Most business owners think selling their company themselves will save money and give them complete control. The reality tells a different story.

We at Unbroker see these DIY challenges destroy deals worth millions every year. The hidden costs, time demands, and costly mistakes often exceed what professional help would cost.

The numbers don’t lie: 73% of self-managed business sales fail to close, leaving owners exhausted and their companies damaged.

What Are the Real Costs of Going Solo?

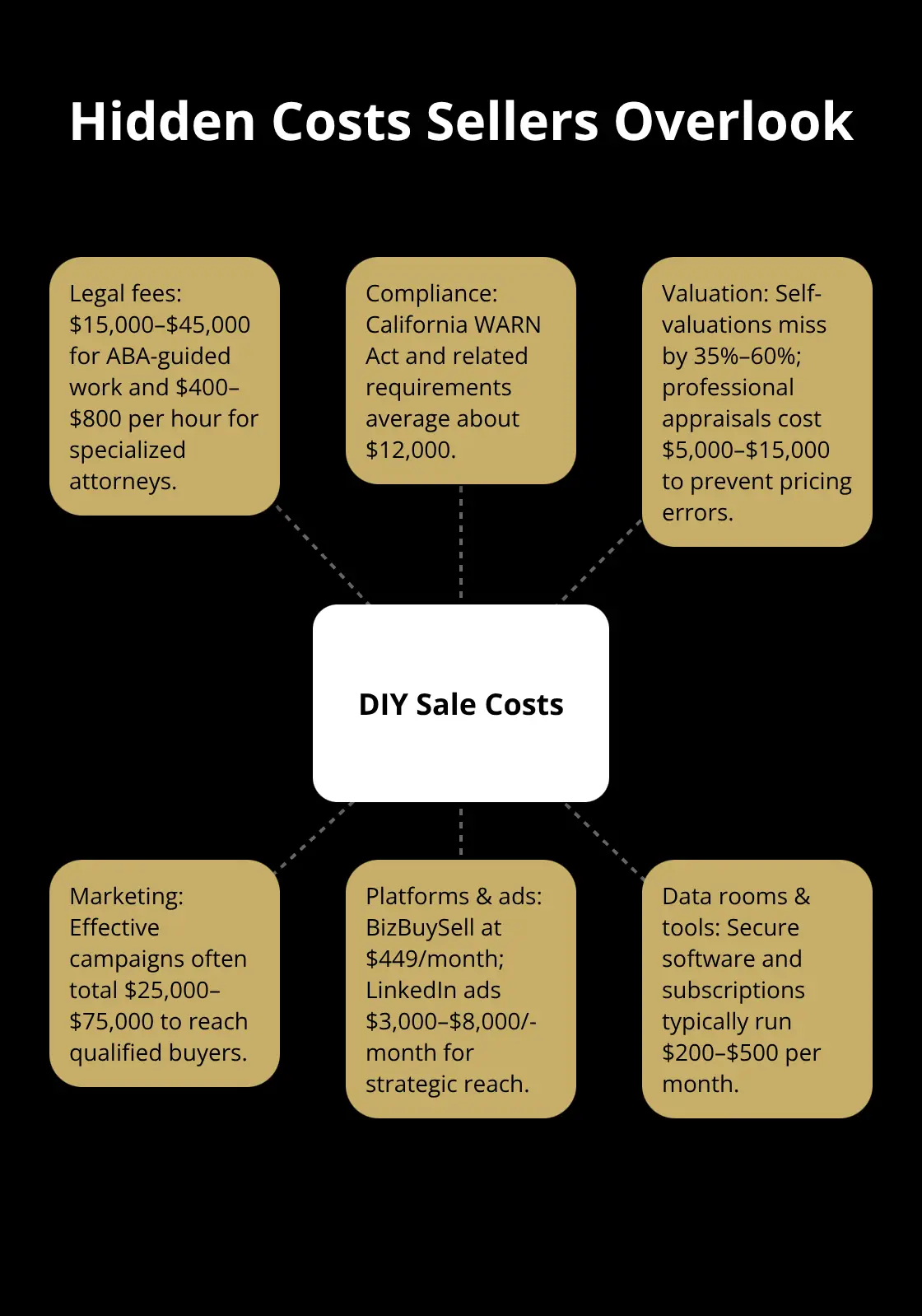

The legal maze alone costs most DIY sellers between $15,000 and $45,000 according to the American Bar Association. Asset purchase agreements, non-disclosure documents, and employment transfer paperwork require specialized attorneys who charge $400 to $800 per hour. California businesses face additional compliance costs that average $12,000 for environmental assessments and worker notification requirements under the WARN Act. Most owners discover these expenses only after they start the process, when they can no longer back out without financial devastation.

Valuation Errors That Destroy Wealth

Self-valuations miss the mark by 35% to 60% according to the International Business Brokers Association, with most owners who undervalue their companies by $200,000 to $2 million. The Seller Discretionary Earnings method requires adjustments for owner perks, personal expenses, and market comparables that inexperienced sellers routinely miscalculate. A manufacturing company in Ohio lost $800,000 because the owner failed to account for equipment depreciation and customer concentration risks. Professional appraisals cost $5,000 to $15,000 but prevent these catastrophic price mistakes that sellers can never recover.

Marketing Costs That Blindside Sellers

Qualified buyers demand specialized platforms, targeted ads, and professional materials that cost $25,000 to $75,000 for effective campaigns. BizBuySell charges $449 monthly for premium listings, while targeted LinkedIn ads run $3,000 to $8,000 monthly to reach strategic buyers. Confidential information memorandums, financial summaries, and due diligence data rooms require graphic designers, copywriters, and secure software subscriptions (most costing $200 to $500 monthly).

Most sellers underestimate these expenses by 300% and end up with amateur materials that repel serious buyers.

These financial surprises pale compared to the time investment that destroys both deals and daily operations.

How Much Time Does Selling Really Take?

The brutal reality hits within the first month: business sales require extensive time commitments spread across 8 to 18 months according to industry professionals. Owners dedicate 40 hours weekly to buyer calls, document preparation, and due diligence requests during peak negotiation periods. A Texas restaurant owner tracked 380 hours over 14 months before closing (including 60 hours on financial summaries, 120 hours in buyer meetings, and 80 hours on legal documentation). Most sellers underestimate this commitment by 200% and discover they cannot maintain both sale activities and business operations without severe consequences.

Revenue Drops When Owners Focus on Sales

Business performance deteriorates rapidly when owners shift attention to sales activities. Small business revenue faces significant challenges during ownership transitions. Customer service suffers when owners spend mornings on data room preparation instead of operations management. A Michigan manufacturing company lost two major contracts worth $400,000 because the owner missed client meetings while he negotiated with potential buyers. Employee productivity drops 20% when staff sense ownership changes but lack clear communication about company direction.

Negotiation Stress Destroys Decision-Making

Complex negotiations while owners run daily operations create mental exhaustion that leads to poor financial decisions. The American Psychological Association emphasizes that psychological well-being remains a high priority for workers in demanding situations. Emotional attachment clouds judgment when buyers request price reductions or demand seller financing. A California tech company owner accepted $300,000 below market value after six months of negotiations because stress made continued discussions unbearable.

These time demands and stress factors create the perfect storm for the costly mistakes that plague most DIY sales attempts.

What Fatal Mistakes Kill DIY Business Sales?

Unqualified buyers waste months of seller time and often destroy confidentiality without serious purchase intent. The International Business Brokers Association reports that 85% of initial buyer inquiries lack proper financing or genuine interest. A Florida service company owner spent four months with a buyer who claimed $2 million in available capital but never provided proof of funds or bank statements.

The deal collapsed during due diligence when the buyer requested seller financing for 90% of the purchase price.

Poor Buyer Qualification Wastes Critical Time

Professional qualification requires verified financial statements, proof of liquid assets worth 30% to 40% of the asking price, and signed confidentiality agreements before any business information gets shared. Most DIY sellers skip these verification steps and engage with unqualified prospects who cannot complete transactions. Financial due diligence requires thorough analysis of target company financial statements and proper buyer verification. A Texas manufacturing company owner discovered after three months that his “serious buyer” had never successfully acquired any business and lacked basic industry knowledge.

Confidentiality Breaches Destroy Company Value

Information leaks to competitors, employees, or customers create permanent damage that reduces business value by 15% to 30% according to merger and acquisition professionals. A Tennessee manufacturer lost three major clients worth $600,000 annually after a potential buyer contacted customers directly to verify contract terms. Employees become anxious and start job searches when sale rumors spread (productivity drops and talent loss follow immediately). The owner of a California marketing agency watched two key employees quit after they learned about sale discussions from a careless buyer who mentioned the acquisition during a client meeting.

Negotiation Errors Cost Hundreds of Thousands

Inexperienced sellers accept the first reasonable offer instead of creating competitive situations that drive prices higher. Professional exit planning strategies help maximize business value through proper preparation and implementation. Sellers often agree to unfavorable terms like extensive seller financing, long earn-out periods, or personal guarantees that professional negotiators would reject immediately. An Ohio restaurant owner accepted a deal with 70% seller financing and a five-year personal guarantee because he feared losing the only interested buyer (the deal structure created massive personal liability and cash flow problems that lasted years beyond the sale).

Final Thoughts

DIY challenges make sense for businesses under $500,000 with simple structures, experienced owners who have sold companies before, and situations where confidentiality matters less. Professional help pays off for complex businesses, first-time sellers, or deals above $1 million where mistakes cost more than broker fees. Most owners discover that complete self-management creates more problems than it solves.

We at Unbroker created a middle path that addresses these problems without traditional brokerage fees. Our modern platform provides expert support at transparent prices. The Full Service option costs $485 upfront plus $4,500 at closing, while the Assisted Service runs $99 monthly for sellers who want professional guidance without full representation.

Business owners ready to sell should start with accurate valuation and organize financial records first. Choose your support level based on deal complexity and personal experience (not wishful thinking about time availability). Complete DIY approaches often cost more than professional assistance when you factor in hidden expenses, time investment, and costly mistakes.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)