Business owners routinely lose millions in failed sales because their valuations miss the mark by 30-50%. The gap between asking price and market reality has never been wider.

At Unbroker, we see sellers clinging to outdated methods while buyers walk away from overpriced deals. Valuation accuracy determines whether your business sells in months or sits on the market for years.

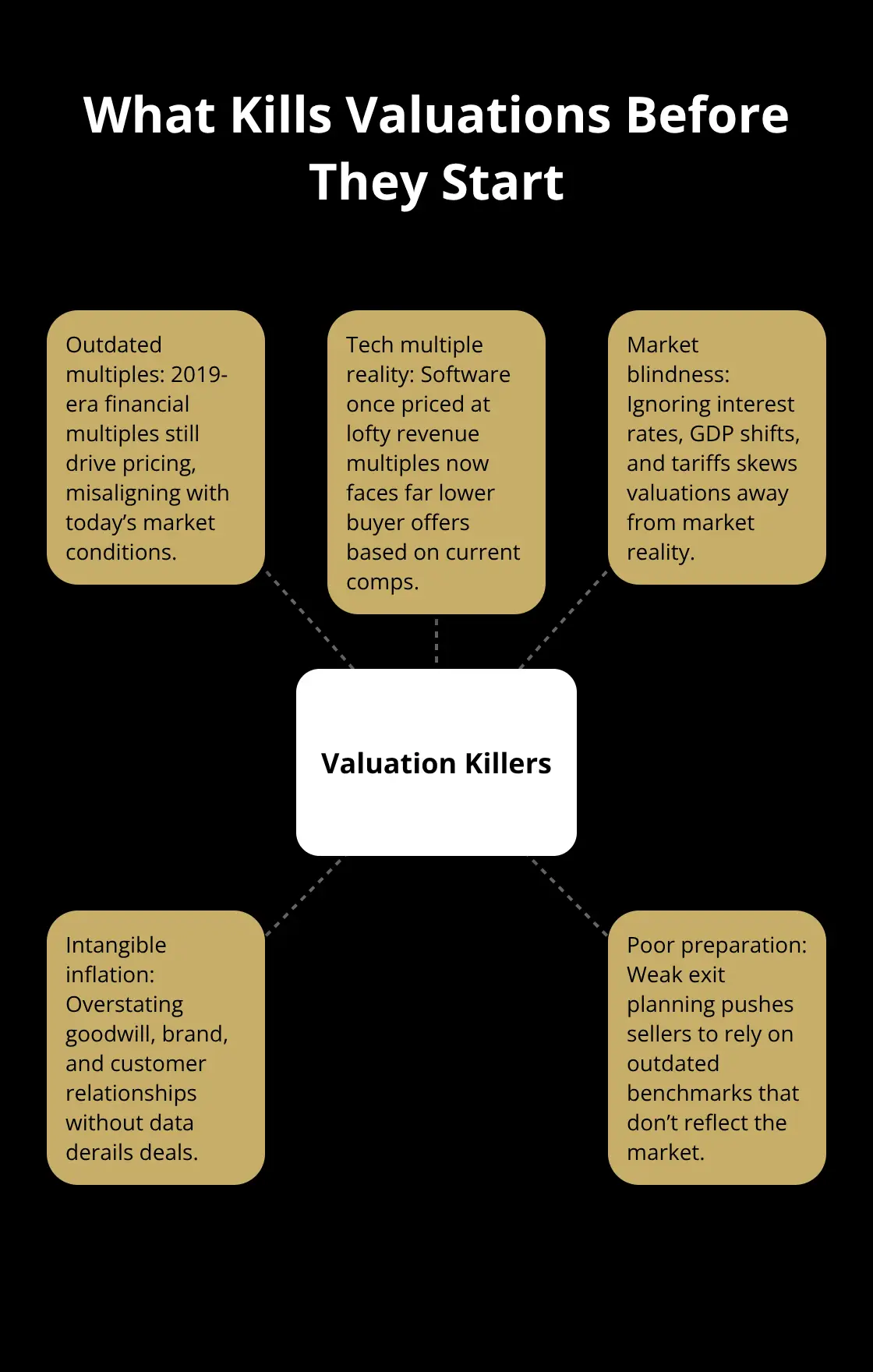

What Kills Business Valuations Before They Start

Most sellers sabotage their deals before negotiations even begin. Financial multiples from 2019 still dominate valuation spreadsheets, despite markets that have shifted dramatically. Software companies use 10x revenue multiples and face reality when buyers offer 3x based on current market conditions.

Business owners agree that exit planning is essential to their success, yet more than half lack proper preparation, which leads them to rely on outdated industry benchmarks that no longer reflect market reality.

Revenue Multiples That Stopped Work Years Ago

Traditional valuation methods crumble under current economic pressures. Tech companies valued at 15x revenue in 2021 now trade at 4-6x revenue multiples. Manufacturing businesses that saw 8-12x EBITDA multiples face 5-7x reality checks from buyers who understand supply chain vulnerabilities. Restaurant chains once valued at 3-4x revenue now struggle to achieve 2x multiples due to labor cost inflation and consumer behavior patterns that have changed.

Market Blindness Creates Valuation Disasters

Sellers ignore macroeconomic factors that directly impact their business value. Interest rates that have risen reduce buyer power by 25-30%, yet sellers maintain pre-rate hike expectations. Economic projections show GDP growth declining, but business owners still use growth assumptions from stronger economic periods. Tariff impacts that average 18.6% create additional cost pressures that sellers fail to incorporate into realistic valuation models.

Intangible Asset Inflation Destroys Deals

Goodwill overestimation ranks as the top valuation error according to recent Tax Court cases. Sellers assign 40-60% of business value to customer relationships and brand recognition without data that supports these claims. Customer acquisition costs have doubled across most industries, yet sellers maintain historical customer lifetime value calculations. Patent portfolios lose 15-20% of their value annually in fast-tech sectors (particularly in AI and software), but owners resist markdown adjustments that reflect technological obsolescence.

These valuation errors create a cascade of problems that extend far beyond initial price disappointment. Overpriced businesses can sit on the market for over a year, while higher-risk businesses typically receive lower valuations due to dependency on small client bases and market volatility.

What Happens When Your Valuation Is Wrong

Overpriced businesses face a brutal reality that destroys seller wealth faster than market crashes. Failed sales due to unrealistic prices create significant lost opportunities, while extended market exposure reduces final sale prices by 15-25% as desperation becomes apparent to buyers. The Exit Planning Institute reports that 91% of business owners lack written transition plans, which leads them to accept fire-sale prices when unexpected events force immediate sales.

Extended Market Time Destroys Deal Value

Businesses priced between 20% and 30% above fair market value have a 40% chance of selling within six months, while correctly priced businesses sell faster. Extended exposure creates negative perception among buyers who assume hidden problems exist when businesses remain unsold. Carrying costs during extended sale periods average $50,000-100,000 monthly for mid-market businesses, which includes legal fees, accounting costs, and operational disruption that reduces business performance. The University of Michigan consumer sentiment index shows confidence declined to 55.4, which makes buyers more selective and price-sensitive than previous years.

Legal Disasters From Valuation Errors

Valuation disputes generate significant litigation costs that can exceed $500,000 in complex cases according to recent Delaware court decisions. Tax Court cases increasingly challenge inflated goodwill valuations, with penalties that reach 40% of disputed amounts when sellers cannot justify intangible asset values. Built-in gains tax considerations for S corporations create additional liability exposure when sellers overestimate business values without proper tax obligation calculations (particularly for companies with appreciated assets). Professional liability insurance claims against business brokers and appraisers have increased 35% since 2023 due to valuation accuracy disputes.

The Cascade Effect on Business Operations

Valuation errors create operational problems that compound over time. Employees lose confidence when sale processes drag on for months, which leads to key talent departure and reduced productivity. Customers notice extended sale periods and question business stability, which results in contract cancellations and delayed purchase decisions. Suppliers tighten payment terms when they perceive financial distress, which strains cash flow and operational efficiency during the most critical period of business ownership.

Modern valuation methods offer solutions that address these costly mistakes through data-driven approaches and professional oversight.

What Valuation Methods Actually Deliver Results

Accurate valuations require real market data, not spreadsheet assumptions from better economic times. AI-powered platforms analyze thousands of comparable sales and provide current market multiples that reflect actual buyer behavior. Google Cloud’s valuation tools incorporate built-in ROI tracking and process market data in real-time, while platforms like BizBuySell and LoopNet provide transaction databases that show actual sale prices versus list prices. Customer-based corporate valuation methods now generate 15-20% higher valuations for subscription businesses by analyzing recurring revenue patterns that traditional DCF models miss completely.

Market Data That Reflects Current Reality

Professional appraisers who maintain ASA or ABV certifications access proprietary databases with transaction details from business sales annually. These platforms show that manufacturing companies with strong supply chain relationships trade at 6-7x EBITDA, while those with single-source dependencies struggle to achieve 4x multiples. Software companies with annual recurring revenue above 80% command 8-12x revenue multiples, but those dependent on project-based income face 3-5x reality. Delaware court cases increasingly require three valuation approaches (income, market, and asset) which makes professional oversight essential for defensible valuations.

Technology That Eliminates Human Bias

AI-enhanced platforms analyze financial statements, customer concentration, and market position to generate valuations within accuracy ranges. These systems process economic indicators and projected unemployment to adjust discount rates automatically. Professional valuators who ignore technology trends risk missing cybersecurity liabilities that reduce business values when data breaches occur. McKinsey reports that enterprises see ROI from AI investments in decision-making (particularly in enhanced decision-making processes), which makes technology-assisted valuations the new standard for serious sellers.

Professional Oversight Prevents Costly Errors

Qualified professional valuators reduce legal challenge risks and improve valuation accuracy significantly. The IRS requires consideration of all three valuation approaches, which increases complexity and demands expert knowledge of current regulations and court rulings. Tax Court cases note that subjectivity in minority and marketability discounts can result in valuation disputes if not adequately justified with credible external data. Professional valuators stay current with evolving methodologies and incorporate contemporary risks into the valuation process, while DIY valuations often overlook critical factors that affect final business value.

Final Thoughts

Valuation accuracy determines whether your business sells quickly or becomes another market casualty. With 92% of businesses planning increased AI investments in 2025, buyers demand precise valuations backed by current market data rather than outdated assumptions. Professional oversight prevents the costly mistakes that destroy deals.

The IRS requires all three valuation approaches, while Tax Court cases increasingly challenge inflated goodwill claims. Delaware courts now demand defensible methodologies that withstand legal scrutiny. Technology transforms valuation from guesswork into data-driven science, with AI platforms that process thousands of comparable sales and adjust for economic indicators automatically.

Business owners who ignore modern valuation methods face extended market exposure that reduces final sale prices by 15-25%. Professional valuators with ASA or ABV certifications access proprietary transaction databases that reveal actual market conditions (rather than wishful thinking). We at Unbroker combine technology with professional expertise to deliver accurate valuations through our transparent platform that eliminates high brokerage fees while connecting sellers with qualified buyers who understand current market values.

ValuBot is live!

ValuBot is live!

![Why Your Business Sale Is Taking Forever [Common Delays Explained]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/sale-timeline-hero-1765519819.webp)

![Beyond Traditional Brokers [Your Complete Guide to Modern Options]](https://v6d0bbyc8ns.c.updraftclone.com/wp-content/uploads/emplibot/broker-alternatives-hero-1765174159.webp)