Partnership disputes can turn a thriving business into a battleground. At Unbroker, we’ve seen firsthand how these conflicts can complicate the process of selling a company.

This guide will walk you through how to sell a business after a partner fallout, covering legal considerations, valuation challenges, and preparation strategies. Our goal is to help you navigate this complex situation and achieve a successful sale, despite the hurdles.

Navigating Legal Hurdles in Partnership Disputes

Partnership Agreements: Your First Line of Defense

Partnership agreements form the foundation of dispute resolution. This document outlines each partner’s rights and responsibilities, including procedures for resolving conflicts and dissolving the business. Without a formal agreement, state laws govern disputes, often leading to unpredictable outcomes.

The Role of Legal Counsel in Dispute Resolution

Engaging a qualified business attorney is essential, not just advisable. An experienced lawyer will help you interpret your partnership agreement, navigate state laws, and represent your interests in negotiations or court proceedings.

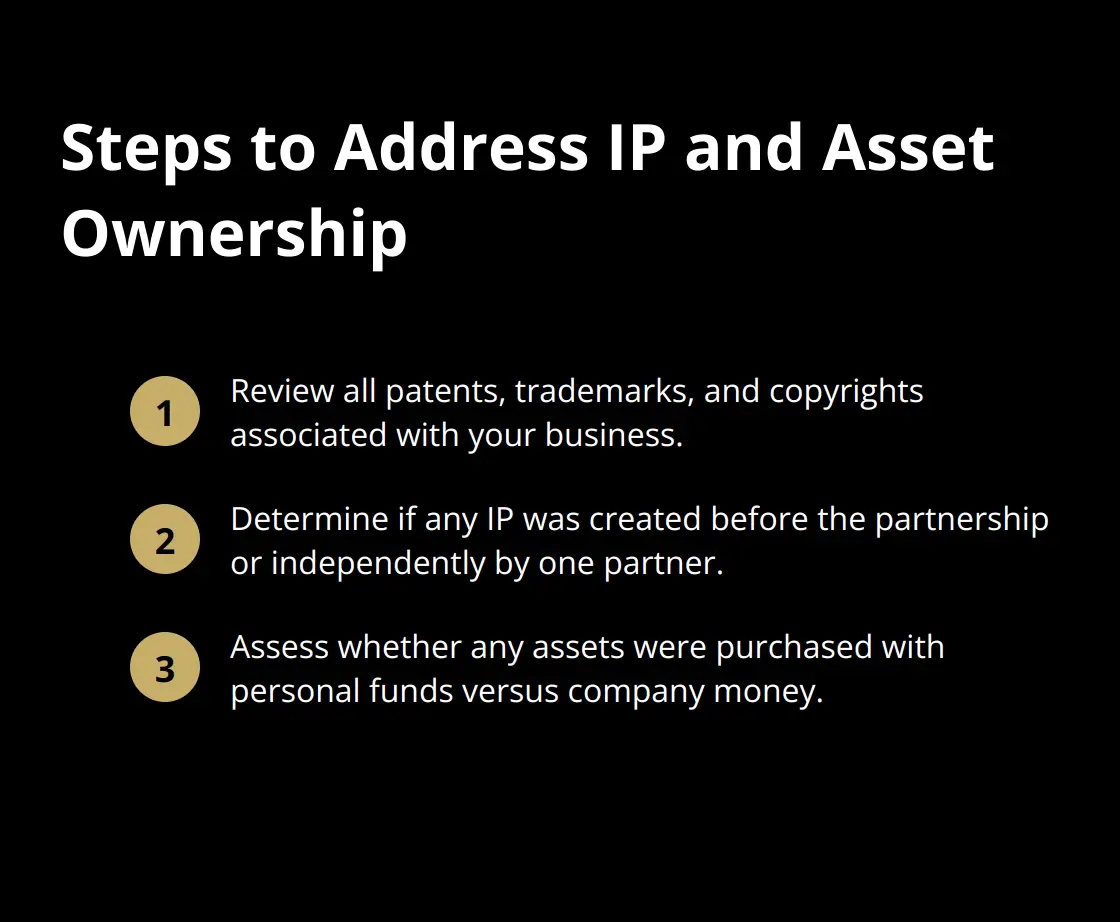

Tackling Intellectual Property and Asset Ownership

Intellectual property (IP) and asset ownership often become contentious issues during a partnership dispute. You must clearly establish ownership before proceeding with a sale.

To address this:

- Review all patents, trademarks, and copyrights associated with your business.

- Determine if any IP was created before the partnership or independently by one partner.

- Assess whether any assets were purchased with personal funds versus company money.

Resolving these issues upfront will prevent costly legal battles later and make your business more attractive to potential buyers.

Mediation: A Cost-Effective Alternative

Before you resort to litigation, consider mediation. Mediation allows partners to work with a neutral third party to reach a mutually acceptable resolution. This process can preserve relationships and business value (both critical factors when preparing for a sale).

Preparing for the Valuation Process

As you navigate these legal hurdles, you’ll need to prepare for the next crucial step: valuing your business post-dispute. This process will require a thorough assessment of how the partnership conflict has impacted your company’s worth. You’ll need to gather all relevant financial documents and consider how the dispute might have affected your business’s reputation or operations. A professional valuation will provide a clear picture of your company’s current market value, setting the stage for a successful sale despite the challenges of a partnership dispute.

How a Partnership Dispute Affects Business Value

Quantifying the Dispute’s Impact

Partnership disputes can significantly reduce a company’s worth. These conflicts often result in decreased productivity, lost customers, and damaged reputations. The Journal provides an opportunity for members of the labor and employment bar to share insights and perspectives on practical issues of current interest.

To accurately assess this impact:

- Compare financial performance before and during the dispute

- Analyze customer retention rates

- Review employee turnover data

- Assess any damage to your brand’s reputation

The Necessity of Professional Valuation

A professional valuation proves essential when valuing a business after a partnership dispute. Certified business appraisers bring objectivity and expertise to the process, which you need when dealing with the emotional fallout of a partnership dispute.

Professional valuations typically cost about $5,000, with fees going up to $30,000 or more, depending on factors like the size of the business. This investment can pay off significantly by providing an accurate, defensible valuation that stands up to scrutiny from potential buyers and legal challenges from your former partner.

Identifying Key Assets and Liabilities

The valuation process requires you to identify and accurately value all assets and liabilities. This includes tangible assets like equipment and inventory, as well as intangible assets such as customer relationships and brand value.

Pay special attention to:

- Intellectual property: Patents, trademarks, and copyrights can drive significant value. IP valuation can help a company uncover the true value of the business as a whole.

- Customer contracts: Long-term contracts can provide stable future cash flows.

- Outstanding debts: You will need to settle or transfer these as part of the sale.

The dispute may have created new liabilities, such as legal fees or settlement costs, which you need to factor into the valuation.

Adjusting for Non-Recurring Expenses

Partnership disputes often result in non-recurring expenses that can skew your financial statements. These might include legal fees, settlement costs, or temporary drops in revenue due to the conflict. Work with your valuation professional to adjust for these expenses to present a more accurate picture of your business’s true earning potential.

As you move forward with the valuation process, you’ll need to prepare your business for sale. This involves organizing financial records, addressing operational challenges, and developing a compelling narrative for potential buyers. The next section will guide you through these critical steps to maximize your chances of a successful sale.

How to Prepare Your Business for Sale After a Dispute

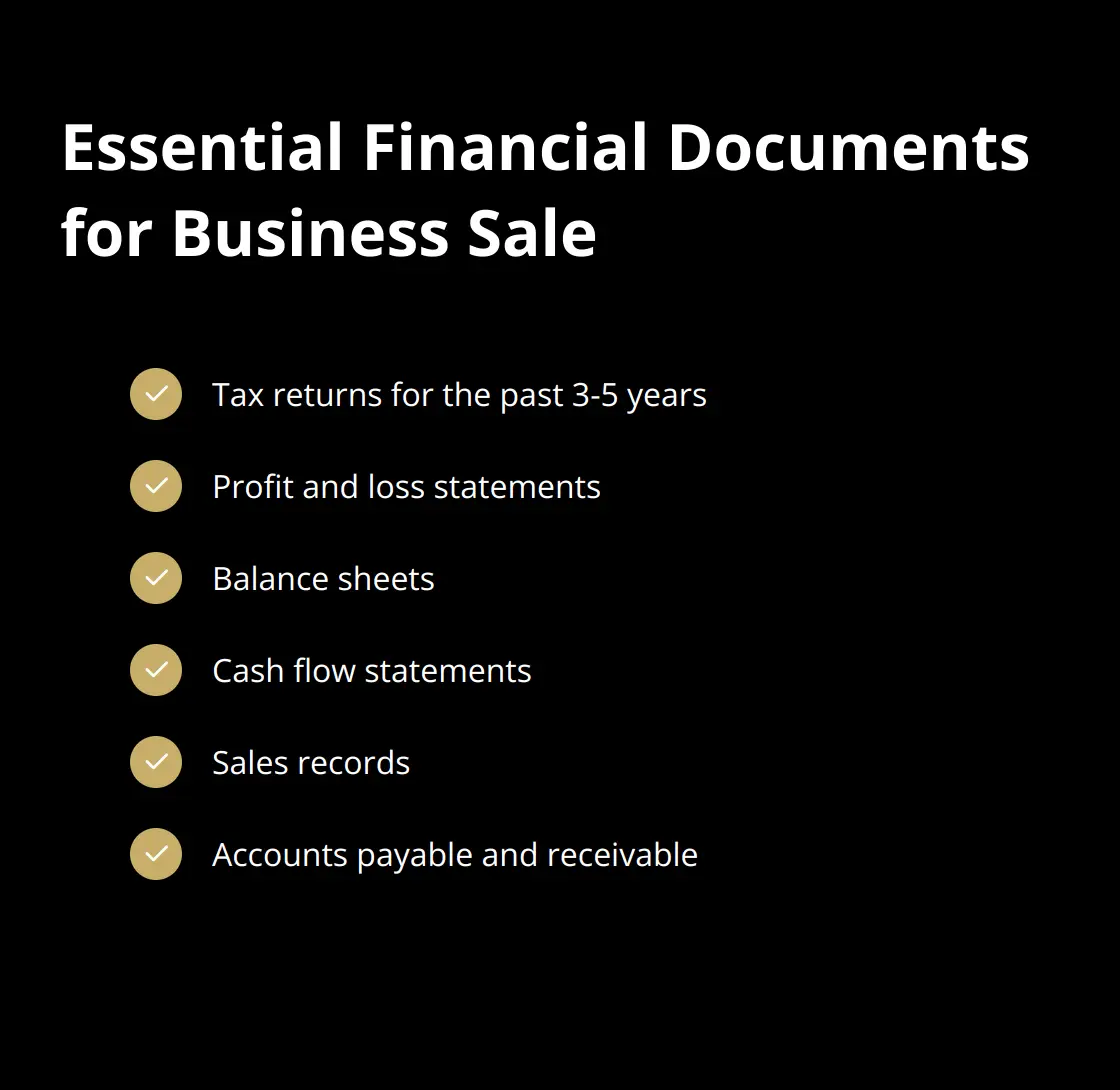

Organize Your Financial Records

Start by gathering and organizing all financial documents. This includes:

- Tax returns for the past 3-5 years

- Profit and loss statements

- Balance sheets

- Cash flow statements

- Sales records

- Accounts payable and receivable

Ensure these documents are up-to-date and accurate. Research suggests that a standard local adjustment model of cost structure can be beneficial for businesses preparing for sale.

Consider hiring a professional accountant to review and organize your financial records. This investment (typically costing between $1,000 to $5,000) can significantly increase buyer confidence and potentially lead to a higher sale price.

Address Operational Challenges

Partnership disputes often disrupt normal business operations. Take steps to stabilize your business:

- Reassure key employees about the company’s future through transparent communication

- Maintain relationships with important clients and suppliers

- Review and update operational processes

- Document standard operating procedures

If the dispute has led to the loss of key personnel, consider hiring temporary management to fill gaps. This can cost anywhere from $1,000 to $10,000 per month but can be vital in maintaining business stability during the sale process.

Craft a Compelling Business Narrative

Despite the partnership dispute, your business still has value. Develop a narrative that highlights its strengths and potential. Focus on:

- Unique selling propositions

- Market position and growth potential

- Strong customer base or contracts

- Valuable intellectual property or assets

Be transparent about the partnership dispute, but frame it as a resolved issue. Research indicates that performance transparency is important to reap key benefits of CSR activities, which can include increased firm profits and stronger consumer attachment.

Consider working with a professional business writer to craft your business story. This service typically costs between $2,000 to $5,000 but can significantly enhance your business’s appeal to potential buyers.

Implement Cost-Cutting Measures

To make your business more attractive to potential buyers, implement cost-cutting measures:

- Analyze your expenses and identify areas for reduction

- Negotiate better terms with suppliers

- Streamline operations to improve efficiency

- Consider outsourcing non-core functions

These steps can improve your profit margins and make your business more appealing to buyers.

Develop a Transition Plan

Create a comprehensive transition plan to show potential buyers how the business will continue to operate smoothly after the sale. This plan should include:

- Training procedures for new owners

- Key employee retention strategies

- Transfer of client relationships

- Handover of operational processes

A well-thought-out transition plan can alleviate buyer concerns and potentially increase the sale price of your business.

Final Thoughts

Selling a business after a partnership dispute requires careful planning and execution. Professional guidance proves invaluable at every stage, from legal counsel to certified business appraisers and financial experts. These professionals help navigate complex issues, provide accurate valuations, and present your business in the best light to potential buyers.

The future potential of your business should remain your focus, despite the challenges. You can demonstrate your company’s value to prospective buyers by addressing operational issues and developing a solid transition plan. This approach increases your chances of a successful sale and can help you achieve a better price for your business.

If you wonder how to sell a business after a partner fallout, you don’t have to navigate this journey alone. Unbroker offers a modern platform for selling businesses with transparent, low-cost options (combining AI-driven processes with expert support). Our services provide the tools and guidance needed to sell your business successfully, even in the wake of a partnership dispute.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)