Selling your business involves complex decisions that directly impact your final payout. The wrong sale structure can cost you thousands in unnecessary taxes.

We at Unbroker see business owners lose 20-30% of their proceeds by choosing suboptimal structures. Understanding your options helps you keep more money in your pocket when you exit.

Which Sale Structure Fits Your Business

Asset sales versus stock sales represent the fundamental choice every business owner faces. In an asset sale, buyers purchase individual business assets while sellers retain the corporate entity and its liabilities. Stock sales transfer ownership of the entire corporation (including all assets and liabilities). Asset sales typically benefit sellers through depreciation recapture at lower capital gains rates, but buyers prefer them for stepped-up asset basis and liability protection.

The Power of Deferred Payment Structures

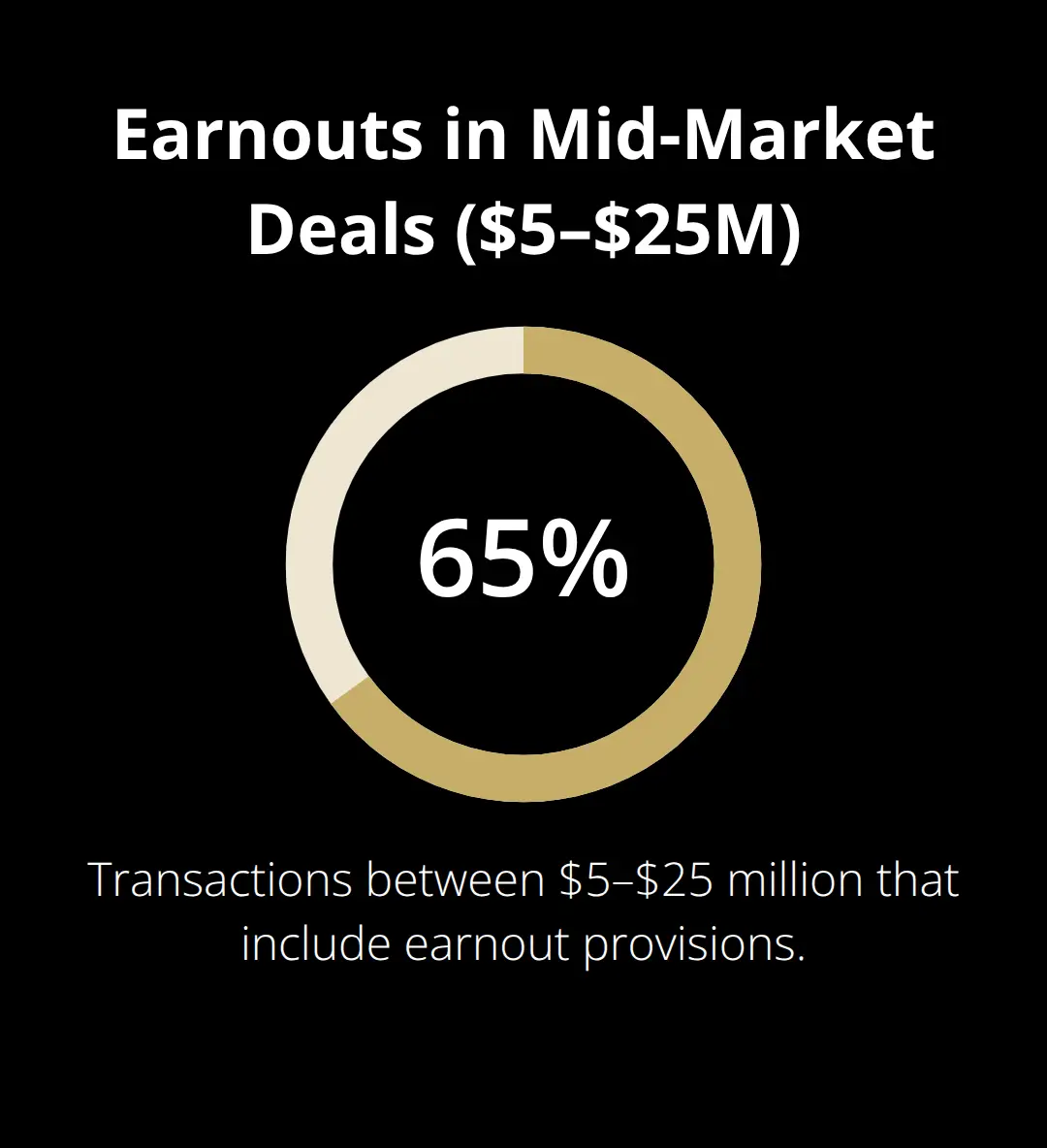

Installment sales spread payments across multiple years and reduce your tax burden through income averaging. The IRS allows sellers to recognize gain proportionally as payments arrive, potentially keeping you in lower tax brackets. Earnouts tie additional payments to future business performance and share risk with buyers while maximizing your upside. According to Pepperdine University’s Private Capital Markets Report, 65% of transactions between $5-25 million include earnout provisions.

These structures work best for businesses with predictable revenue streams and strong growth trajectories.

Internal Transitions Create Tax Benefits

Management buyouts and Employee Stock Ownership Plans offer unique tax advantages for business transitions. ESOPs allow sellers to defer capital gains taxes indefinitely when they reinvest proceeds in qualified securities within 12 months. The National Center for Employee Ownership reports that ESOPs paid out over $156 billion to participants in 2022. Management buyouts typically use leveraged structures where business cash flow services acquisition debt and creates favorable tax deductions for the acquiring entity while providing sellers with steady payment streams.

Tax Treatment Varies Dramatically

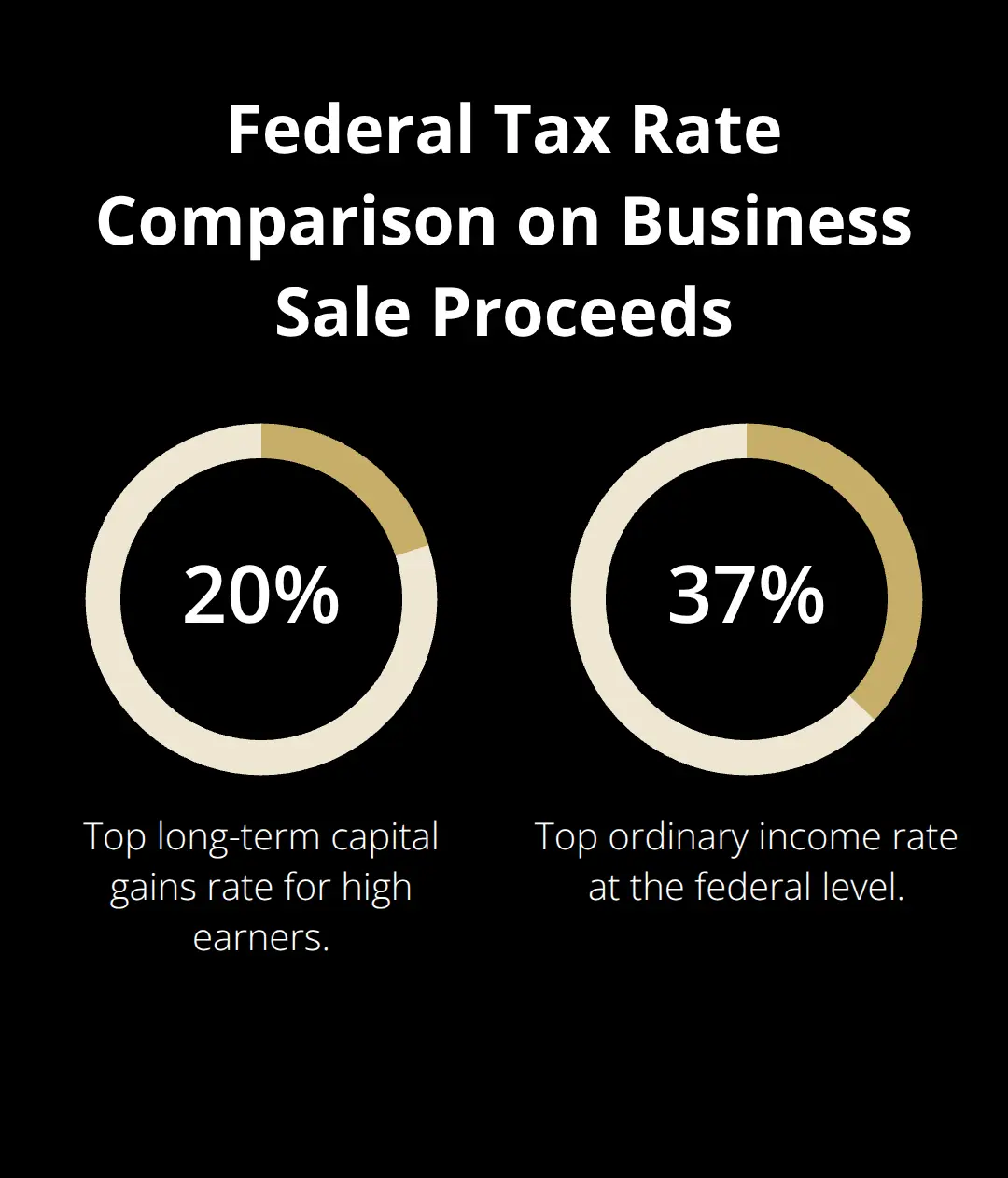

Each sale structure triggers different tax consequences that directly impact your final proceeds. Asset sales often generate ordinary income on inventory and accounts receivable, while goodwill and customer relationships qualify for capital gains treatment. Stock sales generally receive full capital gains treatment but may face restrictions under Section 1202 qualified small business stock rules. The choice between structures can create significant tax differences on your total proceeds, making professional guidance essential for optimal outcomes.

How Much Will Taxes Actually Cost You

Tax treatment differences between sale structures can swing your final proceeds by hundreds of thousands of dollars. Capital gains rates currently max out at 20% for high earners, while ordinary income reaches 37% at the federal level. Asset sales create mixed tax consequences where inventory, accounts receivable, and depreciated equipment face ordinary income treatment, but customer lists, goodwill, and non-compete agreements qualify for capital gains. Stock sales generally receive full capital gains treatment, which makes them preferable for sellers despite buyer resistance.

Section 1202 Creates Massive Tax Savings

Qualified Small Business Stock under Section 1202 offers the most powerful tax benefit available to business sellers. Eligible C-corporation stock held for five years allows sellers to exclude up to $10 million (or 10 times their basis) from federal taxes. The Tax Cuts and Jobs Act preserved this exclusion while it eliminated the alternative minimum tax preference, which makes Section 1202 even more valuable. However, strict requirements limit eligibility including $50 million gross asset limits, active business tests, and original issuance requirements. Many business owners miss this opportunity because they convert to S-corporations or fail to meet the five-year requirement.

Depreciation Recapture Hits Asset Sales Hard

Asset sales trigger depreciation recapture on previously deducted equipment, buildings, and improvements at ordinary income rates up to 25%. The IRS requires sellers to recapture all depreciation taken since 1997 on real estate and all equipment depreciation regardless of when they took it. Smart sellers plan ahead through installment sales to spread recapture across multiple tax years or consider like-kind exchanges under Section 1031 for real estate components. The right sale structure choice depends on several factors that determine which approach maximizes your after-tax proceeds.

What Determines Your Best Sale Structure

Your business entity type fundamentally shapes which sale structure works best for your situation. S-corporations face pass-through taxation that makes stock sales attractive since buyers cannot step up asset basis anyway. C-corporations create double taxation risks in stock sales but offer Section 1202 benefits for qualified small business stock. Limited liability companies provide flexibility through tax elections but complicate buyer finance since most lenders prefer corporate structures. Partnerships split tax consequences among multiple owners and require careful coordination of sale times to optimize everyone’s tax position.

Buyer Finance Drives Structure Decisions

Most buyers prefer asset purchases because banks readily finance them through SBA loans and conventional loans. Stock purchases create finance challenges since buyers inherit unknown liabilities and cannot depreciate purchased assets from a stepped-up basis. Private equity groups typically demand stock purchases to maintain contracts and relationships while they avoid transfer complications. Strategic buyers often accept either structure but negotiate price adjustments based on their tax benefits. Cash buyers provide more flexibility in structure choice while leveraged buyers face lender requirements that limit options.

Risk Tolerance Shapes Payment Structure

Sellers who seek immediate cash exit prefer stock sales with full payment at close despite potentially higher tax costs. Risk-averse owners choose asset sales with escrow protection even when buyers demand price reductions for assumed liabilities. Growth-oriented sellers embrace earnout structures that tie additional payments to future performance metrics (like revenue or EBITDA targets). Conservative sellers avoid earnouts entirely since they cannot control post-sale operations that determine final payouts. Your personal financial situation determines whether you can afford payment deferrals through installment structures or need immediate liquidity for retirement or other investments.

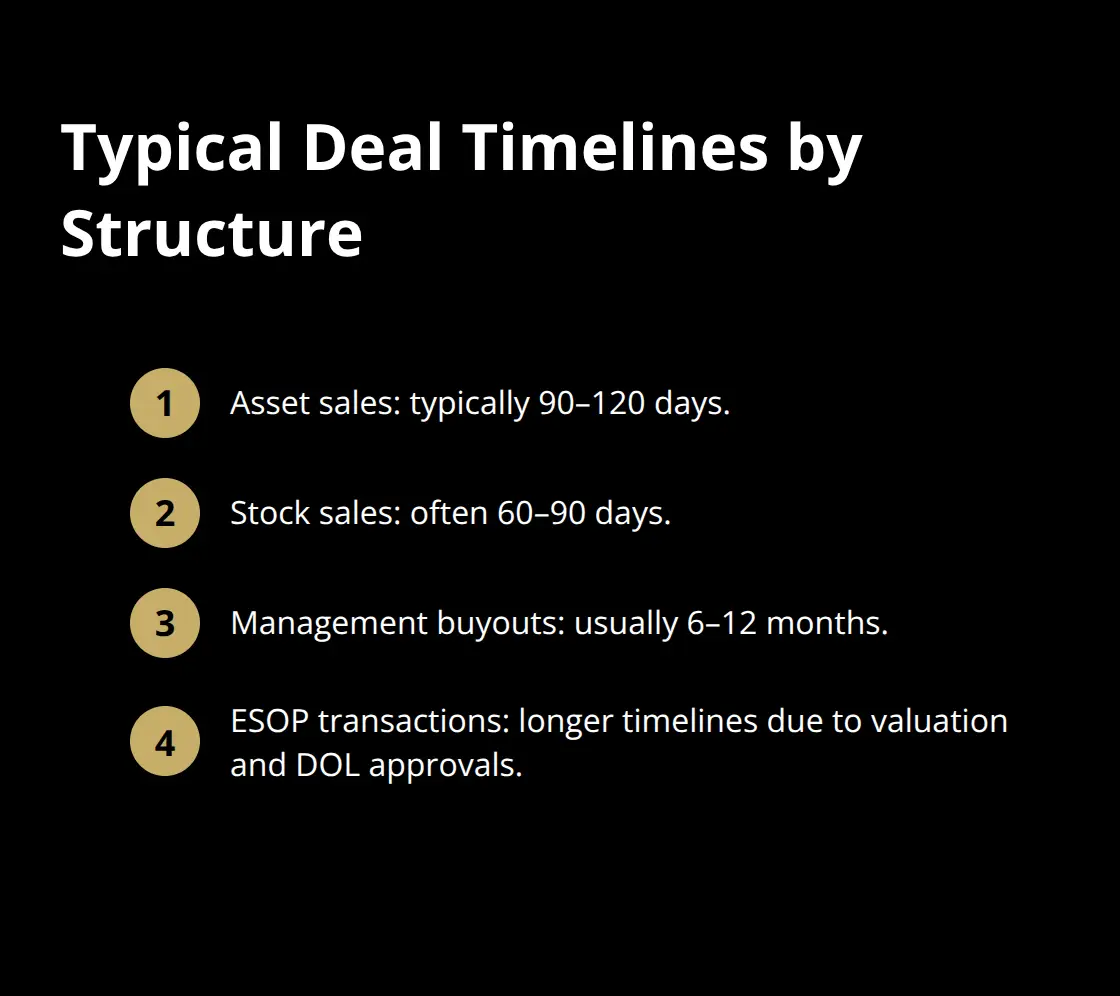

Sale Structure Affects Deal Timeline

Asset sales typically require 90-120 days to complete due to individual asset transfers and third-party consents. Stock sales close faster (often within 60-90 days) since ownership transfers through share certificates rather than individual asset deeds. Management buyouts extend timelines to 6-12 months as internal teams secure finance and negotiate terms.

ESOP transactions require extensive valuation requirements and Department of Labor approvals. Your urgency to exit directly impacts which structures remain viable options for your specific timeline needs.

Final Thoughts

The right sale structure saves you hundreds of thousands in taxes while the wrong choice costs you dearly. Asset sales work best for S-corporations and businesses with significant depreciation, while stock sales benefit C-corporation owners who seek capital gains treatment. Section 1202 qualified small business stock provides the ultimate tax advantage with up to $10 million in federal tax exclusions for eligible sellers.

Professional guidance becomes essential given the complexity of tax laws and deal structures. Tax attorneys and CPAs help you navigate depreciation recapture, installment sale elections, and entity-specific considerations that impact your final proceeds. Investment bankers structure deals to optimize both tax outcomes and buyer appeal.

Start to plan your exit strategy years before you sell to maximize tax benefits. Consider conversion to C-corporation status early to qualify for Section 1202 benefits or explore ESOP transitions for tax-deferred proceeds (which can significantly reduce your immediate tax burden). We at Unbroker help business owners navigate these complex decisions through our transparent platform that connects sellers directly with qualified buyers.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)