Selling your business represents one of the biggest financial decisions you’ll ever make. The wrong broker can cost you hundreds of thousands of dollars in lost value.

Smart broker selection starts with asking the right questions upfront. We at Unbroker have seen too many business owners rush this process and regret it later.

The questions you ask today will determine whether you maximize your sale price or leave money on the table.

Which Broker Experience Really Matters?

Experience means nothing without the right context. A broker with 20 years in restaurant sales won’t help you sell a manufacturing business. Industry-specific experience trumps general brokerage experience every time.

Ask for Specific Industry Numbers

Ask your potential broker how many businesses they’ve sold in your exact industry within the past two years. Demand specific numbers, not vague responses. A manufacturing broker should have closed at least 5-8 manufacturing deals recently. Software business brokers need SaaS transaction experience. The International Business Brokers Association reports that specialized brokers achieve higher sale prices than generalists.

Recent Performance Numbers Tell the Real Story

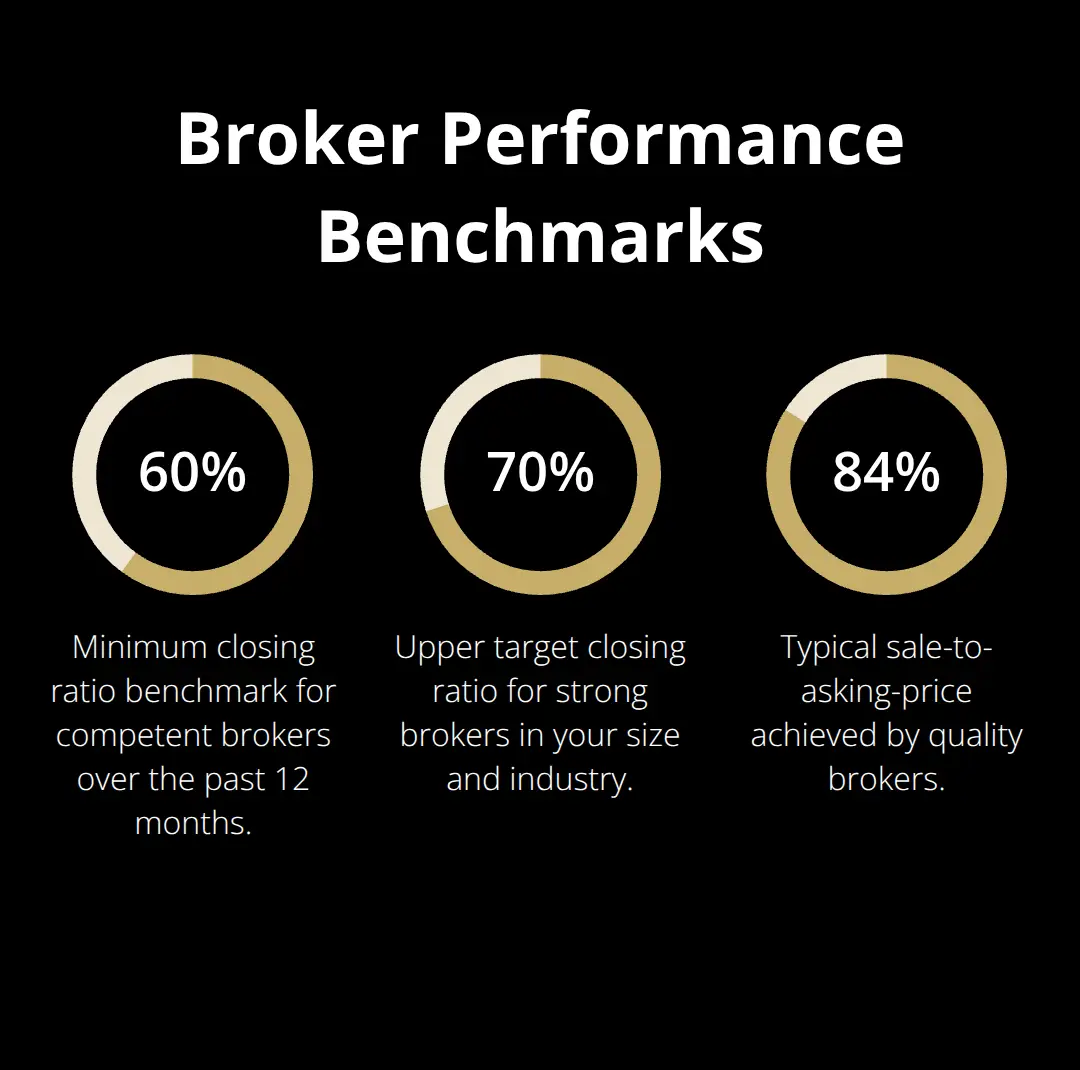

Generic success rates hide the truth. Ask for their closing ratio specifically for businesses your size and industry over the past 12 months. A competent broker should close 60-70% of their listings.

Request the average time from listing to closing for similar businesses. Manufacturing companies typically take roughly a year to sell, while service businesses often close within 6-9 months (depending on complexity and market conditions). Demand to see actual sale prices versus original asking prices. Quality brokers achieve approximately 84 percent of asking price. If they can’t provide these metrics immediately, they lack the systematic approach needed for complex business sales.

Client References Reveal Hidden Problems

Contact at least three recent clients who sold businesses similar to yours. Ask specific questions about communication frequency, problem-solving ability, and negotiation skills. Former clients will reveal whether the broker maintained confidentiality, handled buyer financing issues effectively, and managed due diligence smoothly. Request references from deals that took longer than expected or faced complications. These conversations expose how brokers perform under pressure. Avoid brokers who refuse to provide recent references or only offer testimonials without contact information.

Understanding broker experience sets the foundation, but their fee structure determines your actual profit from the sale.

What Will This Broker Really Cost You?

Broker fees vary wildly, and most business owners face surprise bills at closing. Main Street businesses under $1 million typically pay 8-10% commission, while lower middle market deals between $1-25 million follow the Double Lehman formula: 5% on the first million, 4% on the second, 3% on the third, and declining percentages thereafter. Middle market brokers who handle businesses over $25 million charge 1-4% but demand retainers from $5,000 to $50,000 upfront. Never accept vague commission discussions. Demand exact percentages and minimum fees in written form before you sign anything.

Hidden Costs Add Up Fast

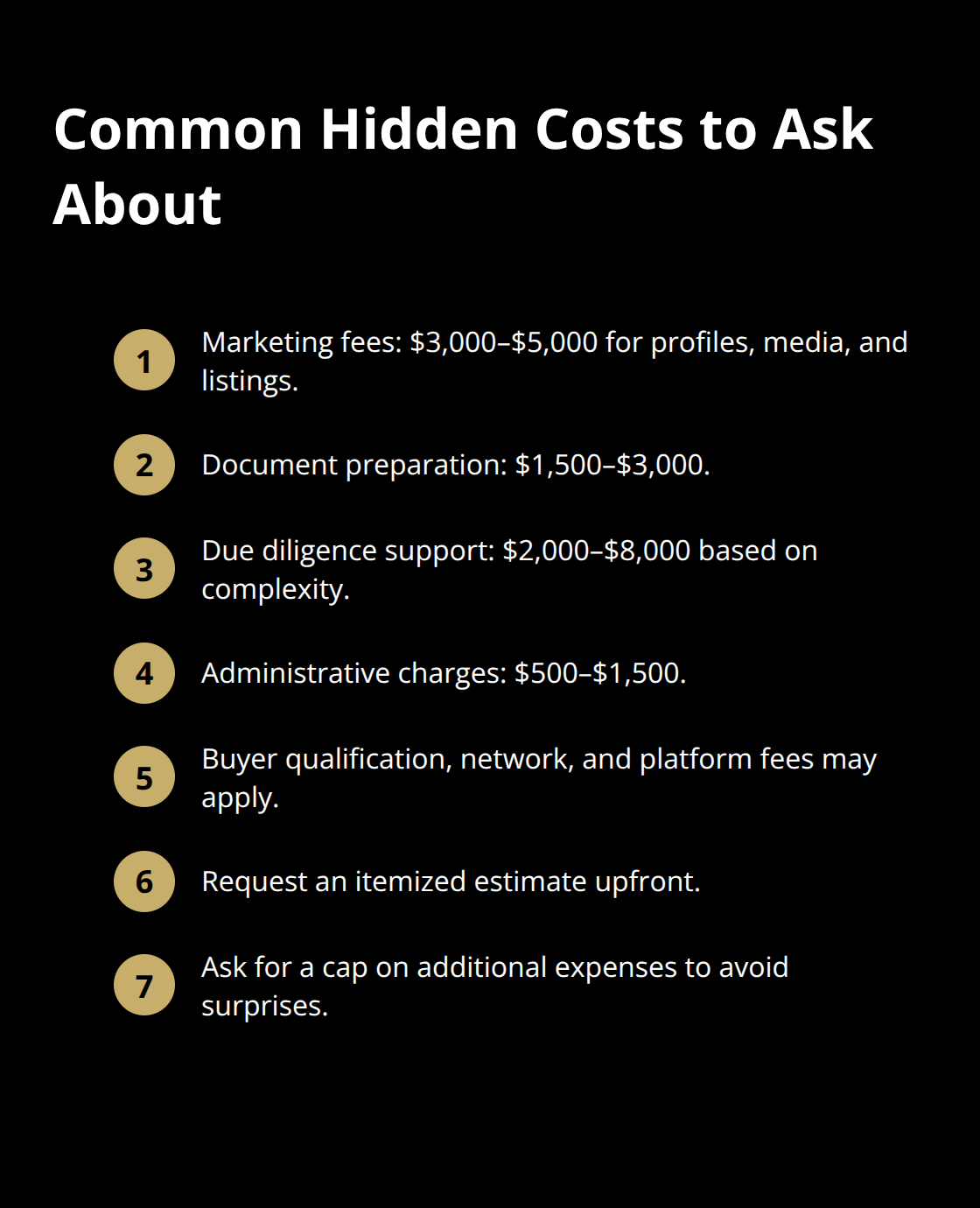

Most brokers quote commission rates but hide additional expenses. Marketing fees can reach $3,000-5,000 for professional business profiles, photography, and online postings. Document preparation costs another $1,500-3,000. Due diligence support fees range from $2,000-8,000 (based on complexity).

Administrative charges for buyer qualification and communication can add $500-1,500. Network fees, extended commission structures, and platform costs typically add significant expenses to transaction costs compared to direct broker relationships. Ask for a complete fee breakdown that includes every possible charge. Legitimate brokers provide detailed cost estimates upfront. Request a cap on additional expenses to prevent surprise bills at closing.

Payment Structure Protects Your Interests

Success-only payment models align broker incentives with your goals. Avoid brokers who demand large upfront retainers unless you sell a business worth over $10 million. Monthly retainers between $2,000-5,000 are standard for middle market deals but unnecessary for smaller transactions. Commission payments should occur only at closing, never before. Negotiate commission reductions if the sale price falls below expectations. Some brokers accept partial payment terms, where they take 50% at closing and the remainder within 90 days. This structure demonstrates confidence in their ability to close deals successfully.

Alternative Fee Models Save Money

Traditional brokers charge high commissions, but modern platforms offer transparent alternatives. Some services charge flat fees instead of percentage-based commissions, which can save tens of thousands on larger deals. These platforms typically combine upfront fees with smaller success fees, creating predictable cost structures. Compare total costs across different models before you commit. Calculate potential savings on a $2 million sale: traditional 6% commission costs $120,000, while flat-fee services might charge $10,000-15,000 total.

The fee structure reveals broker priorities, but their marketing strategy determines how quickly qualified buyers discover your business.

How Does Their Marketing Strategy Work

Most brokers claim they have extensive buyer networks, but the reality disappoints. Ask for specific marketing channels they use beyond basic business-for-sale websites. Quality brokers maintain databases of qualified buyers across different industries and actively reach out to strategic acquirers, private equity groups, and individual investors. Demand proof of their buyer qualification process. They should screen for financial capacity, industry fit, and serious purchase intent before they show your business. Traditional brokers often rely on passive listings that generate unqualified inquiries and waste your time with tire-kickers.

Marketing Channels That Actually Work

Professional brokers use multiple marketing channels simultaneously. They post on major platforms like BizBuySell, BusinessBroker.net, and LoopNet while maintaining private buyer databases. They contact industry-specific buyers directly through cold outreach and warm introductions. Quality brokers also leverage LinkedIn, industry publications, and trade associations to find strategic buyers. Ask which platforms generate the most qualified leads for businesses in your industry. Manufacturing businesses perform better on specialized industrial platforms, while service businesses attract more buyers through general marketplaces. Understanding how to market a business for sale requires targeted strategies and the right platforms.

Timeline Expectations Separate Professionals from Amateurs

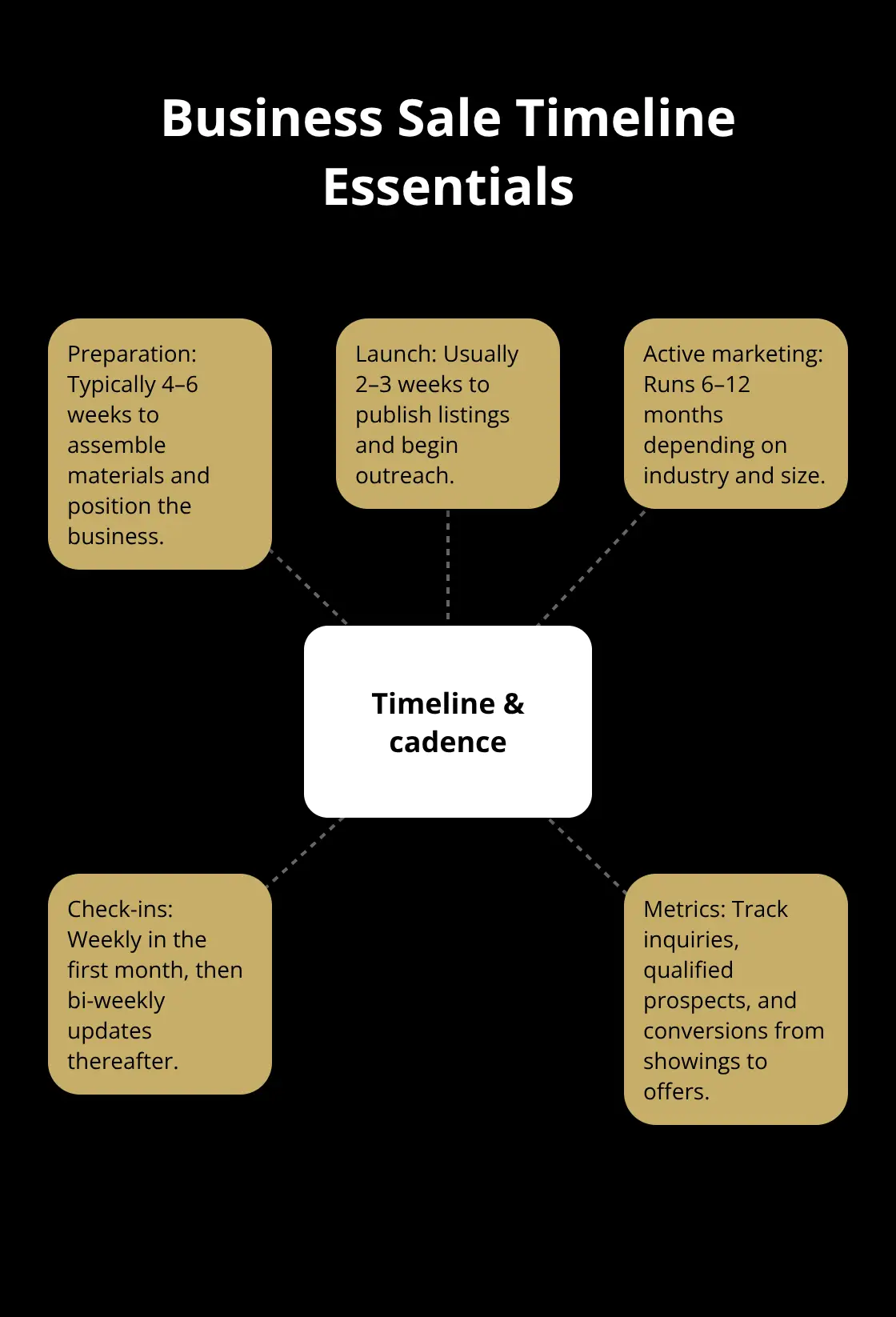

Professional brokers provide detailed timelines with specific milestones. Business preparation takes 4-6 weeks, marketing launch requires 2-3 weeks, and active marketing runs 6-12 months (depending on your industry and business size).

Quality brokers schedule weekly check-ins during the first month, then bi-weekly updates throughout the process. They track metrics like inquiry volume, qualified prospects, and conversion rates from showings to offers. Brokers who cannot provide specific timeline frameworks lack systematic processes. Ask how they handle delays, buyer financing issues, and due diligence complications. A clear business sale timeline helps set realistic expectations.

Communication Standards Determine Success

Effective brokers send detailed weekly reports that show marketing activity, buyer inquiries, feedback from showings, and next steps. They respond to your messages within 24 hours and provide monthly performance summaries with concrete metrics. Poor brokers disappear for weeks, provide vague updates, and blame market conditions for lack of progress. Demand sample reports from previous clients to evaluate their communication quality. Set expectations for response times, meeting frequency, and report formats before you sign any agreement. Clear communication protocols prevent frustration and keep your sale moving forward efficiently.

Final Thoughts

Three questions matter most when you make your broker selection: How many businesses like yours have they sold in the past two years? What is their exact commission structure with all fees included? How do they qualify buyers before they show your business? Watch for red flags during broker interviews such as brokers who refuse to provide recent client references, give vague responses about industry experience, or use pressure tactics to sign agreements immediately.

Traditional brokers charge 8-15% commissions plus hidden fees that add tens of thousands to your costs. Modern platforms offer transparent alternatives with flat fees instead of percentage-based commissions (which can save substantial money on larger deals). We at Unbroker provide comprehensive business sale services with transparent fee structures that eliminate surprise costs at closing.

Your broker selection determines whether you maximize your sale price or leave money on the table. Take time to interview multiple brokers, verify their track records, and compare total costs across different service models. The right broker will provide detailed timelines, maintain regular communication, and deliver qualified buyers who close deals successfully.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)