Business owners lose millions every year through preventable exit mistakes that destroy decades of hard work. The average entrepreneur makes at least three critical errors during their business sale process.

We at Unbroker have analyzed hundreds of failed transactions to identify the most costly pitfalls. These seven mistakes can slash your sale price by 40% or completely derail your exit strategy.

Mistake 1: Waiting Until the Last Minute to Plan Your Exit

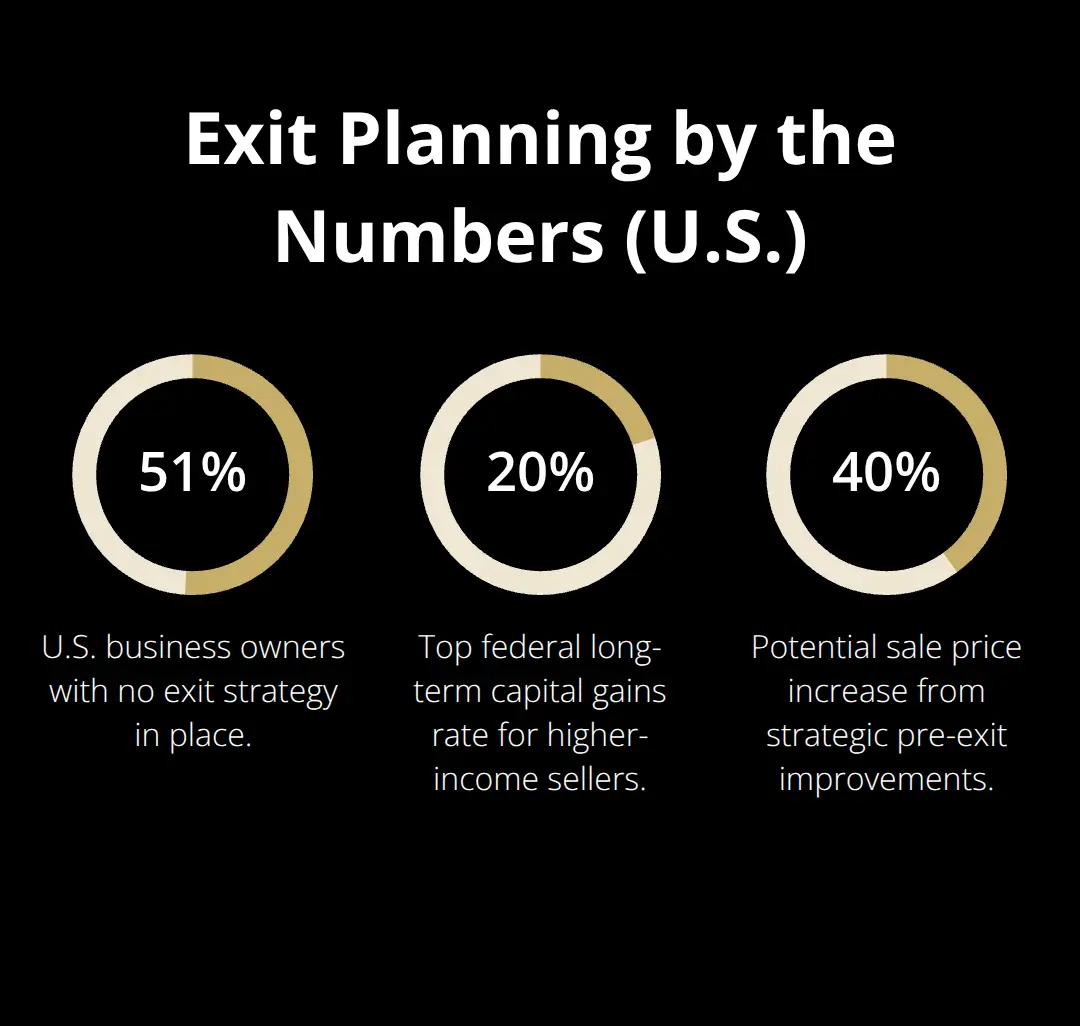

Most business owners start exit planning waiting 6-12 months before they want to sell, but this timeline guarantees financial disaster. Recent studies show that 51% of current American business owners have no exit strategy at all. Smart exit planning requires 3-5 years minimum to optimize business value and structure tax-efficient deals. Owners can increase their sale price by 20-40% through strategic improvements like reducing owner dependency, cleaning up financial records, and building management teams that operate independently.

This preparation period transforms businesses from owner-dependent operations into attractive acquisition targets.

Rushed exit planning creates a cascade of expensive mistakes that destroy wealth permanently. Owners who start late typically face significant valuation challenges because they lack negotiating leverage and time to find qualified buyers. The IRS penalizes hasty exits through capital gains taxes, with rates reaching 20% for higher income earners when proper tax planning structures aren’t implemented years in advance. Emergency exits also force owners to accept unfavorable deal terms like extended earnout periods, personal guarantees, and minimal escrow protection that leave them financially exposed long after closing. These rushed decisions create the perfect storm for the second major mistake that destroys business value.

Mistake 2: Emotional Business Valuation Destroys Sale Prices

Business owners routinely overvalue their companies by 50-200% due to psychological attachment and confirmation bias. Harvard Business School research shows entrepreneurs consistently inflate valuations because they mistake sweat equity for market value. The endowment effect makes owners believe their business is worth more simply because they built it from scratch. This emotional pricing creates a devastating gap between owner expectations and buyer reality that kills deals before negotiations even begin. Professional valuations prevent price mistakes that kill deals, while market comparables typically value businesses 30-60% lower than owner estimates.

The financial consequences of emotional overvaluation extend far beyond hurt feelings during initial buyer meetings. Overpriced businesses sit on the market for 18-24 months longer than properly valued companies, which creates desperation that forces owners to accept below-market offers. Each month of extended marketing costs owners thousands in legal fees, accounting expenses, and lost opportunity costs while business performance often deteriorates from prolonged uncertainty (uncertainty that buyers interpret as weakness). Smart owners obtain independent business valuations from certified professionals to establish realistic price expectations and avoid the emotional trap that destroys their position. Poor financial documentation compounds this valuation problem and creates the third major mistake that scares away serious buyers.

Mistake 3: Sloppy Financial Records Kill Deals

Incomplete financial documentation destroys 30% of business deals during due diligence according to investment banking data. Buyers demand three years of audited financial statements, detailed cash flow analyses, accounts receivable reports, and comprehensive tax returns that many small business owners cannot provide. Missing documentation immediately signals operational weakness and forces buyers to assume the worst about hidden liabilities or revenue quality. Professional buyers walk away from deals when sellers cannot produce clean profit and loss statements, balance sheets, or working capital calculations because incomplete records suggest poor management systems. The due diligence process becomes impossible when financial data lacks consistency across periods or contains unexplained variances that raise red flags about business integrity.

Poor bookkeeping makes it harder to trust financial statements, which can lower your valuation or even cause deals to fall apart. Cash-based accounting systems create valuation disasters since buyers cannot determine true profitability or working capital requirements for operations. Smart owners implement monthly financial closes with certified public accountants who prepare investor-ready statements using generally accepted accounting principles that serious buyers expect. Cloud-based accounting platforms like QuickBooks Enterprise or Sage Intacct provide the documentation standards that professional acquirers require during negotiations. Quality financial records become your strongest weapon because they demonstrate operational competence and eliminate buyer concerns about hidden problems that could surface after closing.

This documentation weakness often masks an even more dangerous problem that scares away sophisticated buyers: excessive owner dependency that makes businesses impossible to operate without the founder’s daily involvement.

Mistake 4: Owner Dependency That Scares Away Buyers

Businesses that cannot operate without their owner’s daily involvement face significant valuation challenges, as sophisticated buyers immediately recognize key person risk when owners handle all major decisions, customer relationships, and operational oversight because this dependency creates massive post-acquisition risks. Companies where founders manage everything from sales calls to vendor negotiations become unsellable to serious acquirers who need businesses that generate predictable cash flows without constant owner intervention. The Hub and Spoke business model where everything flows through the owner represents the kiss of death for premium valuations because buyers cannot justify top dollar for a job rather than an investment.

Smart owners spend 2-3 years developing leadership depth through these strategies:

- Promote high-performing employees into department head roles with profit and loss responsibility

- Document all client relationships and standard operating procedures in management systems

- Create vendor contracts that remove personal dependencies

- Establish decision-making protocols that function without owner approval

Manufacturing companies with strong operations managers typically command higher sale price multiples than owner-operated facilities according to investment banking transaction data. Service businesses that systematically transfer operational knowledge to management teams remove the owner dependency that destroys deal value while maintaining strategic oversight that buyers actually prefer. Owners who successfully delegate daily operations create businesses that buyers view as turnkey investments rather than risky acquisitions.

This independence becomes worthless without proper tax planning that protects your sale proceeds from government seizure.

Mistake 5: Tax Planning Disasters That Destroy Sale Proceeds

Capital gains taxes devastate business sale proceeds when owners fail to implement tax strategies years before their exit. The federal capital gains tax rate reaches 20% for high-income earners, plus a 3.8% net investment income tax that applies to individuals, estates, and trusts that have net investment income above applicable threshold amounts. State capital gains taxes add another 5-13% in high-tax states like California and New York, which means owners can lose 35-40% of their sale proceeds to taxes without proper advance preparation. Installment sales spread capital gains over multiple years to reduce tax brackets, while charitable remainder trusts allow owners to defer taxes indefinitely and generate income streams for retirement.

Estate taxes become critical for business owners whose companies represent 70-80% of their total wealth because federal estate taxes claim 40% of assets that exceed $12.92 million per person in 2023. Grantor retained annuity trusts freeze business valuations at current levels and transfer future appreciation to family members tax-free, while qualified personal residence trusts remove primary residences from taxable estates. Family limited partnerships discount business valuations by 30-40% for gift and estate tax purposes through lack of marketability and minority interest discounts that the IRS accepts when structured properly (these structures require 3-5 years to maximize tax savings and protect generational wealth transfer).

Poor advisor selection compounds these tax disasters and creates the sixth mistake that costs owners hundreds of thousands in unnecessary fees and suboptimal deal structures.

Mistake 6: Expensive Advisors That Drain Your Sale Proceeds

Traditional business brokers charge 8-12% commissions on mid-market deals, which means owners pay $160,000-$240,000 in broker fees when they sell a $2 million business. Most brokers add marketing fees, administrative charges, and success fees that push total costs above $250,000 for typical transactions. Investment bankers demand 5-8% commissions plus monthly retainer fees of $15,000-$25,000 that continue for 12-18 months regardless of sale success. These excessive fees destroy wealth that belongs in your pocket, not your advisor’s bank account. Many brokers also demand 12-24 month exclusive agreements that prevent owners from exploring other options when performance disappoints.

Smart owners recognize several red flags when they evaluate potential advisors:

- Brokers who demand upfront fees that exceed $10,000

- Exclusive periods longer than six months

- Commission rates above 8% on deals over $1 million

- Advisors who cannot provide recent transaction records or client references

Investment bankers make sense for complex businesses where their specialized expertise in forecasting financials and sophisticated deal structures justify premium fees. Business brokers suit smaller deals under $1 million where personal relationships matter more than sophisticated marketing (modern platforms offer transparent alternatives that eliminate massive commissions). Owners should avoid advisors who cannot provide detailed marketing plans that demonstrate professional competence.

These advisor selection mistakes pale in comparison to the legal disasters that await owners who fail to protect themselves during contract negotiations.

Mistake 7: Legal Disasters That Destroy Post-Sale Security

Purchase agreements contain hidden landmines that leave sellers financially exposed years after closing. Representation and warranty clauses create unlimited liability for sellers who sign standard buyer contracts without proper legal review. Most sellers accept 18-24 month escrow periods where 10-15% of sale proceeds remain frozen while buyers hunt for contract breaches or undisclosed liabilities that trigger clawback provisions.

Earnout structures promise additional payments based on future performance but typically favor buyers through impossible metrics or accounting manipulations that sellers cannot control after they lose operational authority. Smart sellers demand liability caps that limit their exposure to 10-20% of the purchase price and sunset periods that eliminate claims after 12-18 months maximum.

Asset sales versus stock sales create massive tax consequences that inexperienced attorneys often miss during contract negotiations. Asset purchases typically generate higher tax bills for sellers because depreciation recapture gets taxed as ordinary income rather than capital gains rates. Stock sales qualify for capital gains treatment but expose sellers to unknown corporate liabilities that remain with the legal entity after closing. Sellers who choose the wrong transaction structure can face significant unexpected tax consequences on mid-market deals. Professional legal counsel who specialize in business transactions prevent these costly mistakes through proper contract negotiation and tax structure optimization.

These legal pitfalls represent just the tip of the iceberg when it comes to exit planning disasters, but smart business owners can avoid all seven mistakes through strategic preparation that starts years before their target sale date.

Final Thoughts

Smart business owners avoid these seven exit mistakes when they start their preparation process 3-5 years before their target sale date. This timeline provides sufficient opportunity for financial record organization, management team development, and tax structure optimization that maximizes sale proceeds. Professional advisory teams become essential during this preparation period, but owners must control costs through selective service usage rather than excessive broker commissions that drain hundreds of thousands from sale proceeds.

We at Unbroker created a modern platform that eliminates traditional brokerage pitfalls while maintaining professional standards. Our Full Service Business Sale costs just $485 upfront plus $4,500 at closing, compared to traditional brokers who charge $160,000-$240,000 on $2 million deals. The Assisted Business Sale option provides expert support for $99 monthly and gives owners control over their process while they access professional tools and legal document templates.

Modern platforms solve the advisor selection problem through transparent fees, AI-driven buyer networks, and comprehensive support without lengthy exclusive agreements (owners maintain confidentiality while they access vast buyer networks that traditional brokers cannot match through personal relationships alone). This approach prevents the costly exit mistakes that destroy business value and protects the wealth you spent decades to build. Professional preparation transforms your business sale from a risky gamble into a strategic wealth transfer that secures your financial future.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)