Most business owners think they only need a professional business appraisal when selling their company. That’s wrong.

At Unbroker, we see entrepreneurs miss opportunities and face legal complications because they waited too long to get their business valued. From divorce proceedings to SBA loans, specific situations legally require professional appraisals.

When Does the Law Require Professional Appraisals?

Courts reject guesswork when business assets face legal scrutiny. Three legal situations mandate professional business appraisals with specific certification requirements that business owners cannot ignore.

Divorce Proceedings Split Business Assets

Family courts require certified business valuations when one spouse owns a business during divorce. Business assets represent significant marital property in high-net-worth divorces.

Courts typically order both parties to hire separate certified appraisers with CVA, ABV, or ASA credentials. The valuation date carries significant weight – courts often use the separation date rather than the trial date, which can impact values by 20-40% in volatile markets.

Business owners who hide income or manipulate financial records before divorce proceedings face fraud charges. These actions can result in criminal penalties plus complete asset forfeiture.

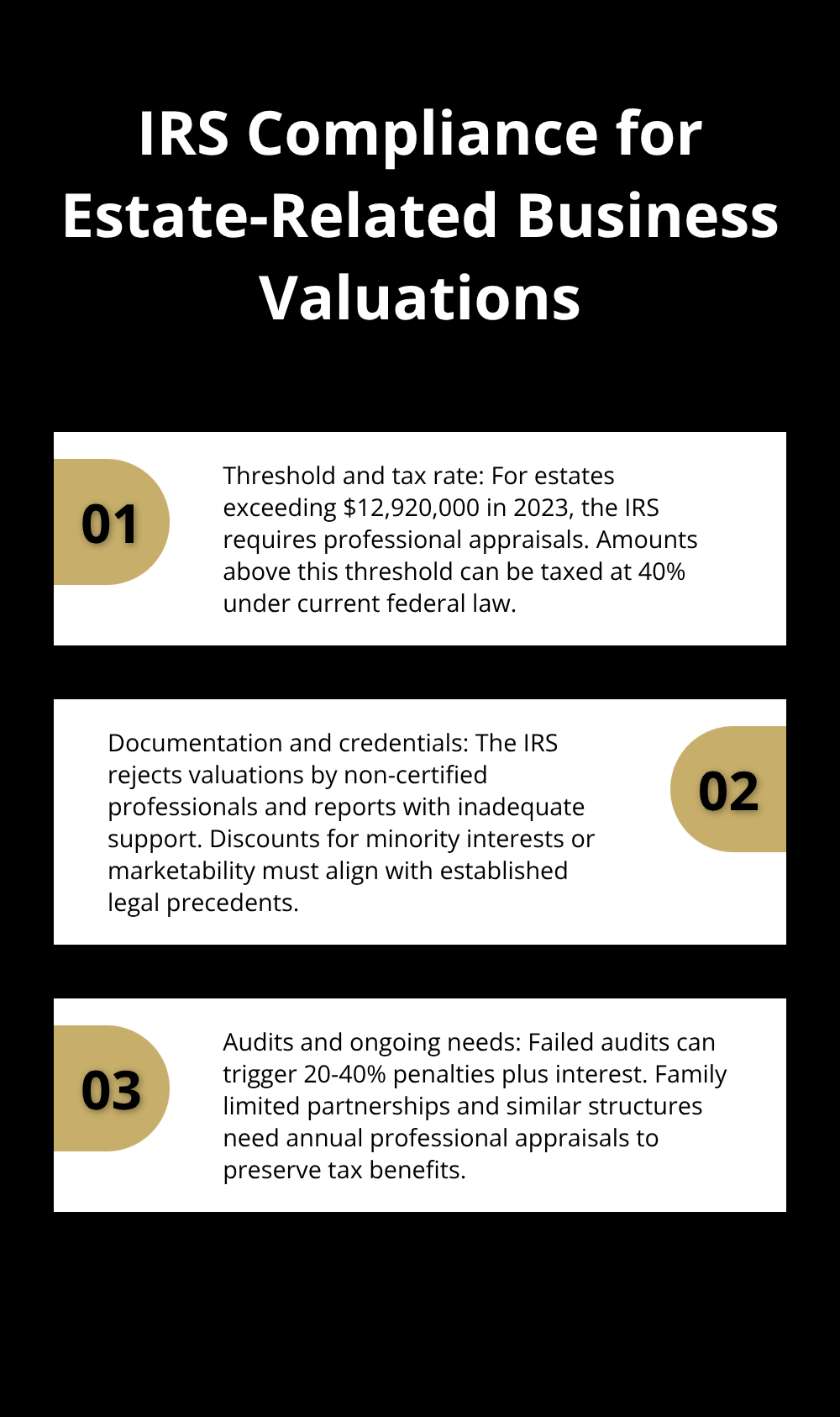

Estate Tax Calculations Demand IRS Compliance

The IRS requires professional appraisals for business interests when estate values exceed $12,920,000 in 2023. Estate taxes reach 40% on amounts above this threshold (according to current federal tax law).

The IRS scrutinizes business valuations heavily and rejects appraisals from non-certified professionals or those with inadequate documentation. Valuation discounts for minority interests or marketability restrictions must follow established legal precedents.

Failed IRS audits result in penalties of 20-40% plus interest on additional taxes owed. Family limited partnerships and other estate planning structures require annual professional appraisals to maintain their tax benefits.

Court Orders Override Owner Preferences

Shareholder disputes, bankruptcy cases, and breach of contract litigation frequently result in court-mandated business appraisals. Federal bankruptcy courts require professional valuations to establish asset values for creditor distributions.

The Uniform Standards of Professional Appraisal Practice governs court-ordered valuations, which means only certified appraisers can provide legally acceptable reports. Business owners cannot choose their appraiser in court-ordered situations – judges typically select from pre-approved lists of certified professionals who charge $5,000-$15,000 for comprehensive reports.

These legal requirements represent just one category where professional appraisals become necessary. Strategic business decisions present equally compelling reasons to obtain certified valuations.

Which Business Moves Require Professional Valuations?

Strategic business decisions that involve ownership changes demand professional appraisals far more often than most entrepreneurs realize. Business owners make costly mistakes when they rely on rough estimates instead of certified valuations during these transactions.

Selling Creates Valuation Expectations

Third-party buyers expect professional valuations for businesses with annual revenues that exceed $1 million. Investment groups and strategic acquirers routinely discount offers when sellers cannot provide certified appraisals.

The middle market experiences this pattern consistently. Buyers view amateur valuations as red flags that signal inexperienced sellers or hidden problems. Professional appraisals cost $5,000-$15,000 but typically increase final sale prices (according to business transfer data).

Quality of earnings reports accompany most professional valuations and identify financial adjustments that buyers will demand anyway during due diligence. These reports prevent last-minute surprises that can derail transactions.

Partnership Changes Require Baseline Values

New partners or investors who enter existing businesses legally require professional valuations to establish fair equity distributions. The IRS scrutinizes partnership interest transfers and rejects valuations from non-certified professionals during audits.

Venture capital firms and private equity groups mandate independent appraisals before they invest. They refuse to negotiate based on owner estimates or informal calculations. Buy-sell agreements become unenforceable without current professional valuations when ownership disputes arise.

Shareholder agreements typically require updated appraisals to maintain legal validity. Courts reject outdated valuations during partnership dissolution proceedings.

Restructuring Demands Current Market Values

Ownership restructures, stock redemptions, and recapitalizations all trigger professional valuation requirements under federal tax law. The IRS applies strict scrutiny to these transactions and penalizes businesses that use inadequate valuations.

Employee stock ownership plans (ESOPs) require annual professional appraisals by law. Companies that fail to obtain proper ESOP valuations face Department of Labor penalties and potential plan disqualification.

These strategic decisions represent just one category where professional valuations become necessary. Financial institutions and tax authorities create additional situations that demand certified appraisals.

When Do Financial Institutions Demand Appraisals?

Banks reject loan applications worth more than $250,000 without professional business appraisals. The Small Business Administration requires certified valuations for all SBA 504 loans and most 7(a) loans above $350,000 according to current lending guidelines.

Regional banks and credit unions follow similar policies because federal regulators scrutinize commercial lending practices heavily. Business owners who submit amateur valuations face automatic loan denials that damage their credit profiles and waste months of application time. Professional appraisals cost $5,000-$10,000 but increase loan approval rates by 60% for businesses with complex asset structures.

Tax Authorities Scrutinize Charitable Deductions

The IRS mandates professional appraisals for charitable contributions of business interests that exceed $5,000 in value. Taxpayers who claim deductions without proper appraisals face automatic audit triggers and penalty assessments of 20-40% plus interest on disallowed deductions.

Charitable remainder trusts and donor-advised funds require annual professional valuations to maintain their tax-exempt status. The IRS publishes specific qualification requirements for appraisers who handle charitable deduction cases and rejects reports from uncertified professionals during audits.

Insurance Companies Demand Current Market Values

Property and casualty insurers require professional appraisals when business interruption claims involve significant losses or when key person life insurance policies surpass $1 million in coverage. Insurance adjusters automatically dispute claims backed by amateur valuations and delay settlements for months while they order independent appraisals.

Workers compensation and liability carriers use professional business valuations to calculate coverage limits and premium rates for high-risk industries (particularly manufacturing and construction). Companies that provide outdated or inadequate valuations during claims processing face coverage denials that can bankrupt their operations.

Final Thoughts

Professional business appraisal requirements extend far beyond company sales. Legal mandates activate during divorce proceedings, estate planning above $12,920,000, and court-ordered disputes. Strategic decisions like partner additions, ownership restructures, or ESOP establishments demand certified valuations.

The cost-benefit analysis strongly favors professional business appraisals. While certified valuations cost $5,000-$15,000, they prevent legal penalties of 20-40% and increase loan approval rates by 60%. DIY valuations create liability risks that far exceed professional fees (including potential IRS audits that can result in criminal charges).

Business owners should obtain professional appraisals before these situations arise rather than scramble during legal deadlines. We at Unbroker help business owners navigate the sale process with transparent support. When you’re ready to sell, Unbroker provides comprehensive tools and legal document templates without high brokerage fees.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)