Most business buyers make a costly mistake: they focus too heavily on historical performance when evaluating acquisition targets. Past financial records tell only part of the story.

We at Unbroker see this pattern repeatedly. Smart investors shift their attention to growth potential instead. Companies with strong future prospects often outperform those with impressive historical metrics but limited upside.

Why Past Performance Falls Short in Modern Markets

Market Conditions Change Rapidly

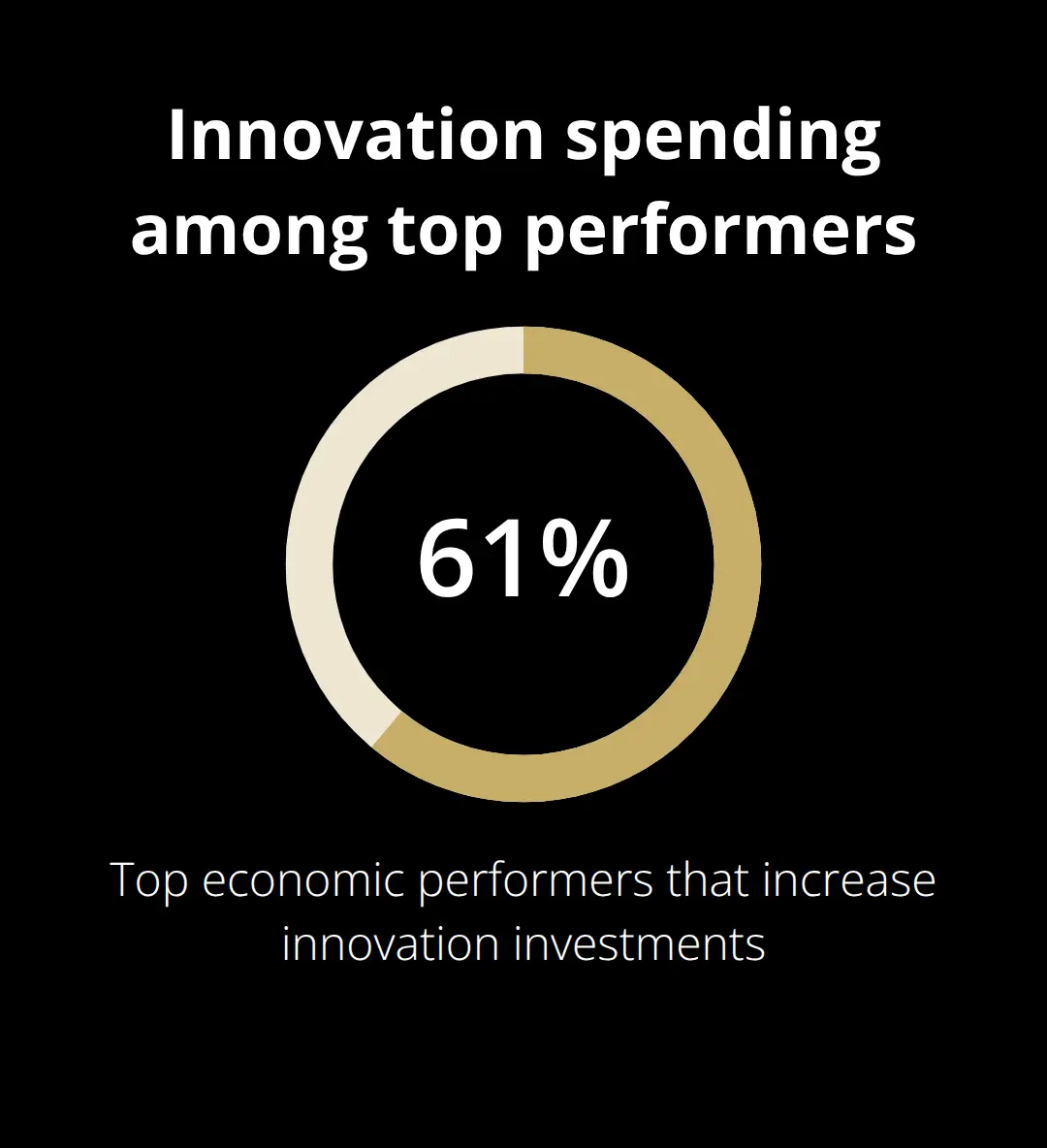

The business landscape transforms at unprecedented speed today. McKinsey research shows that 61% of top economic performers increase innovation investments while others freeze spending, which creates massive competitive gaps within months. A company’s five-year track record holds little value when digital transformation reshapes entire industries overnight.

Kodak dominated photography for decades before smartphones eliminated their market in just a few years. Netflix destroyed Blockbuster’s rental empire despite Blockbuster’s superior historical revenues and extensive store network.

Historical Data Misses Tomorrow’s Revenue Streams

Traditional financial statements capture what happened, not what comes next. Companies that spend heavily on R&D today may show lower current profits but position themselves for explosive future growth. Amazon lost money for years while it built infrastructure that now generates massive returns. Surveyed executives’ expectations for their companies’ performance over the next six months have largely remained stable compared with last quarter. These future revenue streams won’t appear in historical performance data that buyers typically analyze.

Disruption Strikes Without Warning

Past performance assumes stable market conditions that no longer exist. The COVID-19 pandemic wiped out airlines’ decades of growth while it boosted Zoom from a small player to a market leader. Geopolitical events, regulatory changes, and technological breakthroughs create sudden winners and losers regardless of historical success. Tesla’s market capitalization surpassed traditional automakers despite minimal historical revenue because investors recognized electric vehicle potential.

The SEC Disclaimer Exists for Good Reason

The Securities and Exchange Commission requires the disclaimer “past performance is not indicative of future results” for a reason. Markets face unpredictable variables such as economic shifts, interest rate changes, political events, and global crises. John F. Pace, a CPA, notes that recency bias misleads investors into thinking recent trends will continue, especially in volatile economic conditions. Smart buyers recognize this limitation and focus on forward-looking indicators instead.

The question becomes: what should buyers examine instead of historical metrics? The answer lies in identifying key indicators that signal future growth potential.

Key Indicators of Future Growth Potential

Smart buyers examine three essential growth indicators that reveal a company’s future potential. Market expansion opportunities represent the most reliable predictor of sustainable growth. Companies operate in markets expected to grow by double digits annually and offer exponential upside compared to those in stagnant sectors. The global artificial intelligence market is projected to reach $3.5 trillion by 2033 according to Grand View Research, which makes AI-focused businesses attractive targets regardless of current revenue. Geographic expansion potential matters equally – a regional leader with plans to enter new territories shows more promise than a national player with saturated market share.

Innovation Pipeline Strength

R&D investment as a percentage of revenue indicates management’s commitment to future growth. Companies that invest significant portions of revenue in research typically outperform peers within three years. McKinsey research shows that measuring R&D effectiveness requires examining multiple factors beyond simple revenue percentages, which highlights innovation’s vital role. Patent applications, new product launches, and technology partnerships provide concrete evidence of pipeline strength.

Management Track Record and Vision

Leadership teams with proven records of successful product launches and market expansion deserve premium valuations. Look for leaders who previously built companies from startup to exit or transformed businesses into market leaders through strategic vision and execution capability. These executives understand how to navigate market shifts and capitalize on emerging opportunities (rather than simply maintain existing operations).

Market Position and Competitive Advantages

Companies with strong competitive moats face less risk from market disruption. Proprietary technology, exclusive partnerships, or regulatory barriers create sustainable advantages that protect future revenue streams. Businesses that hold dominant positions in niche markets often maintain pricing power and customer loyalty even during economic downturns.

These growth indicators provide the foundation for smart acquisition decisions, but buyers must also understand how to apply this analysis when evaluating specific business opportunities.

How to Evaluate Future Growth When Buying a Business

Industry analysis reveals growth opportunities that financial statements miss. Companies positioned in sectors with regulatory tailwinds or technological shifts often multiply valuations within 24 months regardless of current performance. The renewable energy sector achieved significant growth with Asia leading new installations globally, which rewarded early buyers who recognized policy trends before they appeared in quarterly reports. Smart buyers examine government spending patterns, demographic shifts, and consumer behaviors that create sustained demand over decades rather than quarters.

Analyze Industry Trends and Market Position

Dominant market positions in expanding sectors trump impressive margins in declining industries. A company that holds 15% market share in a $50 billion expanding market offers more upside than a 40% leader in a $5 billion shrinking sector. Market leaders in growth industries command premium valuations because they capture disproportionate benefits from sector expansion.

Geographic diversification across multiple regions and verticals provides stability during economic downturns while it expands addressable markets. Revenue concentration above 25% from any single customer creates unacceptable risk regardless of historical stability (single-client dependency destroys valuations overnight).

Assess Digital Transformation Readiness

Digital transformation readiness separates winners from losers as businesses integrate cloud computing, automation, and data analytics into core operations. Companies that master innovation capabilities generate superior economic profit compared to competitors. Modern businesses require robust digital infrastructure to compete effectively.

Companies that still operate on legacy systems face massive capital requirements and operational disruptions during necessary upgrades. Technology infrastructure assessment reveals whether a business can scale efficiently or will require significant capital investment to remain competitive.

Review Customer Base and Revenue Diversification

Subscription-based revenue models generate higher valuations than transactional businesses because they provide predictable cash flows and lower customer acquisition costs over time. Software companies with recurring revenue models benefit from ARR multiples that reflect their enterprise value relative to annual recurring revenue.

Customer retention rates above 90% indicate strong product-market fit and reduce future acquisition costs. Businesses with diverse customer bases across multiple industries show resilience during sector-specific downturns (this diversification protects against concentrated risk that can eliminate value overnight).

Final Thoughts

Buyers who prioritize growth potential over historical performance consistently achieve superior returns. McKinsey data confirms that companies take through-cycle approaches to growth and outperform peers, while nearly 60% of executives freeze innovation spending during uncertainty. This creates opportunities for forward-thinking investors who recognize that past financial statements reveal little about future market position.

Historical context provides valuable baseline information, but smart acquisition decisions require balance between backward-looking metrics and forward-focused analysis. Companies with strong fundamentals like revenue growth and cash flow deserve consideration, yet buyers must evaluate these metrics alongside innovation pipelines, market expansion opportunities, and digital transformation readiness. The most successful buyers examine industry trends, competitive advantages, and management vision rather than fixate on five-year profit histories.

Growth potential matters more than yesterday’s results when you evaluate acquisition targets. We at Unbroker help you highlight these growth indicators to attract buyers who understand this principle (tomorrow’s potential drives valuations more than historical performance). When you’re ready to sell your business, we connect you with investors who focus on future opportunities rather than past achievements.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)