A comprehensive valuation report serves as the foundation for any successful business sale. Without proper documentation, buyers question your asking price and negotiations stall.

We at Unbroker see deals fall apart when owners skip essential components or rush through the valuation process. The right report structure makes all the difference between a quick sale and months of back-and-forth discussions.

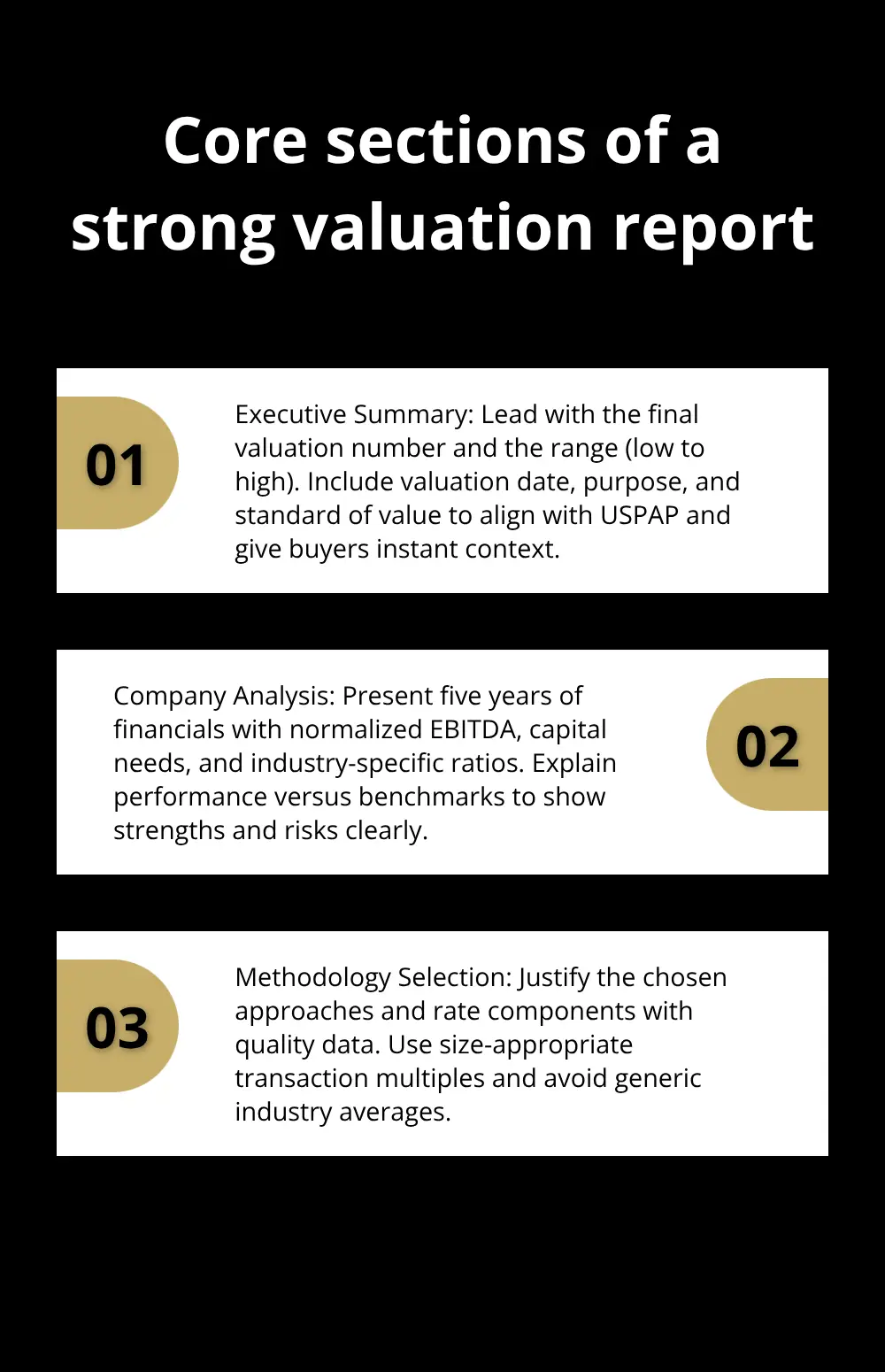

What Makes a Strong Valuation Report Structure?

Your valuation report needs three non-negotiable sections that buyers scrutinize first. Start with an executive summary that states your final valuation number within the first paragraph, followed by a clear range that shows your low and high estimates. According to USPAP standards, this summary must include the valuation date, purpose, and standard of value used. Skip the lengthy introductions that lose buyer attention within 30 seconds.

Executive Summary That Commands Attention

Place your conclusion upfront with specific numbers. A tech services company valued at $2.4 million should show this figure prominently, along with the methodology weight breakdown. For instance, if you used 60% income approach and 40% market approach, state these percentages clearly. Include key financial metrics like trailing twelve months revenue, EBITDA margins, and growth rates that support your conclusion. Buyers want immediate validation that your price makes sense.

Company Analysis With Financial Depth

Document five years of financial statements, not just the standard three years most reports include. Focus on normalized EBITDA calculations when you remove one-time expenses, owner discretionary expenses, and non-operating income. Show capital requirements and capital expenditure needs that impact cash flow. Include industry-specific ratios like inventory turnover for retail businesses or billable hour utilization for service companies. This section should demonstrate why your business outperforms or underperforms industry benchmarks.

Methodology Selection and Rate Justification

Choose your valuation approach based on business type and available data quality. SaaS companies require discounted cash flow models that reflect technology risks. Manufacturing businesses benefit from asset-based approaches combined with multiples from recent transactions. Document your discount rate components (risk-free rate, equity risk premium, and company-specific adjustments). Avoid generic industry multiples and instead use transaction data from businesses with similar revenue sizes, growth rates, and geographic locations.

The financial data you present in these sections forms the backbone of buyer confidence, but the specific metrics and historical performance analysis require careful attention to detail.

What Financial Data Do Buyers Actually Scrutinize?

Five-Year Performance Trends That Matter

Smart buyers demand five consecutive years of audited financial statements, not the abbreviated three-year summaries that waste everyone’s time. Revenue growth consistency matters more than absolute numbers. A $3 million business that grows 8% annually for five years beats a $5 million company with erratic 15% growth followed by -10% decline years.

Calculate year-over-year gross margin trends, operating expense ratios, and working capital requirements as percentages of revenue. M&A volumes globally continue to decline, dropping by 9% in the first half of 2025 compared with the first half of 2024, highlighting the importance of thorough financial analysis.

Document seasonal variations with monthly breakdowns for the past 24 months, especially for retail or tourism businesses where Q4 might represent 40% of annual revenue. Buyers want to see patterns, not surprises that emerge after they sign letters of intent.

Cash Flow Reality Check With Forward Projections

Present normalized cash flow calculations that strip out owner salary adjustments, one-time legal fees, and family member wages above market rates. Project three years of monthly cash flows with conservative revenue assumptions based on signed contracts, not wishful thinking.

Manufacturing businesses must include capital expenditure requirements for equipment replacement cycles. Service companies need detailed customer concentration analysis that shows no single client represents more than 15% of revenue.

Businesses with predictable cash flows sell at closer to 90% of asking price, as valued companies command premium pricing. Buyers pay premiums for certainty, not potential.

Asset Values and Hidden Liability Exposure

Inventory valuations require physical counts within 60 days of the valuation date, with obsolescence reserves for items older than 12 months. Real estate appraisals must reflect current market conditions, not book values from years ago.

Document all lease obligations (including personal guarantees that transfer to buyers), equipment financing terms, and pending litigation that could impact future operations. Professional liability insurance gaps, environmental compliance issues, and employment law violations create valuation discounts that surprise unprepared sellers.

These financial fundamentals provide the foundation, but buyers also examine how your business performs relative to industry competitors and recent market transactions.

How Do Market Comparisons Validate Your Asking Price?

Industry Multiples That Actually Apply

Transaction databases like Pratt’s Stats and BIZCOMPS show manufacturing businesses sold at 3.2x EBITDA in 2024, but this average misleads sellers who ignore revenue size brackets. Companies with $2-5 million revenue command 2.8x multiples, while $10-20 million businesses achieve 4.1x multiples. The EBITDA multiple will depend on the size of the subject company, its profitability, its growth prospects, and the industry in which it works.

Technology services businesses consistently outperform with 4.5-6.2x EBITDA multiples, driven by recurring revenue models and higher profit margins. Your valuation report must segment comparables by revenue size, not just industry classification. A $3 million SaaS company deserves comparison against other $2-5 million SaaS transactions, not billion-dollar enterprise software deals that skew multiples upward.

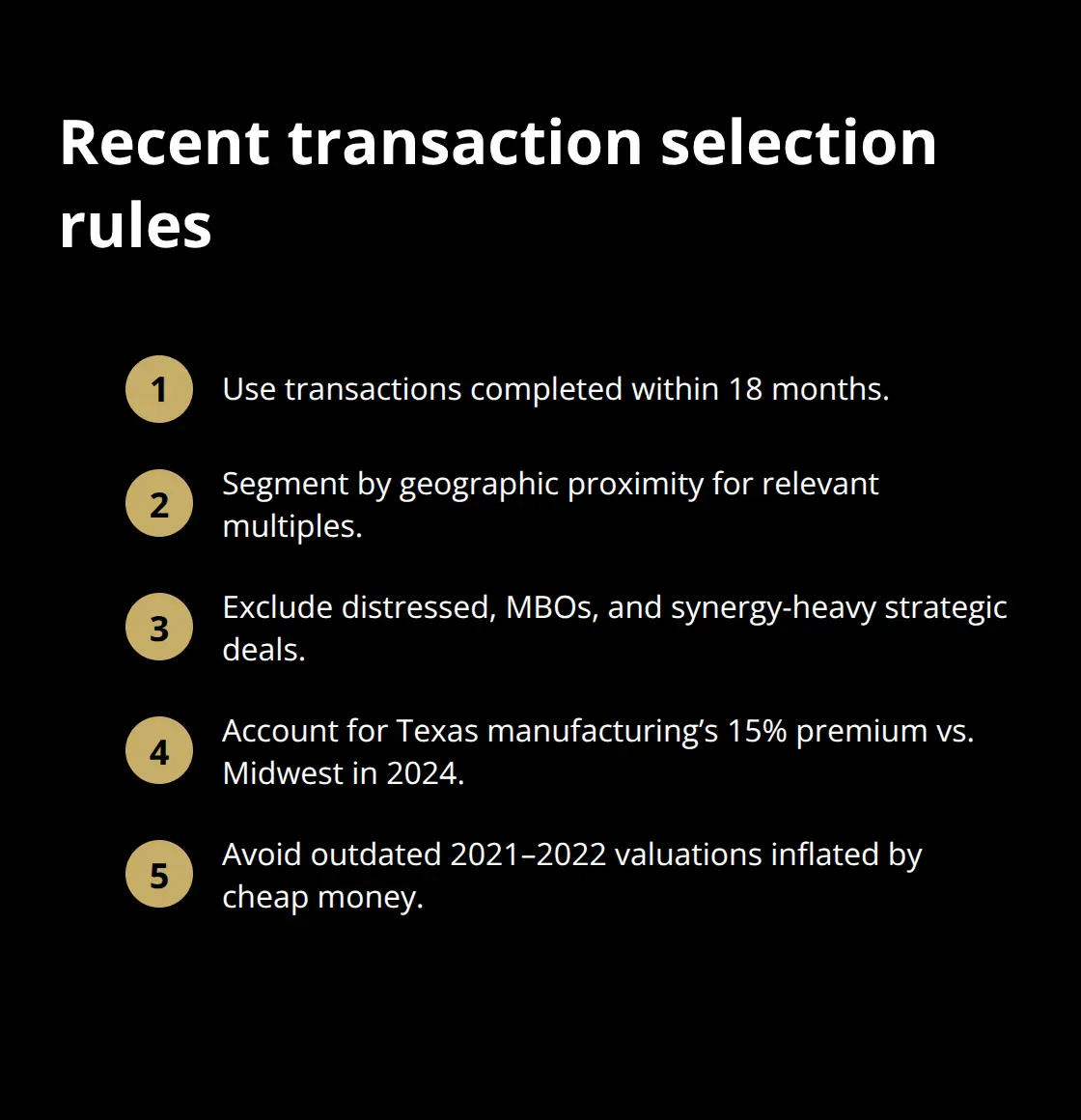

Recent Transaction Reality Check

Use transactions completed within 18 months, not outdated deals from 2021-2022 when cheap money inflated valuations artificially. Recent market data shows increased M&A activity expectations, particularly with volume upticks in late 2023, which creates urgency for sellers who price correctly from day one.

Document geographic proximity because regional economic conditions affect multiples significantly. Texas manufacturing businesses sold at 15% premiums compared to Midwest equivalents in 2024 (reflecting stronger local economies and buyer competition). Exclude distressed sales, management buyouts, and strategic acquisitions that include synergy premiums above 25% of market rates.

Comparable Company Selection Criteria

Choose five to eight comparable businesses with similar revenue ranges, customer bases, and operational structures rather than broad industry matches. A dental practice with three locations requires comparison against multi-location healthcare services, not single-doctor offices that operate differently.

Revenue growth rates matter more than absolute size when you select comparables. Steady 12% annual growth deserves premium multiples regardless of current revenue levels. Geographic market overlap, customer concentration levels, and capital intensity ratios provide better comparison frameworks than generic industry codes that group dissimilar business models together.

Market Conditions Impact on Valuations

Current market conditions directly influence transaction multiples and buyer behavior patterns. There is reason to believe that M&A activity will increase in 2024, especially with an uptick in M&A volume in the last quarter of 2023 and expectations of continued growth.

Private equity groups now focus on businesses with EBITDA margins above 15% and predictable cash flows that can service higher debt costs. This shift benefits well-managed companies with strong fundamentals while penalizing businesses that depend on growth-at-any-cost strategies or thin profit margins. Understanding these dynamics helps sellers position their businesses effectively during negotiations.

Final Thoughts

Professional valuation standards separate successful sales from failed negotiations. USPAP compliance and certified appraisal methods give buyers confidence in your price, which reduces due diligence delays by 40% according to recent transaction data. Accurate valuations prevent the mistakes that kill 60% of business sales before they reach the table.

Your valuation report becomes the foundation for every buyer conversation. Overpriced businesses sit on the market for 18+ months while correctly valued companies sell within 6-8 months at 95% of their price. Professional standards matter because sophisticated buyers immediately spot amateur attempts that use outdated multiples or ignore industry-specific risk factors.

Business owners who invest in comprehensive reports see measurable results. The upfront cost of professional appraisal services pays for itself through faster sales cycles and higher final sale prices. Unbroker provides transparent, low-cost options with professional tools and expert support throughout the entire process.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)