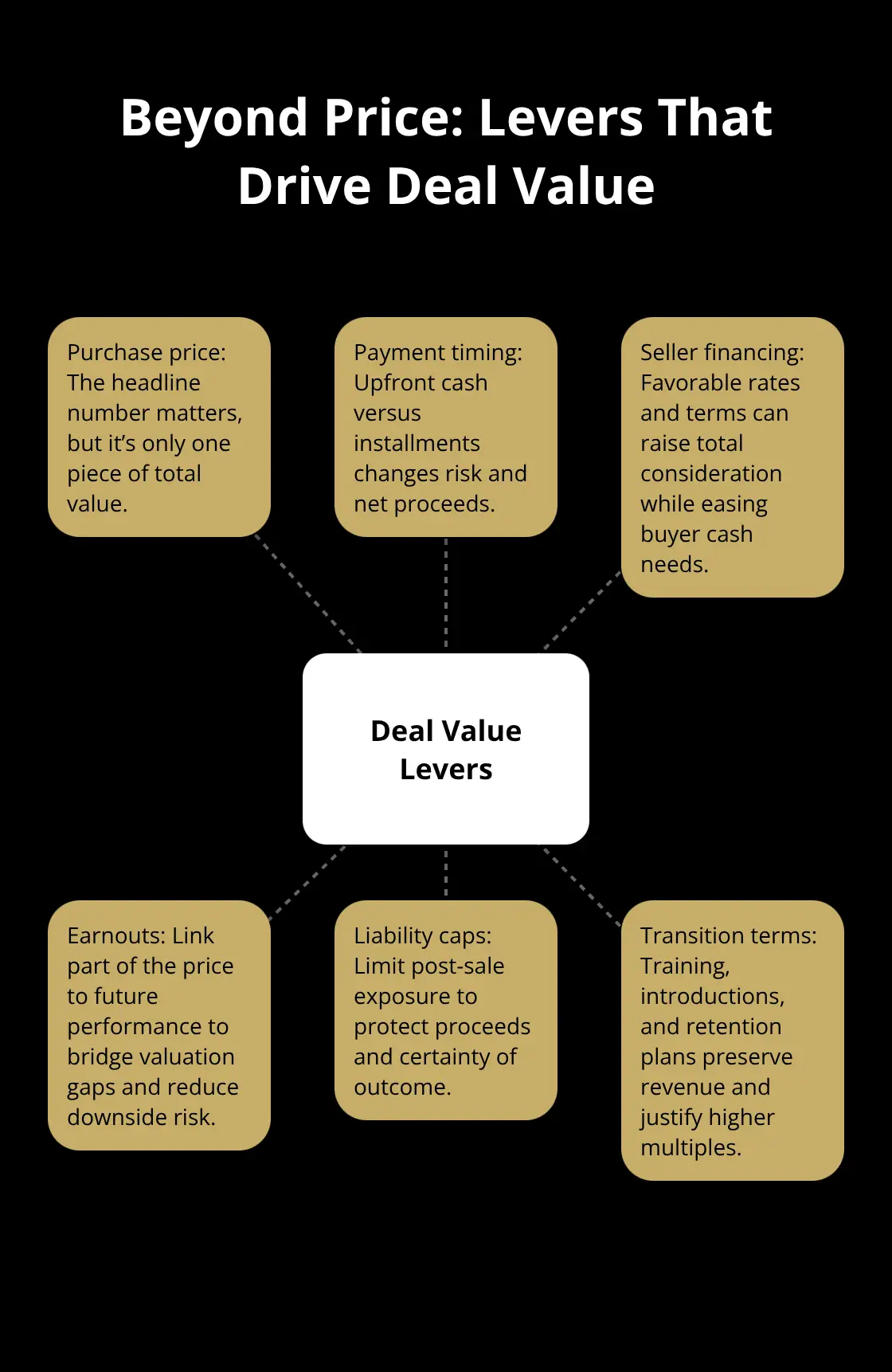

Smart sellers focus on value creation rather than price battles alone. Companies with systematic negotiation approaches see significant improvements in performance according to research benchmarking different negotiation systems within the world’s largest organizations. Present buyers with multiple deal structures that benefit both parties. Seller finance at favorable interest rates can increase your total return while it reduces buyer cash requirements. Earnouts tied to future performance allow buyers to pay premium prices while they protect against downside risks.

Non-financial terms often matter more to buyers than slight price differences. Flexible transition periods, employee retention agreements, and customer introduction processes add substantial value without they reduce your sale proceeds. Buyers pay higher multiples for businesses with smooth transition plans because these plans reduce integration risks and preserve revenue streams.

Navigate Common Negotiation Pitfalls

Most sellers make predictable mistakes that cost them thousands in final sale proceeds. Never reveal your bottom line early in discussions, as this information becomes the ceiling for all future offers. Emotional reactions during tough negotiations signal desperation to experienced buyers who will exploit this weakness. Professional buyers expect sellers to negotiate terms beyond price, so prepare positions on payment structures, transition periods, and liability protections before you enter serious discussions.

Which Negotiation Mistakes Kill Your Business Sale

Exposing Your Financial Desperation Destroys Leverage

Business sellers who reveal their minimum acceptable price early in negotiations watch buyers anchor their offers to that bottom line figure. Research shows that 66% of U.S. workers who negotiate get higher offers, highlighting the importance of proper preparation time. When you tell a buyer you need at least $500,000 to pay off debts, that number becomes their starting point rather than your floor. Professional buyers interpret early price revelations as signs of financial distress or desperation to sell quickly. They exploit this information by structuring offers just above your stated minimum while they add unfavorable terms elsewhere.

Smart sellers establish price ranges instead of specific minimums during initial discussions. Present your asking price as market-driven rather than need-driven. Frame conversations around business value and comparable sales data rather than personal financial requirements. Save specific price negotiations for formal offer presentations when you have established buyer commitment and financial capability.

Emotional Reactions Signal Weakness to Professional Buyers

Anger, frustration, or visible disappointment during negotiations telegraphs amateur status to experienced buyers who exploit emotional sellers. Studies indicate that 60% of customers say no four times before finally accepting a sales offer, which means professional persistence beats emotional reactions. Buyers deliberately test seller composure through lowball offers, unreasonable demands, or delayed responses to gauge your negotiation experience and emotional stability.

Maintain professional demeanor even when buyers present insulting offers or challenge your business practices. Take breaks when discussions become heated rather than respond immediately to provocative statements. Buyers respect sellers who remain calm under pressure and often improve their offers when they realize emotional manipulation tactics won’t work.

Price-Only Focus Leaves Money on the Table

Sellers who negotiate only purchase price miss opportunities to optimize deal value through favorable terms and structures. Research shows that 66% of individuals who negotiate their salary achieve success, securing an average increase of 18.83%. Payment timing, seller financing rates, earnout structures, and liability caps often matter more than headline purchase prices. A $400,000 cash offer may provide less net value than a $450,000 offer with seller financing at market rates and favorable earnout terms.

Prepare negotiation positions on transition periods, employee retention bonuses, non-compete agreements, and working capital adjustments before you enter serious discussions. These terms significantly impact your final proceeds and post-sale obligations.

Buyers expect sophisticated sellers to negotiate beyond price, so failure to address these areas signals inexperience and invites unfavorable standard terms. Professional valuations prevent price mistakes that kill deals, while proper exit planning ensures you maximize your sale price by starting preparations well before you want to sell.

Final Thoughts

Successful business sale negotiations demand preparation, strategic thinking, and disciplined execution. The negotiation tactics covered in this guide work because they address both the psychological and financial aspects of deal-making. Research consistently shows that prepared sellers achieve better outcomes than those who rely on intuition alone.

Win-win outcomes emerge when sellers focus on value creation rather than zero-sum price battles. Buyers appreciate sellers who understand their motivations and constraints. When you present multiple deal structures that address buyer concerns while you protect your interests, negotiations become collaborative rather than adversarial.

The most successful sellers combine thorough market research with emotional discipline during discussions (they establish clear walk-away points, use strategic silence effectively, and negotiate terms beyond purchase price). We at Unbroker help business owners navigate complex sale negotiations through our modern platform that provides expert assistance and legal document templates. Whether you choose our Full Service option or prefer the DIY approach with professional support, you gain access to proven strategies that protect your interests throughout the sale process.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)