Divorce is a challenging time, especially for business owners contemplating a sale. At Unbroker, we often encounter clients grappling with the complexities of how to sell a business before a divorce settlement.

This decision carries significant legal and financial implications that can impact both your personal and professional life. In this post, we’ll explore the key considerations and strategies for navigating this intricate process.

Legal Hurdles When Selling Your Business During Divorce

Marital Property Laws: A Potential Roadblock

Selling a business during divorce presents a minefield of legal complexities. Marital property laws vary by state and can significantly affect your ability to sell. When a marriage ends, courts often must decide whether to classify a business as marital property, separate property, or a combination. This classification can greatly impact your ability to sell without your spouse’s consent.

Full Disclosure: The Non-Negotiable Requirement

Transparency is non-negotiable when selling a business during divorce. You must disclose all business-related information to your spouse and the court. This includes:

- Copies of the business accounts for the last two financial years

- Any available financial statements

- Tax returns

- Business valuations

- Pending deals or contracts

Failing to disclose can result in the sale being voided or, worse, charges of fraud. Some business owners have tried to undervalue their company or hide assets, leading to disastrous legal consequences.

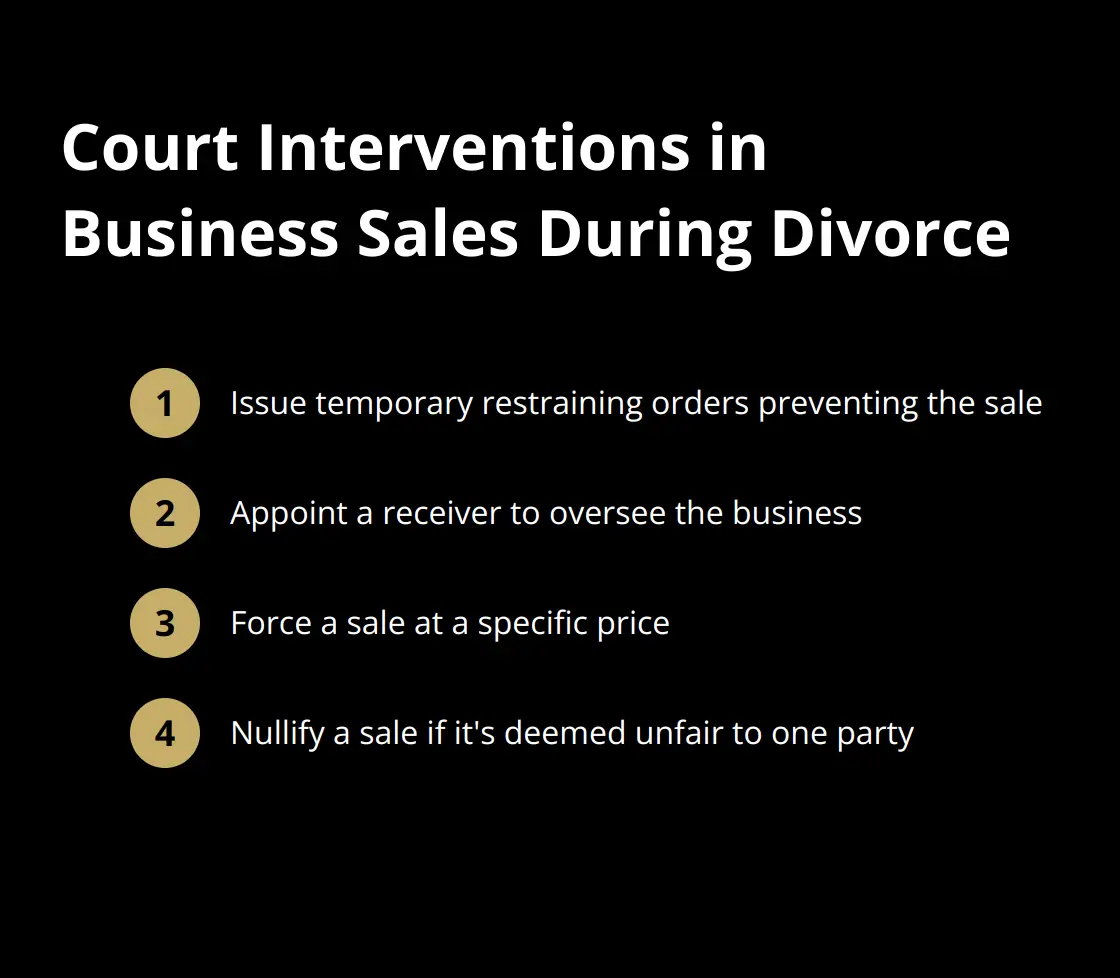

Court Interventions: Expect the Unexpected

Courts have broad powers to intervene in business sales during divorce. They can:

In a recent case, a court appointed a receiver, with the usual powers and directions, to sell the marital residence forthwith, even though the divorce was not yet final.

Navigating the Legal Maze

To navigate these legal hurdles successfully, working with both a divorce attorney and a business sale specialist is highly recommended. This dual approach ensures you protect your interests on all fronts. What seems like a smart business move could be a legal misstep in the context of divorce proceedings.

The complexities of selling a business during divorce underscore the importance of expert guidance. As we move into the next section, we’ll explore the financial implications of selling your business pre-divorce, which can be just as intricate as the legal considerations.

How Selling Pre-Divorce Impacts Your Finances

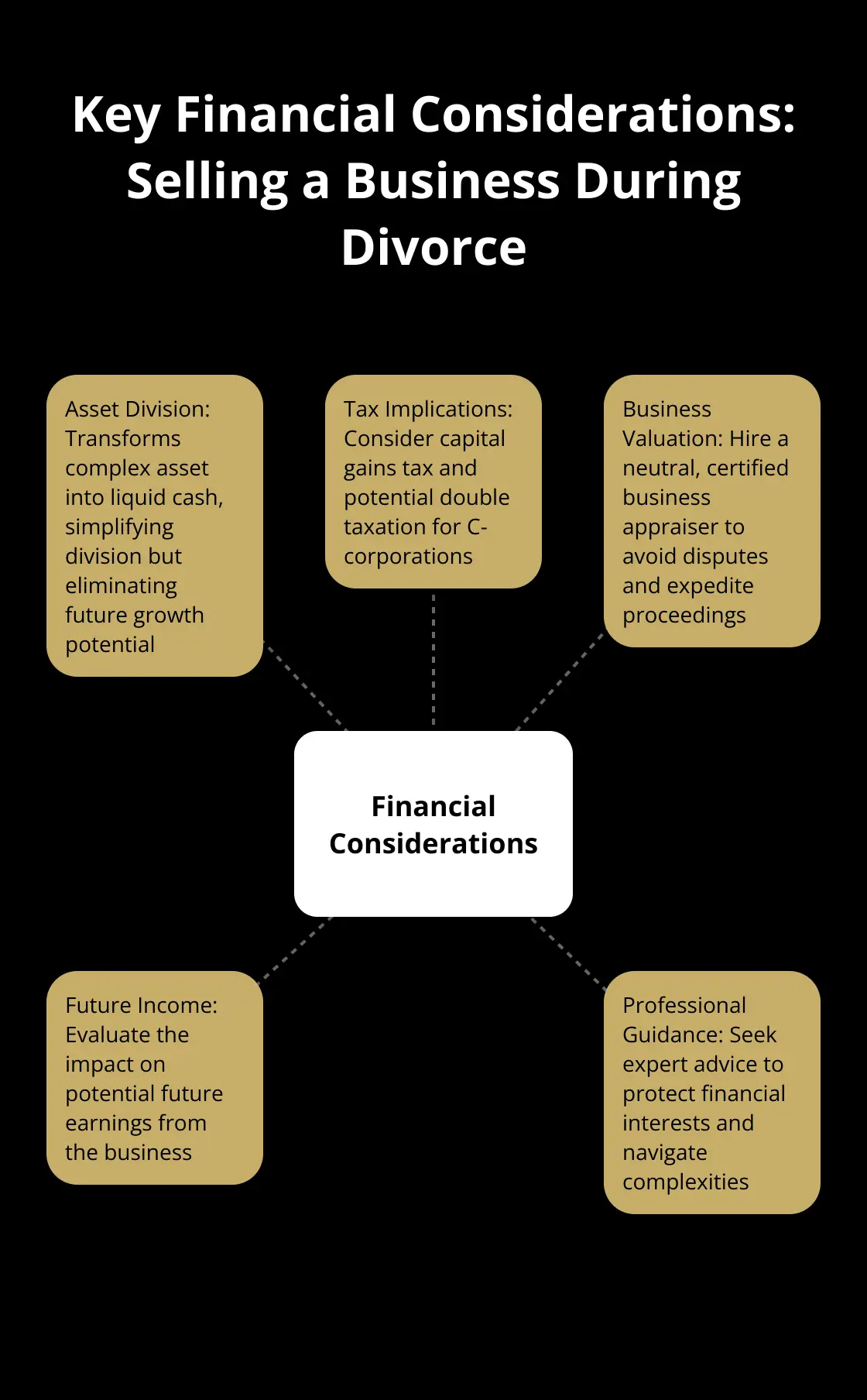

The Asset Division Challenge

Selling your business before a divorce finalizes can reshape your financial landscape. This decision transforms a complex asset into liquid cash, which simplifies asset division but eliminates potential future growth or income from the business. It is crucial to anticipate the ways in which a divorce can affect the operation of the business and the interests of non-spouse shareholders.

Unavoidable Tax Implications

The tax consequences of selling your business during divorce can be substantial. Capital gains tax stands as a primary concern. For businesses owned for more than a year, long-term capital gains tax applies, with rates that can be lower for the transferee spouse who is typically in a lower tax bracket. C-corporation structures might face double taxation – once at the corporate level and again at the personal level when distributing proceeds.

The Valuation Battleground

Business valuation during divorce often sparks contention. Disputes in valuations can significantly impact divorce settlements. A prolonged dispute can lead to increased costs and delayed proceedings.

To mitigate these challenges, hire a neutral, certified business appraiser. Their impartial assessment provides a solid foundation for negotiations and potentially saves thousands in legal fees. Courts often favor professional valuations over DIY estimates.

Professional Guidance: A Game-Changer

Expert guidance can significantly protect your financial interests during this challenging time. Professional valuations tend to expedite deal closures, which proves crucial when navigating the time-sensitive nature of divorce proceedings.

Navigating Complex Financial Waters

Selling your business pre-divorce requires careful consideration of asset division strategies, tax planning, and accurate valuation. These financial intricacies underscore the importance of professional advice. As we move forward, we’ll explore effective strategies for navigating the business sale process during divorce, ensuring you’re well-equipped to protect both your business and personal interests.

How to Sell Your Business During Divorce

Embrace Mediation for Smoother Negotiations

Mediation offers a less adversarial approach to divorce proceedings, which can benefit business owners looking to sell. Mediation offers notable financial advantages over litigation by curtailing immediate costs, reducing long-term expenses, and providing parties with mechanisms for resolution. This process allows you and your spouse to work with a neutral third party to reach mutually agreeable terms for the business sale.

During mediation, you should:

- Define your goals for the business sale clearly

- Identify areas of agreement and disagreement

- Explore creative solutions that benefit both parties

Assemble a Team of Specialized Advisors

The complexities of selling a business during divorce demand specialized expertise. We recommend you build a team that includes:

This team approach ensures you cover all bases – legal, financial, and personal.

Negotiate with Transparency and Fairness

When you negotiate the terms of your business sale with your spouse, transparency is key. You should prepare to:

- Share all relevant financial documents

- Discuss the business’s current value and future potential

- Consider your spouse’s contributions to the business (if any)

- Explore options for structuring the sale that benefit both parties

Consider a Phased Sale Approach

If an immediate sale isn’t feasible or desirable, you should consider a phased approach. This might involve:

- A gradual transfer of ownership over time

- Setting up a buy-out agreement with specific milestones

- Establishing a trust to manage the business during and after the divorce

This approach can provide financial stability for both parties and allow for a smoother transition of the business.

Seek Professional Guidance

Each situation is unique, and what works for one couple may not work for another. Professional guidance can help you navigate this complex process more effectively. Companies like Unbroker offer personalized support to guide you through this challenging process, ensuring you make informed decisions that protect your business and personal interests.

Final Thoughts

Selling a business before a divorce settlement involves complex legal and financial considerations. Business owners must navigate marital property laws, court interventions, and financial implications while maintaining transparency throughout the process. Professional guidance proves invaluable in addressing these challenges and protecting both business and personal interests.

At Unbroker, we offer support for business owners facing this difficult situation. Our platform provides expert assistance, marketing tools, and access to potential buyers to facilitate a smooth sale process. We understand the unique challenges of selling a business during divorce and strive to offer tailored solutions.

The journey of selling a business before finalizing a divorce is challenging but not impossible. With the right approach, open communication, and professional support, business owners can protect their interests and work towards a stable financial future. Exploring creative solutions and maintaining fairness throughout the process can lead to more favorable outcomes for all parties involved.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)