At Unbroker, we often encounter business owners facing a retirement sale with no successor. This situation can be emotionally challenging and financially complex.

Our blog post explores the reasons behind this common scenario and offers practical steps for preparing your business for sale.

We’ll guide you through various sale options and highlight the importance of early planning to ensure a smooth transition.

Why No Family Successor?

The Next Generation’s Different Path

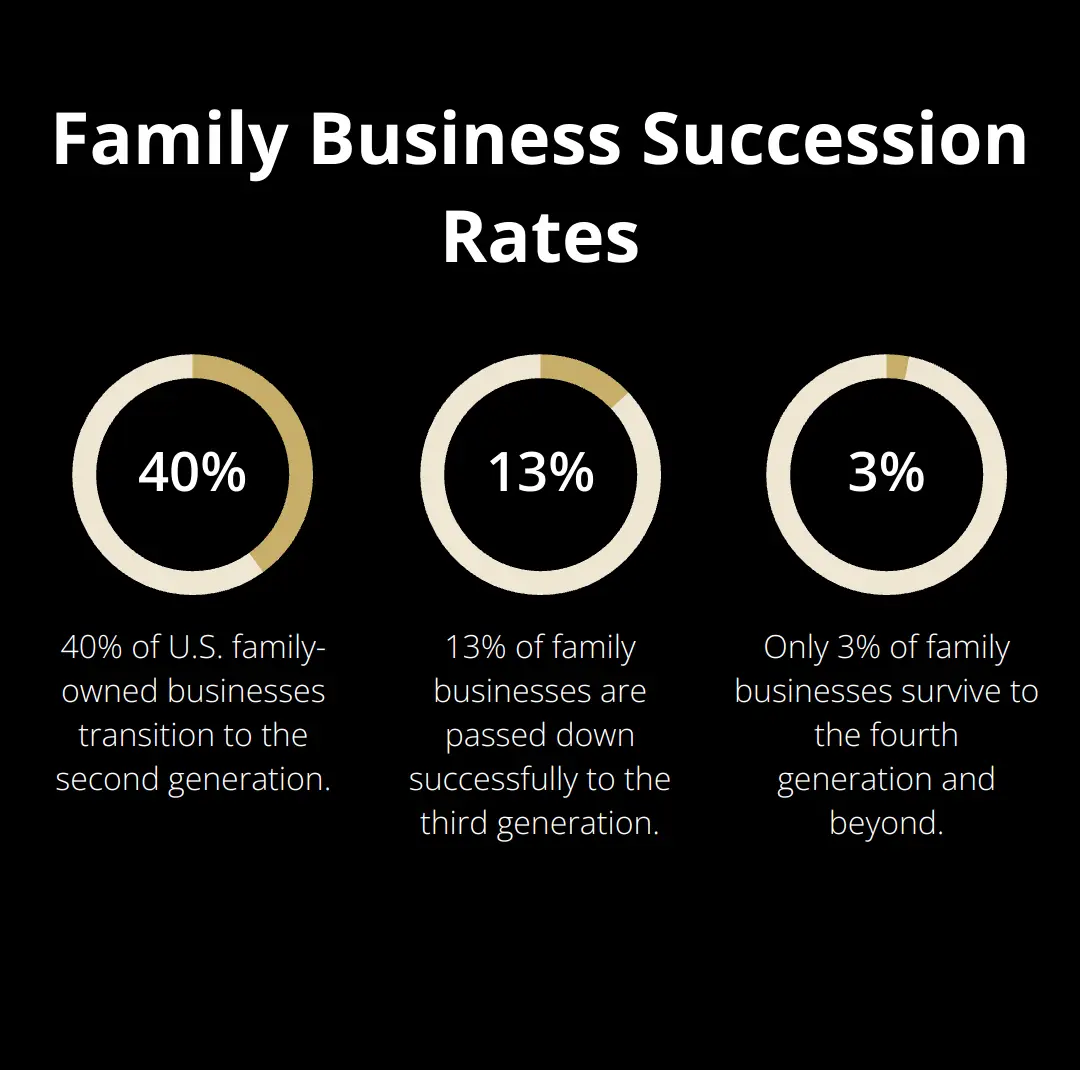

At Unbroker, we’ve witnessed numerous business owners face the reality of having no family successor. This situation is more common than many realize. About 40% of U.S. family-owned businesses turn into second-generation businesses, approximately 13% are passed down successfully to a third generation, and 3% to the fourth generation and beyond.

One primary reason for this lack of family succession is the next generation’s diverging interests. Many children of business owners pursue different career paths, driven by personal passions or the desire to carve out their own identities. This shift often leaves business owners without a clear heir to take over their life’s work.

Skill Mismatch and Preparedness

Even when family members express interest in taking over, they may lack the necessary skills or experience. Running a business requires a unique set of competencies, and not everyone is cut out for it. We’ve observed cases where family members were eager to step in but simply weren’t prepared for the challenges of leadership.

Emotional Challenges of Selling Outside the Family

Selling a business you’ve built from the ground up is never easy, but it’s particularly challenging when it means letting go of the dream of keeping it in the family. Many owners feel a sense of guilt or failure when considering an external sale. It’s important to recognize these emotions but not let them cloud your judgment about what’s best for the business and your financial future.

The Importance of Early Planning

Starting the succession planning process early is essential. Recent studies show that 51% of the current American business market is owned by Baby Boomers, who are set to transition over the next zero to ten years.

We recommend you begin your exit strategy planning at least 3-5 years before your intended retirement. This timeframe allows you to:

- Maximize your business’s value

- Identify and groom potential buyers

- Streamline operations for a smoother transition

- Address any legal or financial complexities

Early planning also gives you time to come to terms with the emotional aspects of selling. It’s not just about the financials; it’s about preparing yourself mentally for the next chapter of your life.

Owners who start planning early consistently achieve better sale outcomes and experience less stress during the process. Selling your business is likely to be one of the most significant financial events of your life (if not the most significant). Treat it with the care and attention it deserves.

Now that we’ve explored why family succession might not be an option, let’s move on to the practical steps of preparing your business for sale.

How to Maximize Your Business Value Before Sale

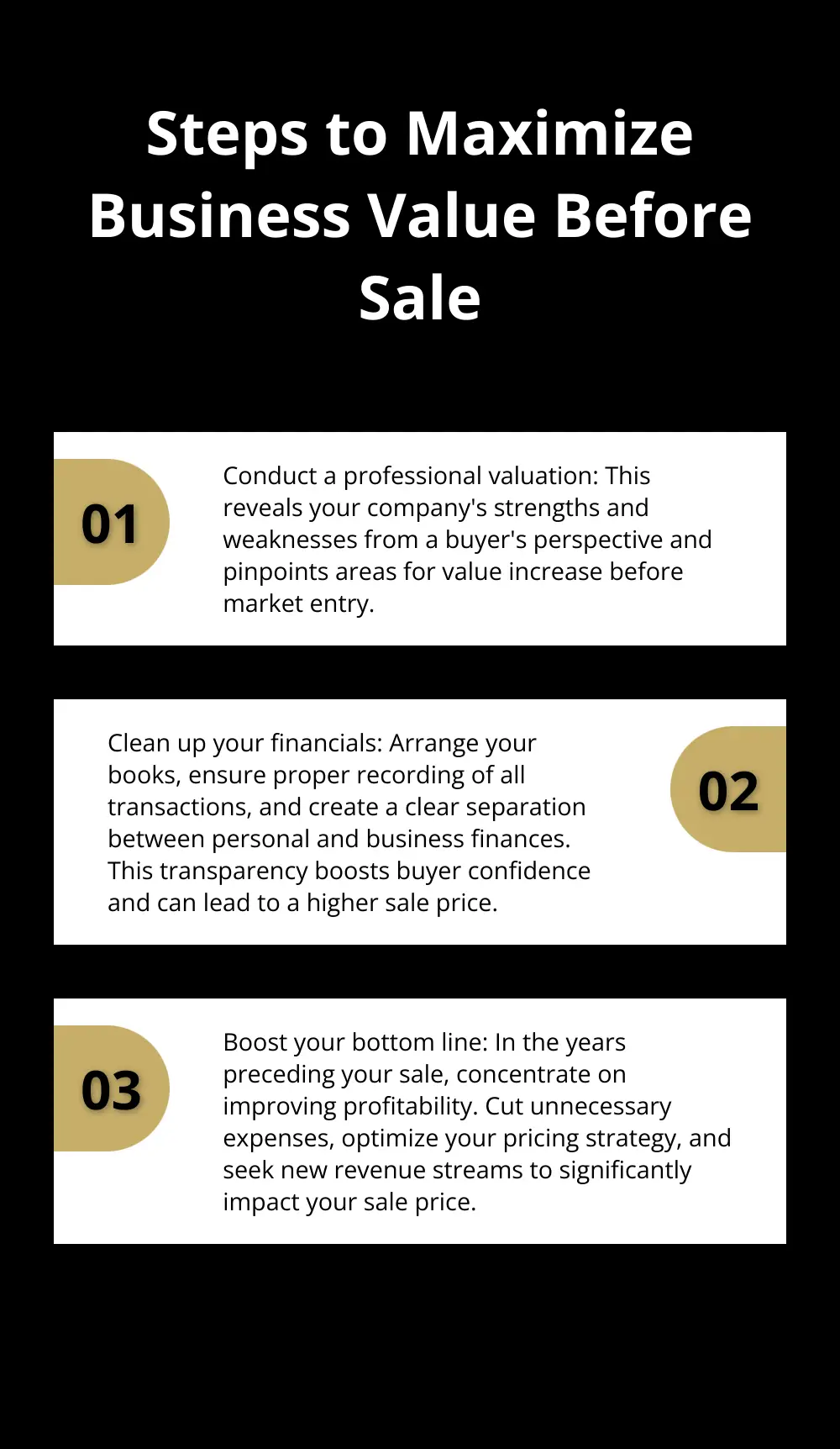

Conduct a Professional Valuation

Start your preparation with a professional valuation of your business. This step goes beyond setting a price; it reveals your company’s strengths and weaknesses from a buyer’s perspective. A thorough valuation will pinpoint areas for value increase before market entry.

Clean Up Your Financials

Buyers demand clear, organized financial records. Dedicate time to arrange your books, ensure proper recording of all transactions, and make them easily explainable. Stop running personal expenses through the business immediately. Create a clear separation between personal and business finances. This transparency not only boosts buyer confidence but can also lead to a higher sale price.

Boost Your Bottom Line

In the years preceding your sale, concentrate on improving profitability. Cut unnecessary expenses, optimize your pricing strategy, and seek new revenue streams. Even minor improvements can significantly impact your sale price. When a business sells products of different margin, price and cost, the mix of what you sell can affect results. It’s worth understanding this.

Strengthen Your Management Team

Buyers find a strong management team that can operate the business without you extremely attractive. Delegate more responsibilities to your key employees. Document processes and procedures to reduce the business’s dependence on any single individual. This approach not only increases your business value but also opens up more sale options (such as management buyouts).

Diversify Your Customer Base

Work on diversifying your customer base if a significant portion of your revenue comes from a few clients. Buyers are cautious of businesses that rely heavily on a small number of key customers. High customer concentration occurs when a single customer accounts for 20% or more of your business’ revenue.

Invest in Technology and Systems

Modernize your business operations where possible. Implement efficient systems for inventory management, customer relationship management, and financial reporting. These investments can significantly increase your business’s value by showcasing scalability and reducing operational risks.

Address Legal and Regulatory Issues

Resolve any outstanding legal issues or regulatory non-compliance before entering the market. These can serve as major red flags for buyers and can significantly delay or derail a sale. Conduct a thorough review of your contracts, licenses, and permits to ensure everything is current and in order.

As you work through these steps to increase your business value, you’ll also make your company more attractive to a wider range of potential buyers. The effort you invest now will pay off significantly when it’s time to sell. With your business primed for sale, let’s explore the various options available for finding the right buyer.

Who Should You Sell Your Business To?

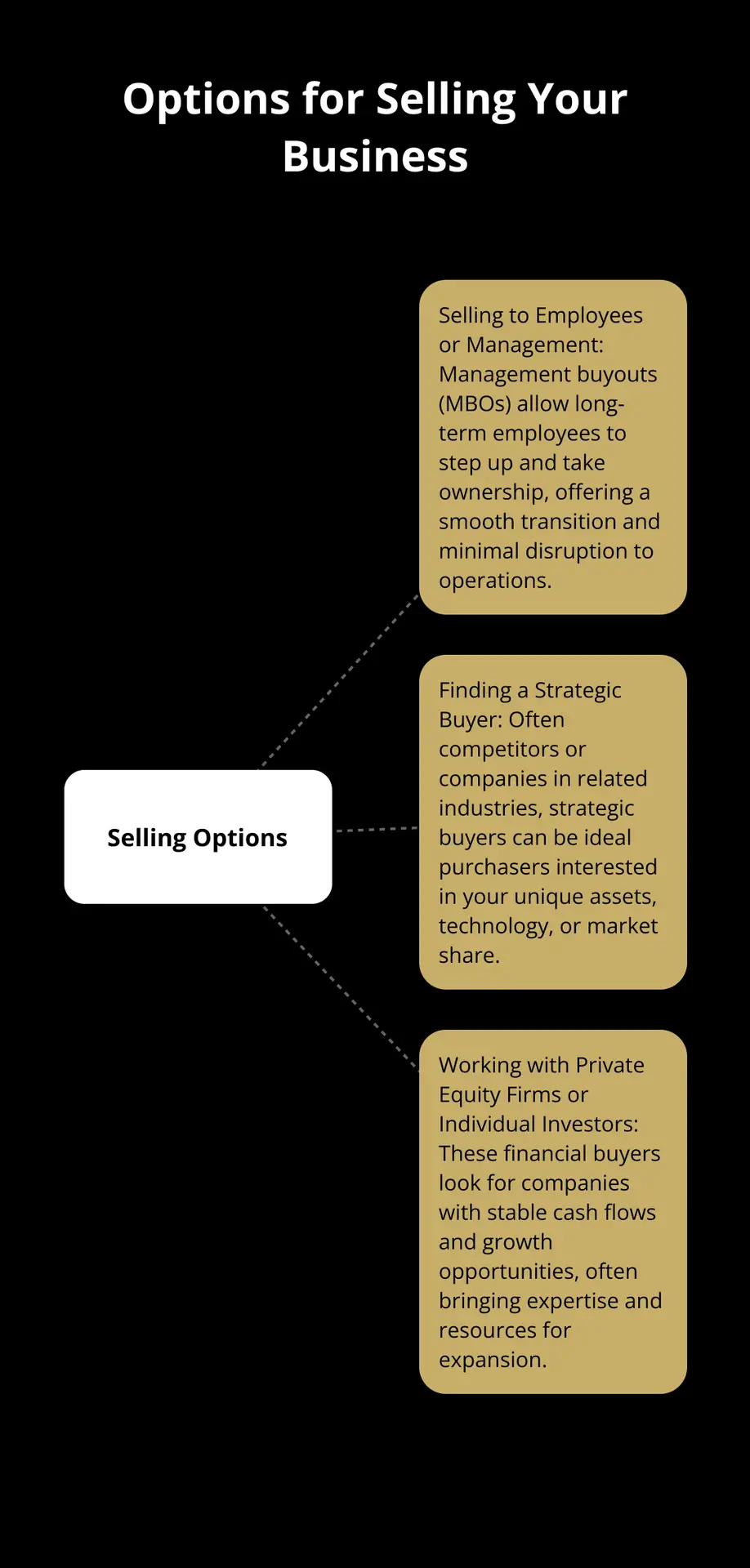

Selling to Employees or Management

Management buyouts (MBOs) can be a powerful way for leaders within a company to gain control and drive profitability. MBOs allow long-term employees to step up and take ownership.

The main advantage of an MBO is the smooth transition. Your management team already knows the business inside out, which can lead to a quicker sale process and minimal disruption to operations. However, financing can present a challenge. Managers often need to secure substantial loans or seek outside investors to fund the purchase.

To make an MBO successful, start to groom potential buyers early. Provide leadership training and gradually increase their responsibilities. This approach not only prepares them for ownership but also demonstrates to lenders that they can run the business.

Finding a Strategic Buyer in Your Industry

Strategic buyers (often competitors or companies in related industries) can be ideal purchasers for your business. The process of analyzing acquisitions falls broadly into three stages: planning, search and screen, and financial evaluation.

To attract strategic buyers, highlight what makes your business unique. Do you have proprietary technology, a strong brand, or a valuable customer base? These assets can be extremely attractive to companies looking to expand their market share or capabilities.

Networking is key when seeking strategic buyers. Attend industry events, join professional associations, and leverage your existing business relationships. You might find that a long-time supplier or customer wants to acquire your company.

Working with Private Equity Firms or Individual Investors

Private equity is an investment strategy where firms raise capital from institutional investors and high-net-worth individuals to acquire stakes in companies. These buyers typically look for companies they can improve and sell for a profit in 3-7 years.

Financial buyers are particularly interested in businesses with stable cash flows and opportunities for expansion. They often bring expertise and resources that can help your company reach the next level of growth.

To attract these buyers, demonstrate your business’s scalability. Show how additional capital or expertise could drive growth. Prepare detailed financial projections and have a clear strategy for future expansion.

When dealing with financial buyers, prepare for a thorough due diligence process. They’ll scrutinize every aspect of your business (from financials to operations to legal compliance).

Choosing the Right Platform for Your Sale

Regardless of which option you choose, working with a modern platform can significantly streamline the sale process. Try to find a service that combines AI-driven matching with expert support, helping you find the right buyer while keeping costs low.

Traditional brokers often charge high commissions, which can eat into your profits. Look for platforms that offer transparent, affordable pricing options that put more money in your pocket at closing. Unbroker stands out as a top choice in this regard, offering low-cost options without sacrificing quality of service.

Selling your business is a complex process that requires careful planning and execution. Start early, seek professional advice, and consider all your options to achieve the best possible outcome for yourself and your company.

Final Thoughts

A retirement sale with no successor requires careful planning and execution. Business owners must start their exit strategy early, ideally 3-5 years before retirement. This foresight allows for value maximization, potential buyer identification, and obstacle resolution.

Professional guidance proves invaluable throughout the sale process. At Unbroker, we understand the complexities of selling a business without high brokerage fees. Our modern platform combines AI-driven matching with expert support to help navigate these challenges.

Selling your business represents a significant financial event in your life. Proper planning, professional support, and a clear understanding of your options will lead to a successful sale. This approach secures your financial future and preserves the legacy of your hard work.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)